Seeking Balance

Hey team. The global sell-off on stock markets deepened as US jobless figures hit a three-year high. Let’s recap last week and see what’s next for the markets!

Impact Snapshot

ISM Services PMI - Monday

Trade Balance - Tuesday

Unemployment Claims - Thursday

Key Earnings: DIS 0.00%↑ CAT 0.00%↑ LLY 0.00%↑

Market Evaluation

Stocks plunged on Friday following the release of a surprisingly weak July jobs report, sparking concerns that the economy could be falling into a recession.

The sense of calm and contentment surrounding the latest bull run began to crack on July 24th, when the S&P 500 experienced its first drop of 2% or more in 17 months.

Following the largest two-day selloff since March 2023, anxiety has surged significantly.

The Federal Reserve faces criticism for delaying rate cuts, while weak earnings are impacting the technology companies that had been fueling the rally.

Earlier in the week, data revealed ongoing contraction in the US manufacturing sector for July due to weak demand, while weekly unemployment insurance claims reached their highest level in nearly a year.

Fed Chair Jerome Powell said a September rate cut "could be on the table," though policymakers will remain data-dependent.

Markets Breakdown

One of the most volatile weeks we’ve had in months is concluded, introducing a lot of emotion in the markets. When emotions are in control of the market, our main focus is always riding the momentum.

The closing weakness of Thursday’s session carried over on Friday where we had another liquidation break with continuation all the way towards our last reference.

Market found a bottom at this level and later saw a range-bound activity well below the previous 5-day balance range.

Catalysts drive markets to trend days while the lack of them can see balance/range formations beginning to take shape.

Next week, the lack of key economical catalysts and earnings in contrast to last week will likely see a market that will try to form a consolidation range with overlapping value areas, something that we haven’t seen at all last week.

ES

Some references we’ll be looking going forward:

Upside Levels: 5387/5422/5452

Downside Levels: 5347/5328/5311

That’s all we got!

Like this post, share it with a friend.

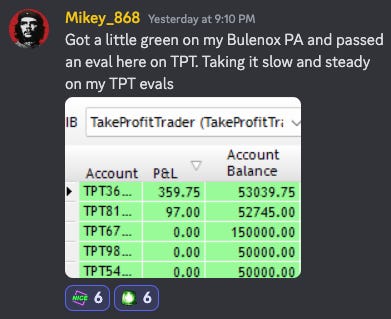

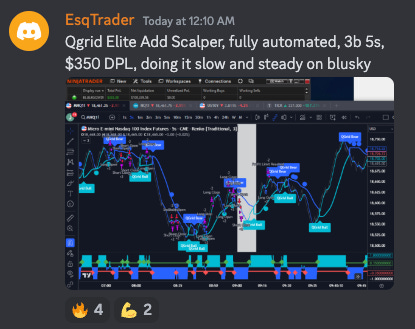

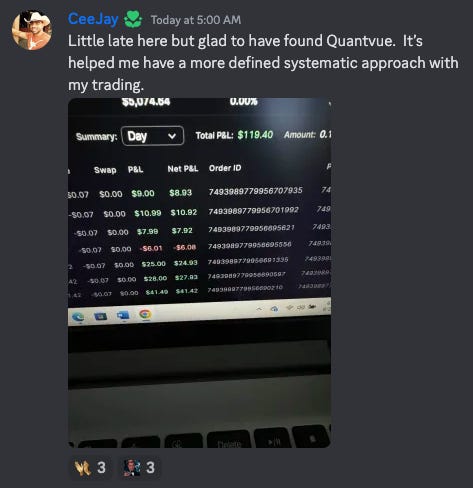

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.