Hey team. The much anticipated volatility is putting us back on imbalance state as the market is seeking fair value. Let’s re-cap today’s session and what we were watching and see what’s next!

Impact Snapshot

US retail sales beat forecasts

Jobless claims fall for a second week to the lowest since July

Market Evaluation

Stocks rose as data on retail spending and the labor market highlighted the strength of the world's largest economy, easing concerns that the Federal Reserve might trigger a more severe slowdown.

After a more than 3% gain this week, the S&P 500 is now roughly 2% below its record.

This week’s positive inflation data had eased investors recession fears before Thursday’s wave of economic reports, leading to a rebound in equities after last week’s steep global sell-off.

Retail sales rose by 1.0% following a downwardly revised 0.2% decline in June, alleviating concerns of a sharp economic slowdown sparked by last week's spike in the unemployment rate.

Markets Breakdown

This morning on a post we’ve made on X here at around 2:00am ET, we’ve given warnings that the poor formation at 5492 was not going to be the lasting globex high.

So much about understanding markets and structure is paying attention to what other traders are doing and who is in control of the market.

The volume that occurs in the overnight is often no more than 25 percent of the volume experienced during the pit session hours.

When you see traders on low volume pilling up on “exactness” of a pivot, they will place their stop just a few ticks above it and try to short the same reference that everyone else does over and over again.

The moment the market pokes this “bubble” of stops, it produces a short-covering rally that feeds on itself on top of emotional momentum buying.

Despite the fact that we’ve made this post at 2:00am, when absolutely no “news” could have hit the market at that time, we were still looking at the same thing.

Poor highs and lows are weak areas and the odds favour excess of at least a couple ticks higher. Here is the update to this post.

The more times you “poke” a reference point the weaker it becomes. This is fundamentally what an unfinished auction is. Price has not gone high enough to shut off buying and print an excess high.

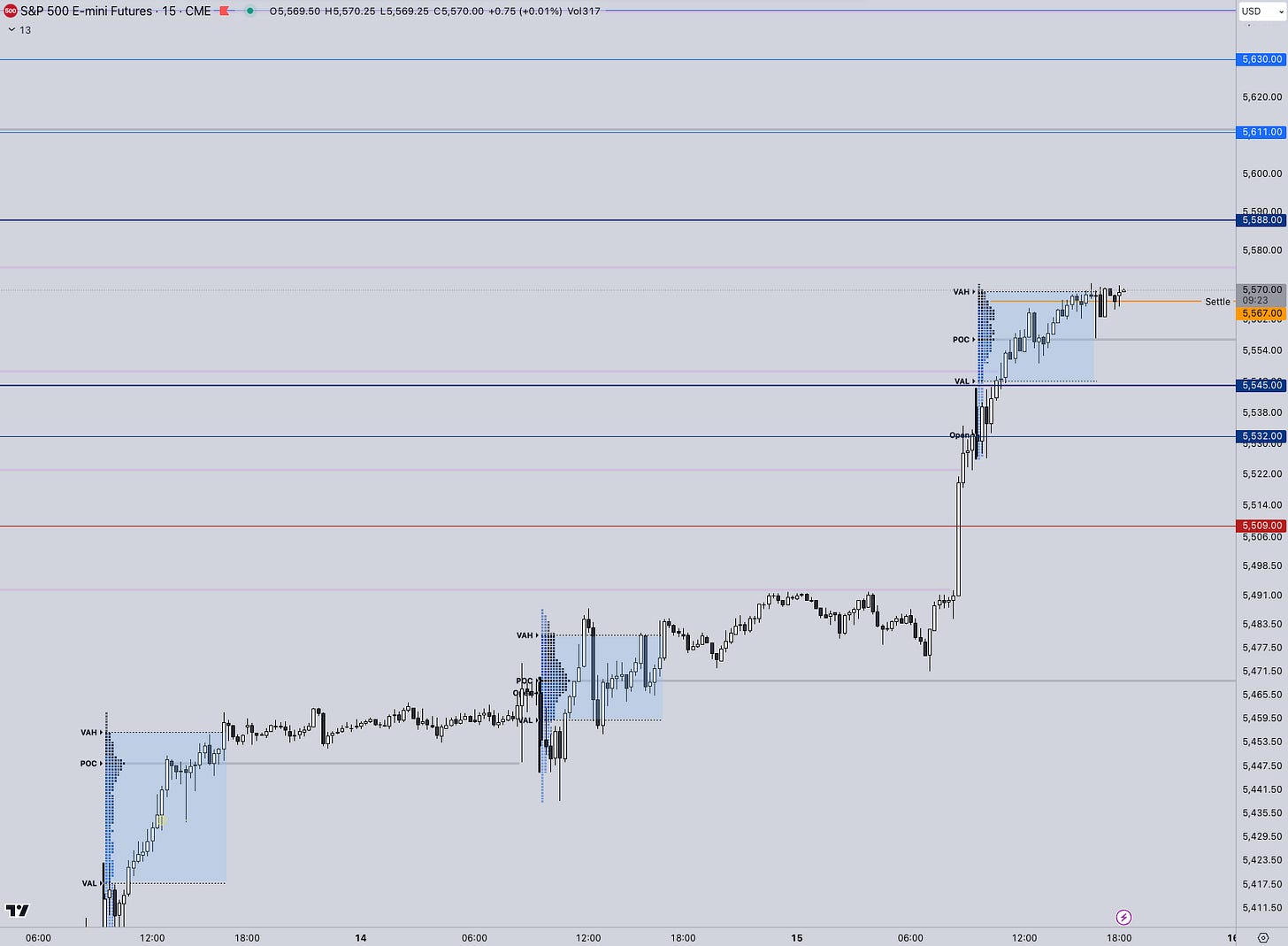

ES

Some references we’ll be looking going forward:

Upside Levels: 5588/5611/5630

Downside Levels: 5545/5532/5509

That’s all we got!

Like this post, share it with a friend.

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.