Pivot Watch

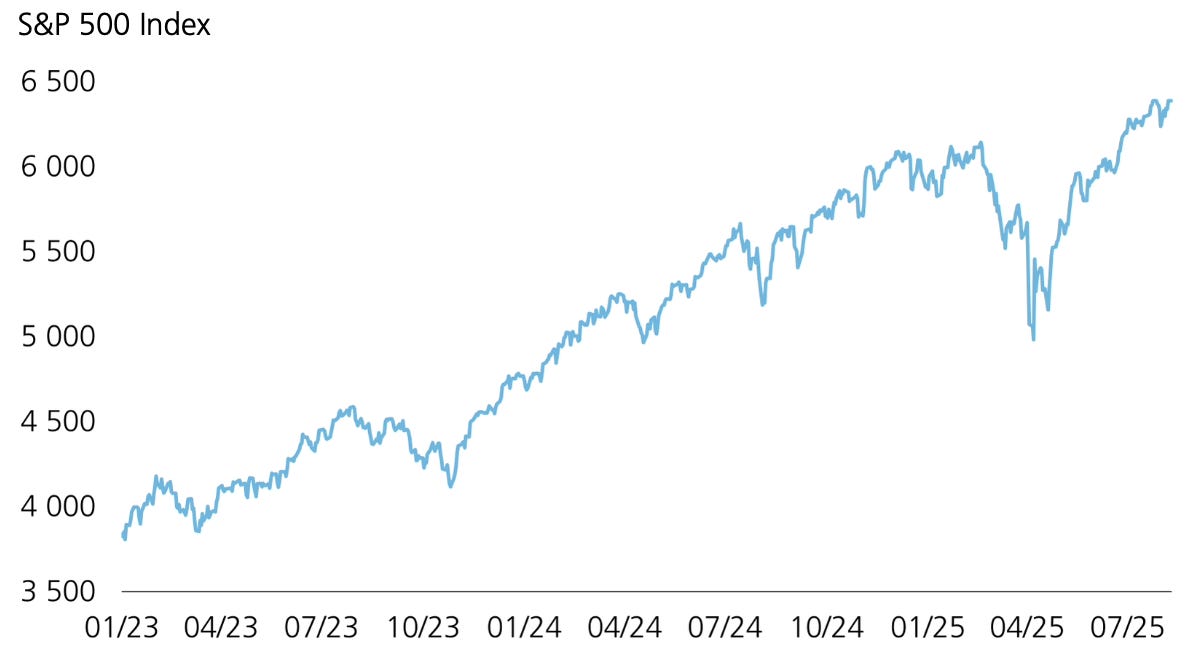

The S&P 500 Index rose 0.9% last week, scaling new peaks as the probability of an interest-rate cut in September remained elevated following divergent inflation reports.

Impact Snapshot

FOMC Meeting Minutes - Wednesday

Unemployment Claims - Thursday

Services/Manufacturing PMI - Thursday

Fed Chair Powell Speech - Friday

Macro Viewpoint

Traders are confident that a weakening job market has opened the door to a more dovish tone from the Fed chair, although surprisingly hot inflation data complicated the outlook.

The odds of a 25-basis-point cut in September reached 99.9% after the soft consumer price data. This near-certain probability, however, dissipated to 84% after U.S. wholesale prices posted the biggest surge in three years, complicating the rates outlook.

Powell’s Friday speech at the Fed’s annual gathering marks a pivotal moment for Treasuries, with markets all but certain of a quarter-point rate cut next month and at least one more by year-end. He’s often used this stage for market-moving policy pronouncements, making this year’s address especially significant.

Rebound

The past three months saw the fastest recovery of the S&P 500 since the COVID sell-off.

We continue to see compelling interest in the ongoing recovery of the S&P 500 and the global equity markets by institutional investors scaling back into the markets.

Today we share the latest regarding institutional systematic positioning and flows, which you can access by becoming a paid subscriber. 👇