Positioning Pulse

Markets closed the week higher, just shy of all-time highs, as next week’s Federal Reserve meeting is shaping up to be one of the most closely watched in years.

Impact Snapshot

JOLTS Job Openings - Tuesday

FED Rate Decision - Wednesday

Unemployment Claims - Thursday

Macro Viewpoint

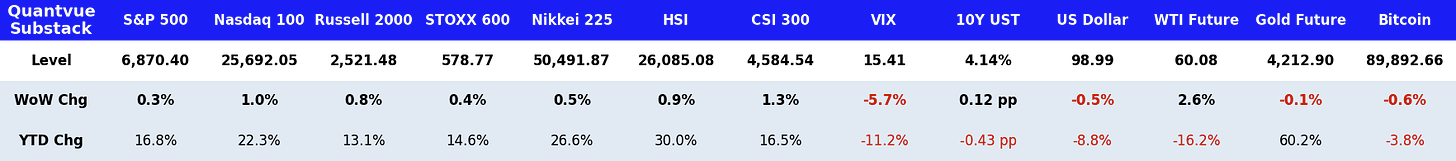

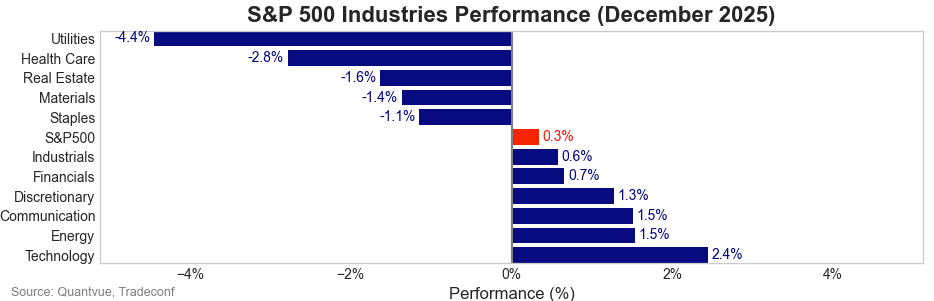

The S&P 500 rose 0.3% last week, with gains in the energy and technology sectors offsetting weakness in utilities and health care. As we’ve highlighted before, the market’s largest sectors continue to drive most of this month’s momentum.

Delayed government data released Friday showed that U.S. consumer spending growth eased in September.

The report, pushed back by the federal government shutdown, arrives just ahead of next week’s Fed meeting, where policymakers will decide on interest rates. Markets are currently pricing in an 86.2% probability of a 25-basis-point cut.

Prime Intelligence

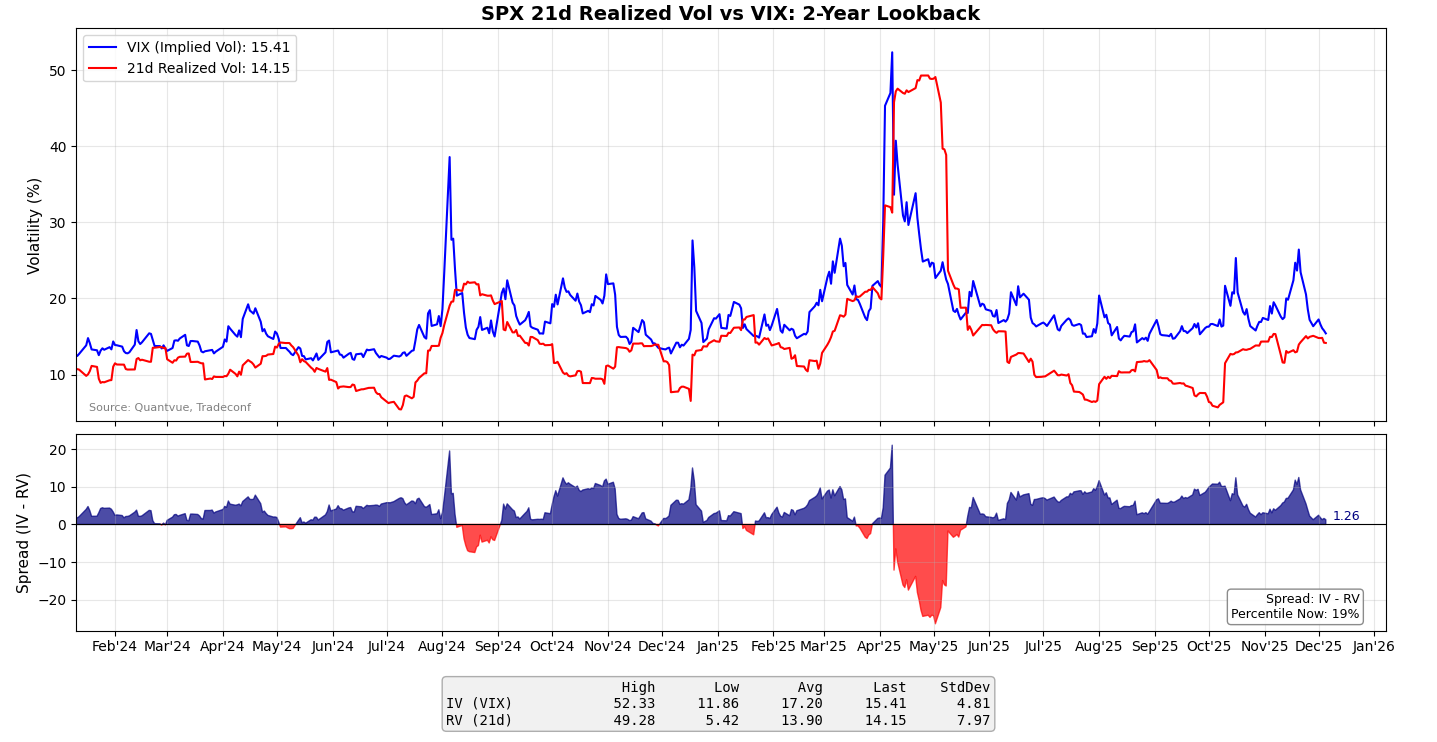

Since we alerted subscribers that the SPX shifted back into positive gamma on November 25th, the VIX has pulled back from 20.55 to as low as 15.41 by Friday’s close, and short-term realized volatility has continued to ease.

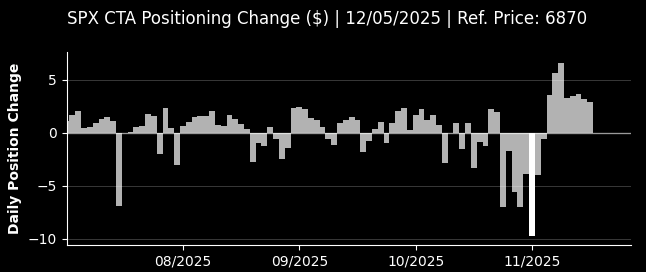

This has triggered mechanical buying from the systematic strategies we track closely, an outcome we had anticipated in last weekend’s brief and has once again played out, helping indexes slowly grind to the upside.

At the start of last week, we also highlighted the potential for consolidation given dealer positioning around the 6900 strikes, and that view played out as the SPX held a tight trading range throughout the week.

What’s next?

In today’s brief we’re sharing our updated forecasts and models to answer what’s next for this market as we approach year-end. We’re covering:

Positioning Update

Institutional Exposure

Corporate Buybacks

Systematic Projections

Liquidity Check

Technical View

We answer all that and much more in today’s brief!

Our research follows a rule-based, data-driven framework rather than discretionary judgment. We focus on breaking down the key market dynamics that matter most.👇