The Aggression Factor

Hey team, a slew of economic reports that will serve as key catalysts is set to test the market’s strength or weakness next week.

In today’s article, we break down the basics of why prices really move.

Impact Snapshot

ISM Manufacturing PMI - Monday

JOLTS Job Openings - Tuesday

ADP Non-Farm Payrolls - Wednesday

ISM Services PMI - Wednesday

Fed Chair Powell Speaks - Wednesday

Unemployment Claims - Thursday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Macro Viewpoint

The S&P 500 index climbed 1.1% during this holiday-shortened week, capping November with its largest monthly gain of the year.

The index closed Friday’s abbreviated trading session at a record high, following a Thanksgiving holiday closure on Thursday.

This week’s economic data revealed that US real GDP grew at an annualised rate of 2.8% in the third quarter, consistent with earlier estimates.

The growth rate for personal consumption expenditures in Q3 was marginally revised down to 3.5% from the initial 3.7%.

Looking ahead, December kicks off with a slew of economic reports, but the spotlight will be on November’s employment data, which is set to be released later in the week.

Why does the price move?

This short article will provide an introduction to what truly drives the movement of the securities you trade and why their prices fluctuate.

The first thought that might come to mind when considering this question is an answer like: "The market moves down because there are more sellers than buyers."

While this may sound correct, it isn't entirely accurate. Aggression is what actually moves the markets.

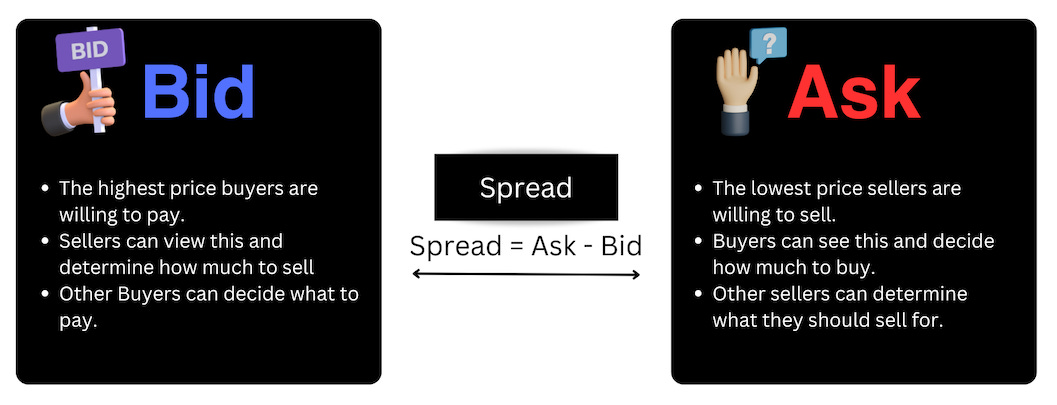

In the futures market, for every buyer there is a seller and for every seller there is a buyer. For market to move down we need to have aggressive sellers that are willing to hit the bid. If everyone was sitting on a limit order the market would simply not move.

In the context of trading futures, if you want immediate execution and assurance that your order will be filled, you’ll use a market order. This means your order will execute at the best available price at that moment.

Financial markets fluctuate based on imbalances between buyers and sellers and their aggression. This dynamic highlights the distinction between strong-handed and weak-handed market participants.

For example, some key economic reports come in better than expected. As a result, investors eager to enter the market early and avoid missing out begin market buying, consuming the limit sell orders and driving prices higher.

Institutional investors, due to the size of their positions, require a longer time horizon to buy or sell without significantly impacting the market price. High liquidity is crucial for them to execute large trades efficiently.