Perfect Balance

Hey team! The market has remained in a well-defined multi-day balance range as traders await more information to determine a directional move.

Let’s recap today’s session and look ahead to what’s next for the market!

Impact Snapshot

Tomorrow: PCE Inflation /Consumer Sentiment

US economy expands at revised 3% rate on resilient consumer

Market Evaluation

The Dow reached a record high close on Thursday amid mixed trading, driven by strong U.S. economic data.

Meanwhile, Nvidia, the artificial intelligence chipmaker, saw its shares decline after its largely in-line forecast failed to impress investors, pulling down both the S&P 500 and NASDAQ.

For a stock that has gained nearly $2 trillion in market value over the past year, NVDA 0.00%↑ earnings report needed to be flawless. However, despite exceeding expectations across the board, the report still triggered a selloff.

Economic data released on Thursday provided a boost to the stock market. Weekly jobless claims declined compared to the previous week, easing fears of a recession.

Additionally, the growth rate for the second-quarter gross domestic product was revised upward to 3%, up from the initially reported 2.8%.

The July Personal Consumption Expenditures report, due on Friday, could offer hints on the central bank's monetary policy easing trajectory.

Markets Breakdown

We can see that the market is coiling and further tightening within the balance range, with any attempts to break from the balance not receiving any follow-up.

As our balance guidelines suggest, which we’ve shared since last Sunday’s report, a move above or below the balance that fails to gain continuation will lead to a complete rollover towards the other end of the balance.

As visualized in the chart, we can see an early attempt in the Globex session to break the balance lows that failed, leading to a complete rotation towards the balance highs, targeting the flip zone at 5657.

The market failed to gain any continuation or hold above that level, which later resulted in a rejection of higher prices back toward the settle, wiping out the entire pit session's advance. Read update here

ES

Some references we’ll be looking going forward:

Upside Levels: 5631/5648/5691

Downside Levels: 5587/5545/5528

That’s all we got!

Like this post, share it with a friend.

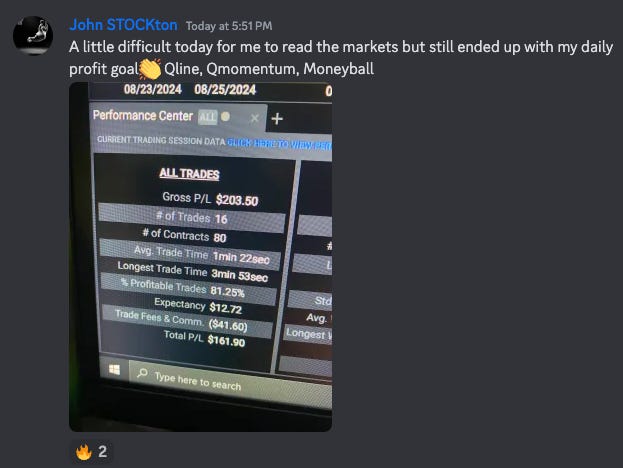

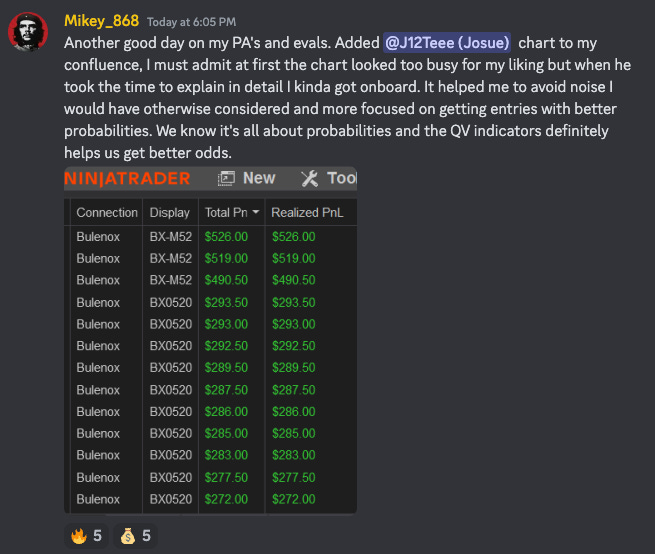

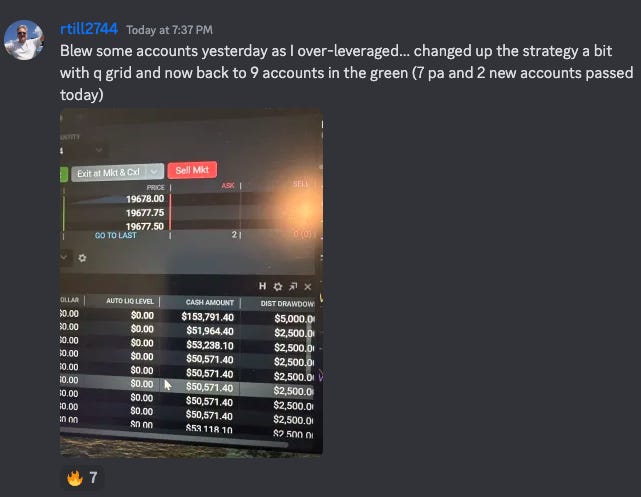

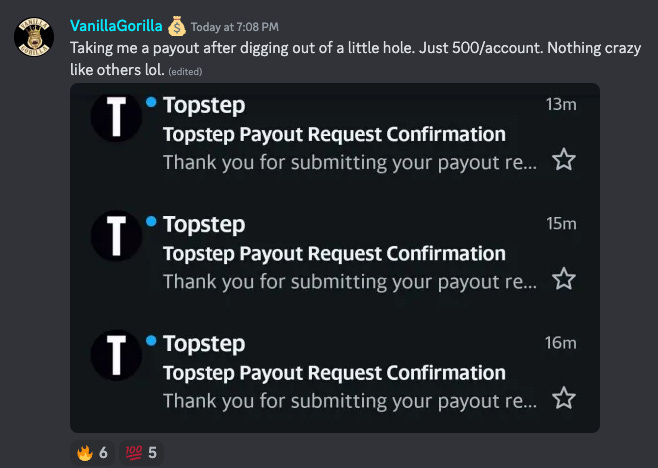

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.