Systematic Flows

Hey team. The S&P 500 index declined by 2.3% this week, adding to its losses for the year as worries over the escalating global trade war and an unexpectedly sharp drop in consumer sentiment weighed on the market.

Let’s re-cap Friday’s session and see what’s ahead for the market!

Impact Snapshot

Retail Sales - Monday

Fed Rate Decision - Wednesday

Unemployment Claims - Thursday

Macro Viewpoint

The S&P 500 officially entered correction territory last week as investors digested the implications of policy uncertainty on the economic outlook.

The S&P 500 just fell 10% in 20 calendar days which is the 5th fastest correction in the last 75 years.

Next week economic data will be focused on February retail sales and Federal Open Market Committee's interest-rate decision.

Investors remain concerned about the outcome of an ongoing tariff war between the US and several of its trading partners.

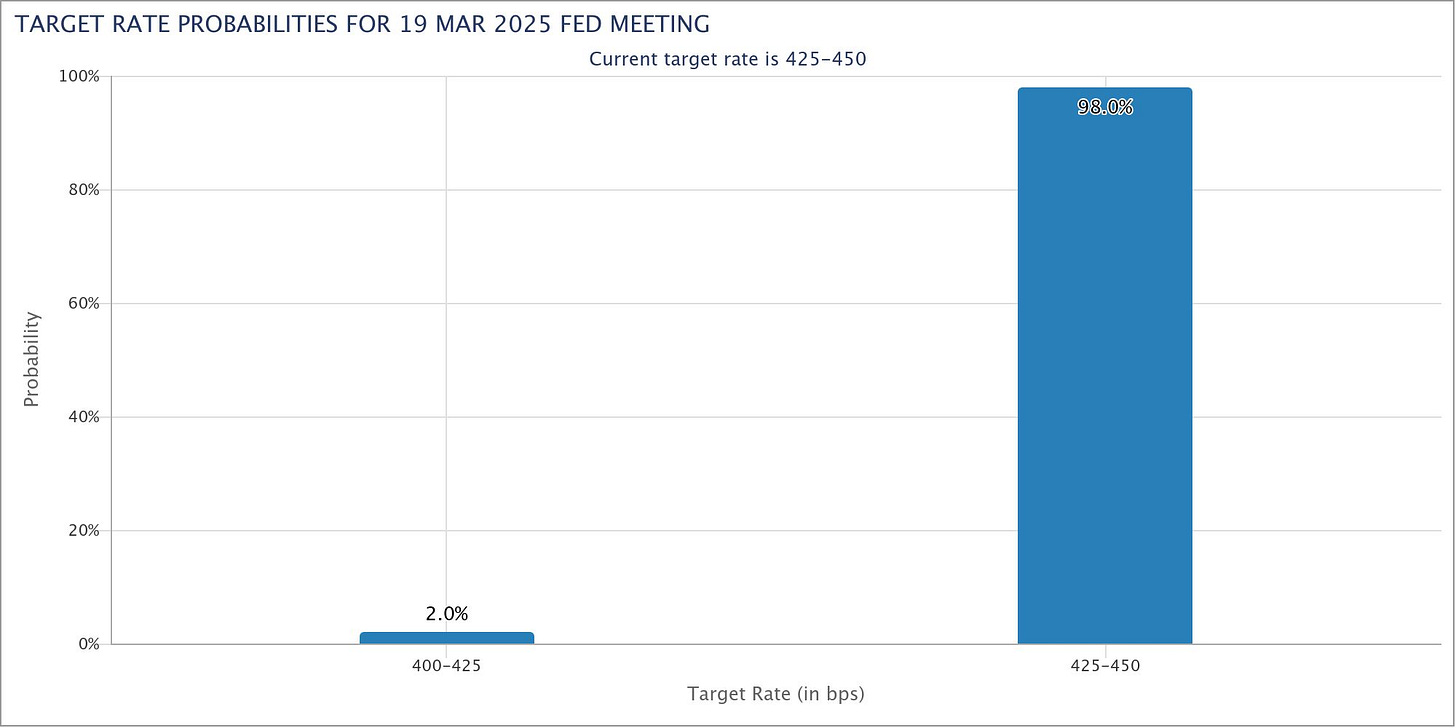

The March FOMC meeting will likely be all about policy uncertainty. The Fed will almost certainly stay on hold, emphasizing patience over panic.

Markets could interpret the Fed’s message as hawkish because they are focused on downside risks to activity

Wall St. Prime Intel

You might assume hedge funds always outperform the market or even the index—but you’d be wrong. Many don’t. They’re structured to remain highly profitable for fund owners through fees, not so profitable for their clients.

This isn’t just speculation from a TikTok influencer—we have the numbers. Data straight from prime services at major U.S. banks, shared with institutional investors and asset managers on their reports.

Today’s article shares insights into the current market situation from the HFs & CTAs perspective, what their outflows reveal, and where they’re adding risk next week.👇