Policy Shift

Powell’s message at Jackson Hole unleashing the biggest cross-markets surge since April by striking a more dovish tone than what investors anticipated.

Impact Snapshot

Consumer Confidence - Tuesday

Nvidia Earnings - Wednesday

Q2 GDP - Thursday

Unemployment Claims - Thursday

PCE Inflation - Friday

Macro Viewpoint

The S&P 500 had been on track to snap its weekly winning streak as of the close of trading on Thursday, but turned positive on Friday following comments from Federal Reserve Chair Jerome Powell that were seen as opening the door to a possible rate cut in September.

"The balance of risks appears to be shifting," and an adjustment to the central bank's policy stance may be warranted, Powell said.

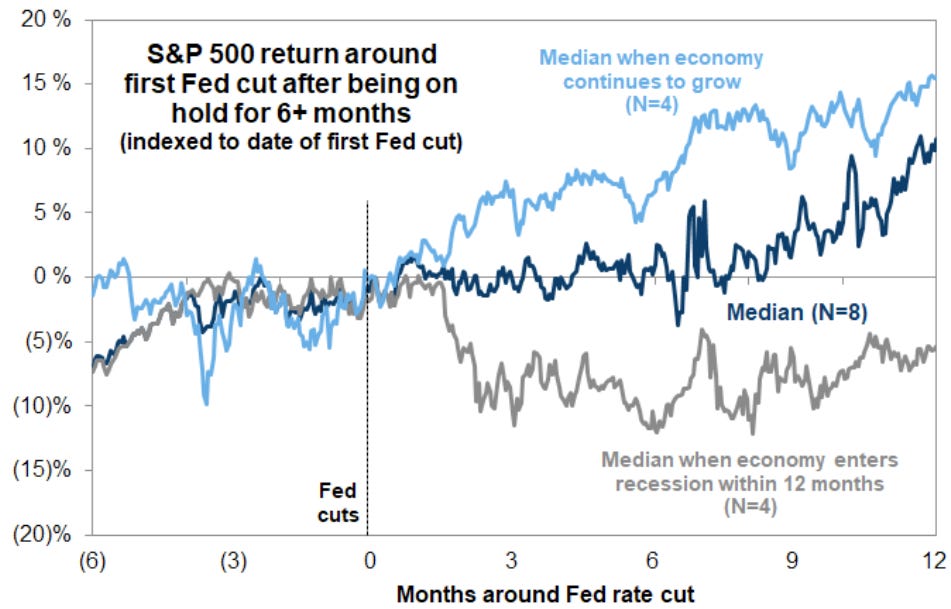

Equities tend to rise as the Fed starts to cut rates even when they start with markets close to ATHs. Volatility and momentum tend to be the best factor performers 3 months prior to and 3 months after the first cut.

Next week's economic reports will include the July Personal Consumption Expenditures Price Index as well as the first revision to Q2 gross domestic product.

Today we’ve authored an in-depth article about the current market environment and what to look moving forward, which you can get access to by becoming a paid subscriber.👇