Summer Liquidity

S&P 500 gained 2.4% last week closing in right at the ATH, as investors digest a constructive earnings season and a changing outlook on the US economy.

Impact Snapshot

CPI Inflation - Tuesday

PPI Inflation - Thursday

Unemployment Claims - Thursday

Retail Sales - Friday

Consumer Sentiment - Friday

Macro Viewpoint

US inflation becomes the focus point for Fed officials and markets. US CPI, PPI are reported this week, with risks skewed towards stronger goods' prices.

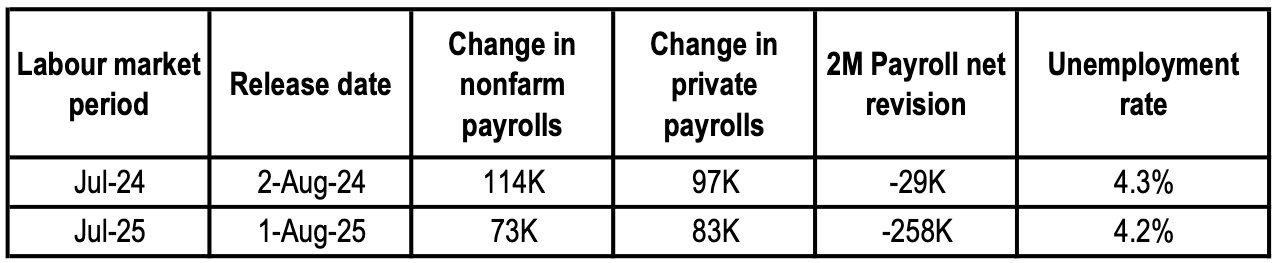

US macro resilience was challenged as the July jobs report showed softness, with sharp downward revisions. This data challenges Chair Powell’s “wait-and-see” approach. The muted unemployment rate impact suggests weak labour demand and supply due to slowing growth in foreign-born labour.

That weak data was met with solid earnings. 2Q Earnings had an upside surprise with an upward trend for EPS growth for 2025 and 2026e gaining traction following downward revisions since January.

Summer Liquidity

To put a line under it, market depth and the ease of risk transfer are starting to deteriorate. This is a “twitchy, erratic” trading environment where day-to-day price action has become a bit more indiscriminate, and some noticeable dislocations are starting to pop up.

This is a FREE edition of the Market Brief. Want our institutional insights on a daily basis, delivered right to your inbox? Get access now! 👇