Reflect. Adjust. Improve.

Hey team. U.S. stocks are set to face one of their final major tests of the year with the upcoming Federal Reserve meeting. Investors will be closely watching for the central bank's guidance on the trajectory of interest rate cuts.

Let’s review last week’s data and see what’s next!

Impact Snapshot

Manufacturing/Services PMI - Monday

Retail Sales - Tuesday

FED Policy Decision - Wednesday

U.S. Q3 GDP - Thursday

Unemployment Claims - Thursday

PCE Inflation -Friday

Consumer Sentiment - Friday

Macro Viewpoint

The S&P 500 index declined 0.6% this week, marking its first weekly loss since mid-November. Despite the dip, the index remains firmly in positive territory for 2024, boasting a year-to-date gain of 27%.

Recent data revealed a 0.3% rise in the US consumer price index (CPI) for November, slightly higher than the 0.2% increases recorded over the previous four months. Additionally, producer prices for November climbed more than anticipated.

Inflation metrics remain under scrutiny as the Federal Reserve's Federal Open Market Committee (FOMC) prepares for its final rate-setting meeting of the year next week.

Market optimism about potential interest rate cuts has contributed to the S&P 500’s gains. While the Fed is widely expected to reduce borrowing costs by another 25 basis points next week, strong economic growth and persistent inflation have tempered investor expectations for the pace of rate cuts in 2024.

The FOMC meeting will dominate attention next week, alongside key economic reports, including the second revision to third-quarter GDP and November US retail sales data.

Why Journaling is important

Your success is not going to lie in your winning trades ever.

Your success is going to come from avoidance of losing trades or modifying those losing trades, making adjustments and cutting those losers down as small as possible.

Keeping a journal allows you to identify recurring mistakes that may be eroding your profits. For each losing trade, reflect on what went wrong.

Did emotional decisions lead you to stray from your trading plan?

Did you act on insufficient evidence when entering or exiting a position?

Are you entering trades based on gut feelings rather than solid strategy?

Do you hold onto losing positions for too long, hoping for a turnaround?

Quantify the financial impact of these errors to fully understand their significance.

Recognising these patterns enables you to create strategies to address them, fostering greater discipline as a trader. The more insights you gain from your mistakes, the less likely you are to repeat them in the future.

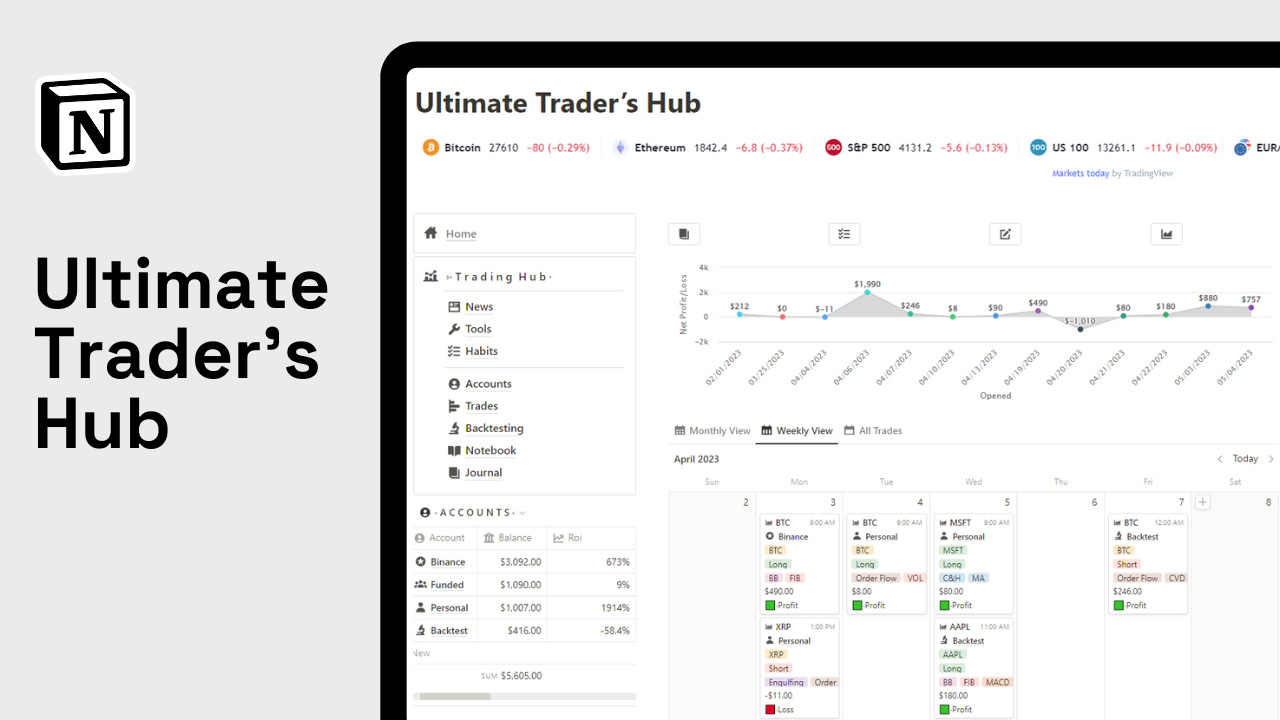

Looking for a trading journal that’s more than just a spreadsheet? Discover the Ultimate Trading Hub—your personalised, all-in-one solution for tracking and improving your trades.

Unlike automated trading journals, the Ultimate Trading Hub puts you in control by requiring manual trade entry. Why?

Because manually recording each trade fosters deeper engagement with your decisions, enhances self-awareness, and encourages thoughtful reflection. Instead of passively reviewing auto-generated data, you’ll actively document your process, gaining valuable insights that automated tools simply can’t provide.