September Risk Outlook

The next few weeks will show Wall Street whether the recent stock rally can continue, with jobs data, a key inflation report, and the Fed’s rate decision in focus.

Impact Snapshot

U.S. Stocks Closed - Monday

ISM Manufacturing PMI - Tuesday

JOLTS Job Openings - Wednesday

ADP Payrolls - Thursday

Unemployment Claims - Thursday

U.S. Jobs Report - Friday

Macro Viewpoint

US markets have had a blistering run since the April lows, with the S&P 500 now up >10% YTD. For context, the 34% run-up since the lows is around 25% more than the best annual S&P return (28%) posted during the legendary late-90s equity bull market.

The rally has been fueled by a resilient economy, exceptionally easy financial conditions, and a surge in applied innovation. Investors are also recognizing that the impact of tariffs is far less severe than initially feared.

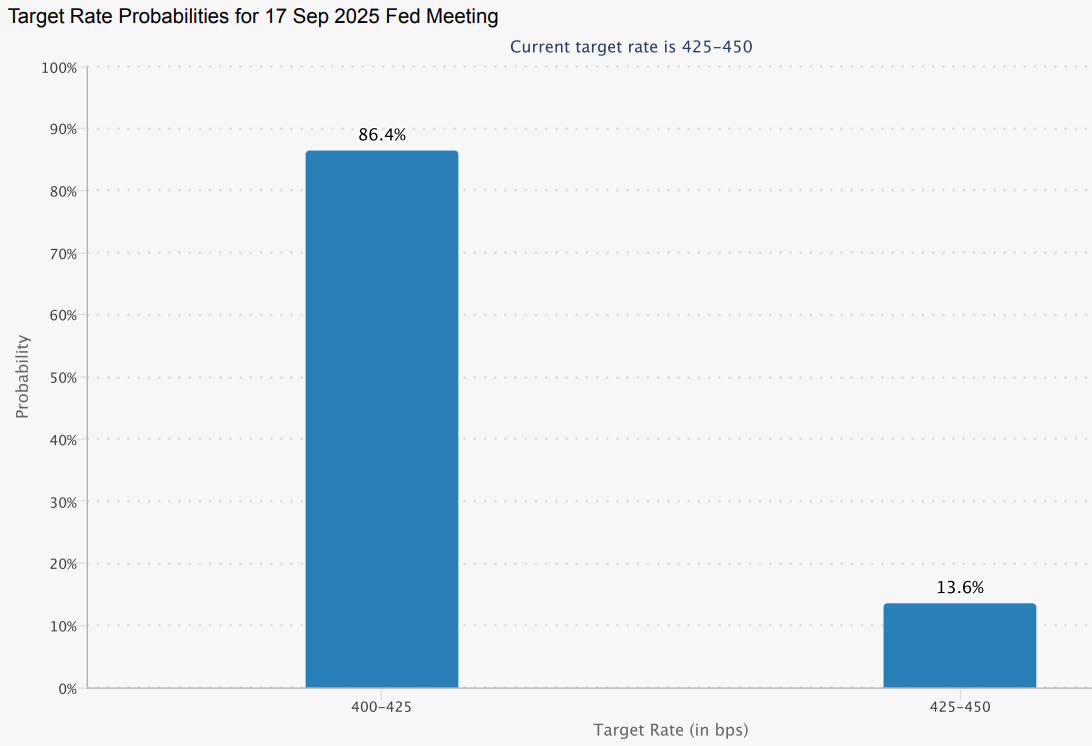

The repricing of expected Fed cuts was a key feature of August price action, cuts are now priced to start (with 86% probability) imminently in September.

With the backdrop of increasingly volatile and uncertain jobs data, the payrolls print next Friday, followed by CPI on 11th Sept, will take on extra significance.

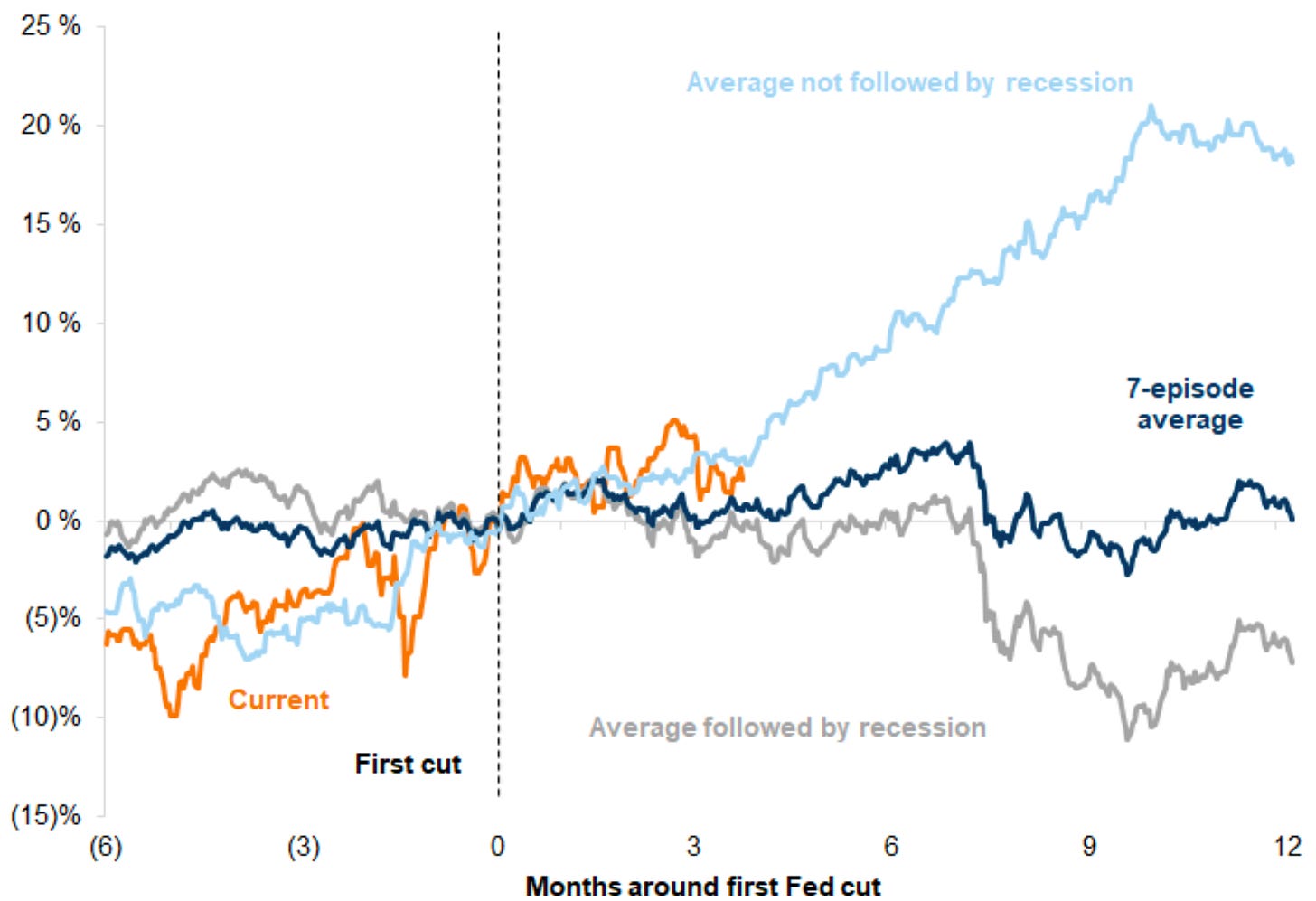

So far, equity markets have applauded and welcomed the prospect of lower rates; as long as the US economy continues to avoid the threat of further contraction and recession risk, history shows equity markets are likely to continue to trade that bullish narrative.

We’ve authored an article today, “Road to September,” – See how top money managers and hedge funds are positioning their money and preparing for next month along with all the potential risks ahead.