Positioning Reset

After a volatile stretch this month, driven by concerns over lofty valuations, assets across the board rebounded strongly last week, with the S&P 500 posting its best November reversal.

Institutional Monitor

“Stock prices rise when demand outweighs supply, and they fall when the opposite happens.”

The quote above , although context-dependent, highlights why understanding investor positioning is critical and the niece of this substack is doing exactly that.

If most investors are already overweight an asset class, everybody already owns it. That means there’s limited incremental buying that can happen, making it more difficult for the stock to go up and very often creates asymmetric risk skew.

How does this formulation help us understand the current market environment?

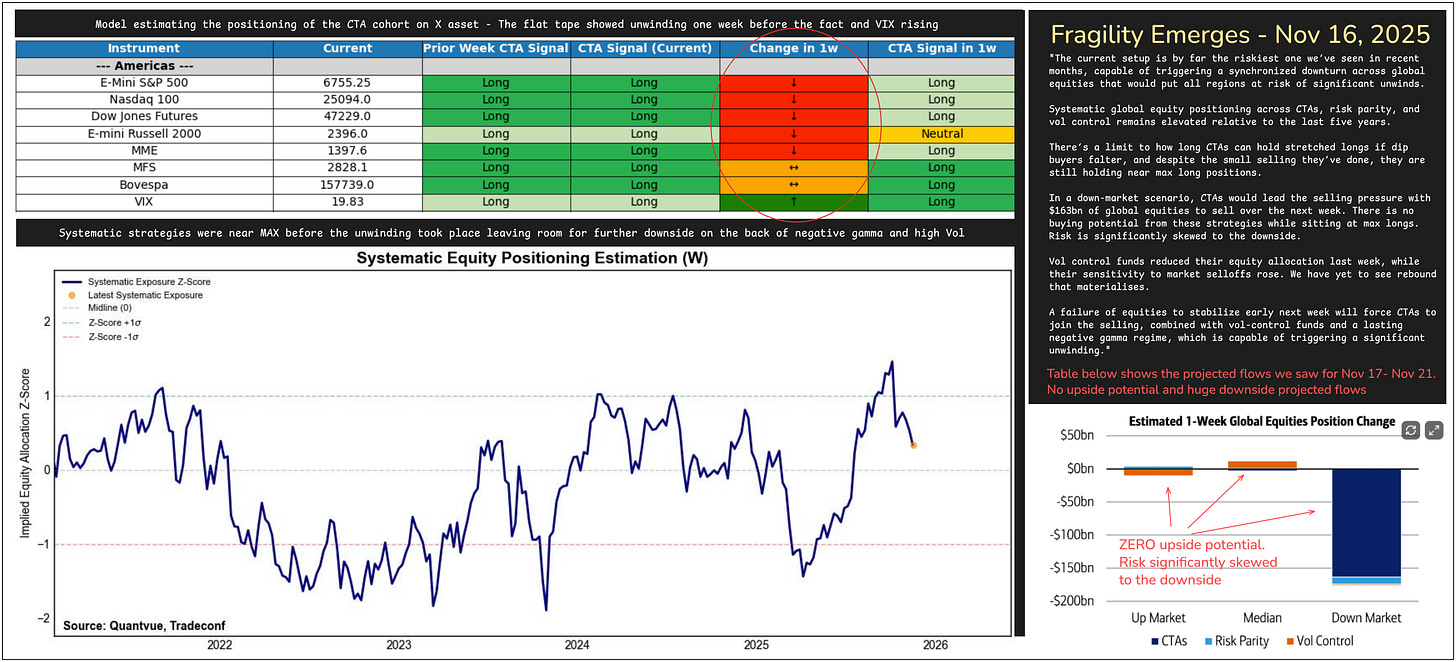

On Nov 16, 2025 we published our weekly report, warning our subscribers for the potential unwinding of systematic positioning at the start of that week.

Everything you see written in the picture below was shared on Nov 16, exclusively with our paid subscribers.

On Thursday 20th, hedge funds sold more equities than they have in 98% of previous times. This drove our systematic proxy models back toward neutral territory. Simply put, there was no more room in a flat or up-case scenario for them to add exposure in the market, and the risk was significantly skewed to the downside.

Aftermath Of Unwinding

After the systematic de-risking was absorbed, this left us with significantly better positioning at the start of last week, meaning that these large market participants had room to grow their positioning and buy more stocks.

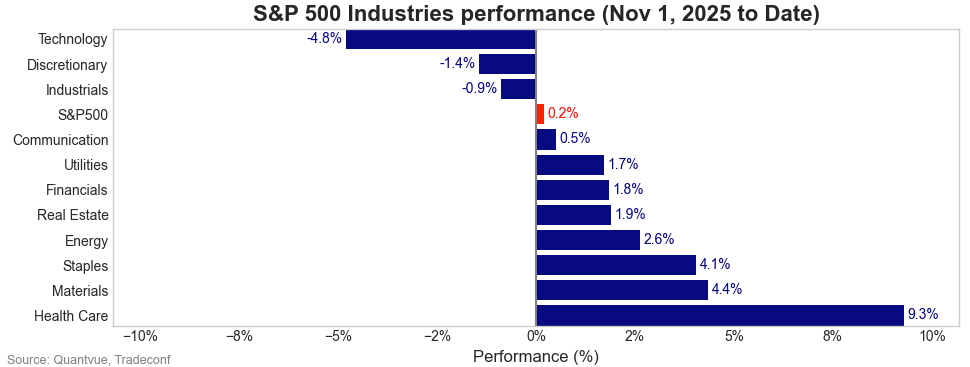

We’ve talked to a great extent the last few weeks about the market experiencing rotational activity into “safer pockets” of the market instead of complete risk-off.

This meant that the stress was happening inside the market, not across it.

The image above adds more color to that view as we see the S&P 500 finishing November with a small gain and significant capital rotation from tech to safer pockets, something we’ve been stressing since the start of November.

The Market Brief

The combined AUM of the strategies we track and build forecasting models on exceeds a trillion dollars. For many institutional funds running rule-based strategies, fundamentals are simply not part of the algorithm.

Our market evaluation process is math-based, repeatable, and fully independent. No conflicts of interest. No narratives to push. Just what the data indicates is likely to come next.

📰 In today’s weekend edition, we cover:

What’s the updated systematic positioning?

Do we have room for growth, or should we expect a reversal?

Has the structural weakness we flagged on Nov 16 shown any improvement?

What risks do we see moving forward?

We answer all this, and more, in today’s brief.👇