Sustaining strength or setting a trap?

Hey team.

We've got another market brief on $ES for you.

Can the closing strength of Friday’s session carry over to next week?

Let’s discuss all the things we’ll be looking moving forward!

Impact Snapshot

ISM Manufacturing PMI - Monday

JOLTS Job Openings - Tuesday

ADP Non-Farm Employment - Wednesday

ISM Services PMI - Wednesday

Unemployment Claims - Thursday

U.S. Jobs Report - Friday

Market Evaluation

The S&P500 index experienced its first weekly drop since mid-April, yet it concluded May with a strong monthly increase.

This week's economic data showed US consumer spending weakened more than expected in April as outlays on goods fell into contraction territory.

April’s decline in consumer spending likely contributed to the welcomed pullback in inflation. Yet it also may raise the question of how long the economy can hold up.

A fresh government jobs report, due Friday, will offer more insights into the direction of the labor market.

Fed policymakers will pay close attention to those numbers as they continue their quest to tame inflation without breaking the economy.

Markets Breakdown

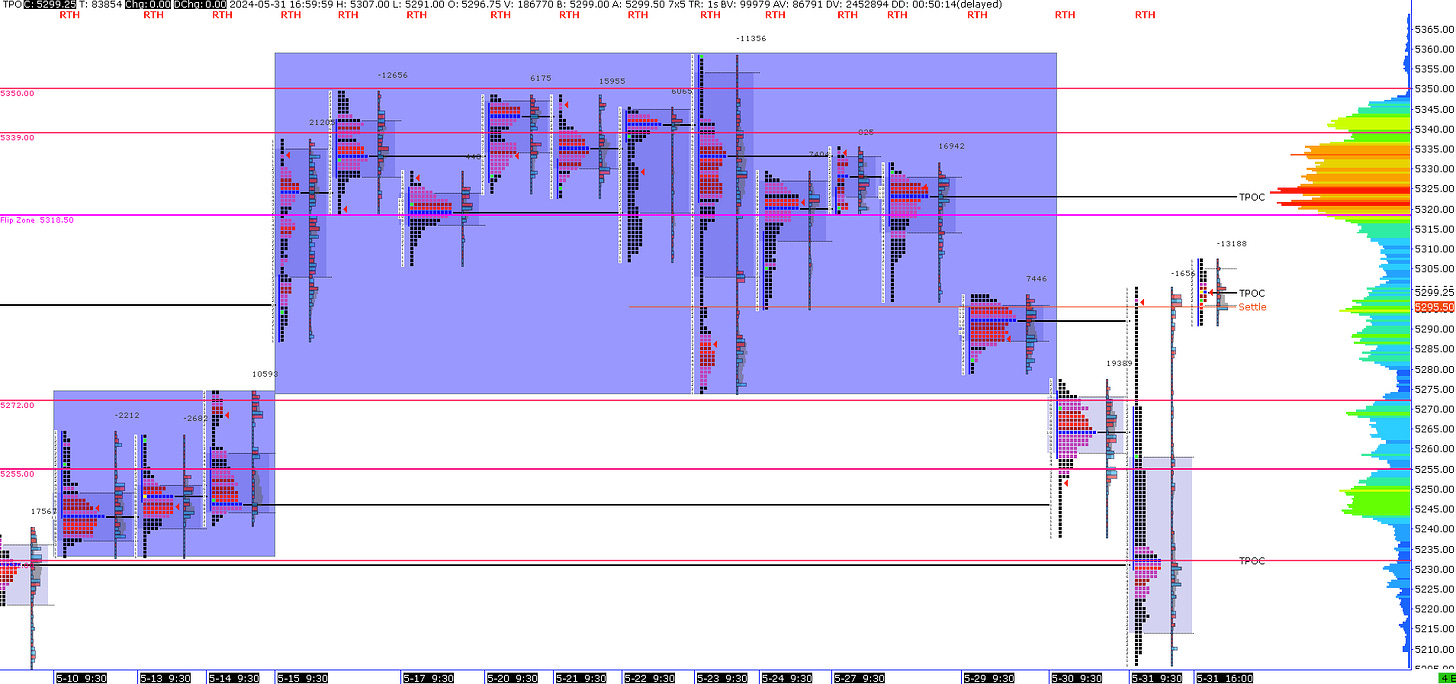

Friday’s emotional session was contained inside the extreme pivots of our market report for the day, sitting at 5205 and 5307. Read update here.

The “week will end with a bang” comment from our previous Substack was justified with the market seeing an emotional role-coaster session with an initial upside at the PCE inflation report and a pullback of 1% towards 5205 before we saw a bounce right back towards the 5300s area.

When a market is being too short, it can actually strengthen that market for the short term. Once the short covering ends, unless it’s joined by new money buying the market, it can weaken that market because that buying power of shorts having to cover is removed.

The key takeaway here is that the market didn’t find acceptance below the 5200s and everyone that was wrong being too short to get the market towards that reference had to cover, sparking a rally that was feeding on itself from an overly short market open.

Going into Monday’s session our focus will be acceptance back inside the previous balance with a clear flip of 5318 as support. Failure to build value above 5300s will lead to a re-test of 5272 where bulls must defend.

ES

Some references we’ll be looking heading into the Monday open

Upside Levels: 5318/5339/5350

Downside Levels: 5272/5255/5232

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.