The Auction Approach

Hey team. The US election on Tuesday will have far-reaching economic consequences and we can expect heightened market volatility in the coming week as a result.

Let’s recap last week’s events and see what’s next!

Impact Snapshot

ISM Services PMI - Tuesday

Presidential Election - Tuesday

Unemployment Claims - Thursday

FED Policy Decision - Thursday

Consumer Sentiment - Friday

Macro Viewpoint

The S&P 500 index dropped 1.4% this week, marking its second consecutive weekly decline, largely driven by mixed quarterly results from major tech giants.

This week brought a wave of economic data, including an early estimate of U.S. Q3 GDP growth, the Federal Reserve’s preferred inflation gauge, and the October jobs report.

The data pointed to ongoing weakening in the labor market, steady but modest economic growth, and persistent inflationary pressures that aren’t fully resolved.

Together, these factors keep the Fed on course for another interest rate cut next week.

Investors next week will also focus on the outcome of a two-day Federal Open Market Committee meeting that concludes Thursday with a rate decision along with The US presidential election is on Tuesday.

Balance to Breakout

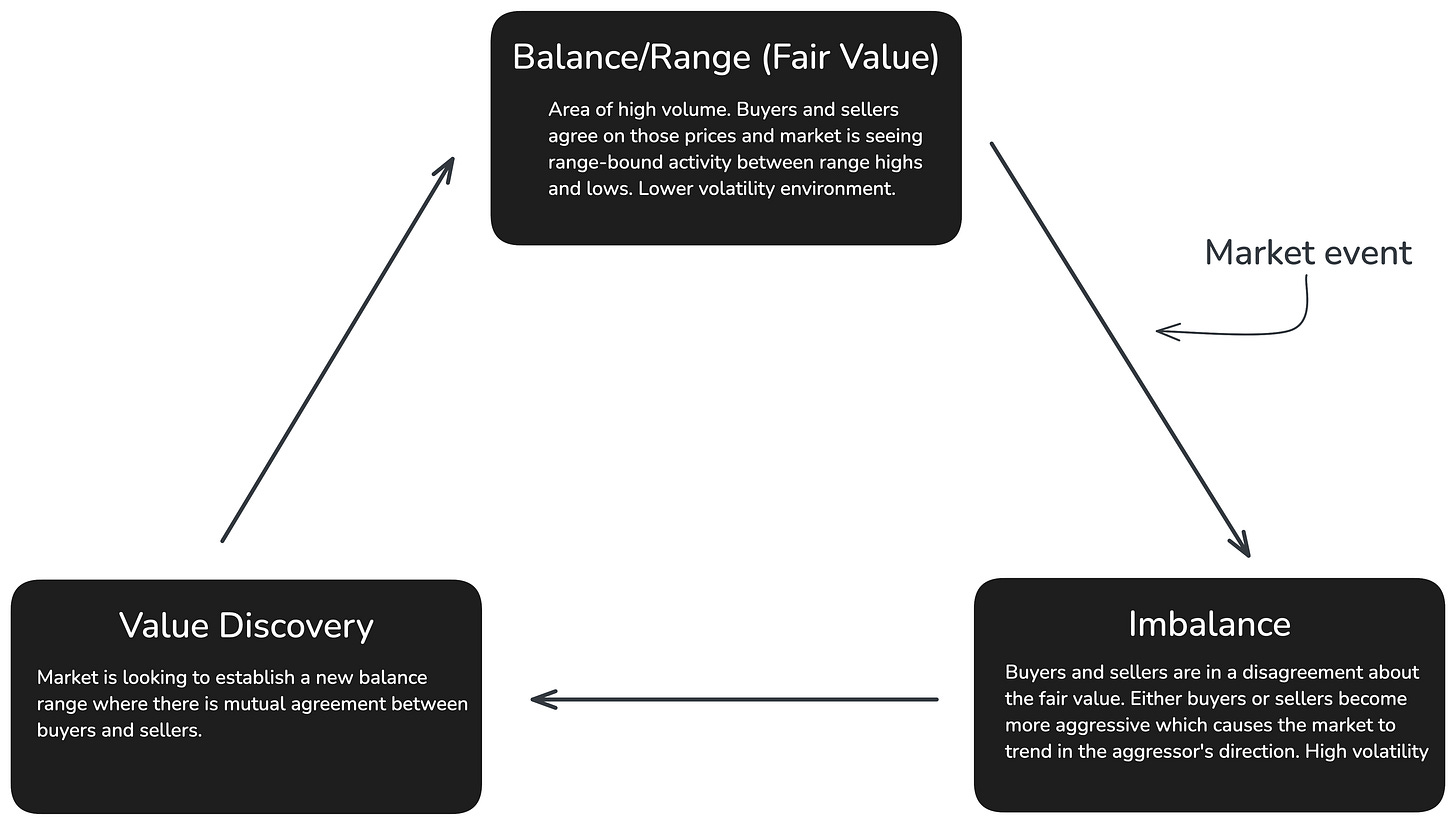

If you’ve been following our reports for a while, you know that we apply concepts from auction market theory. Just as an auction is used to sell a painting, the futures markets function in a similar way.

The market continuously auctions up and down, searching for buyers and sellers at various price levels.

Fair Value represents the price range where trading is most active among market participants. The equilibrium between buyer and seller aggression leads to trading within a range with increased volume that is known as a state of balance.

Market imbalances arise from events that prompt either buyers or sellers to take a more aggressive role. Prices situated above or below the fair value price characterised by high volume are deemed "unfair" prices.

Markets in general only trend about 20% of the time and range 80%.

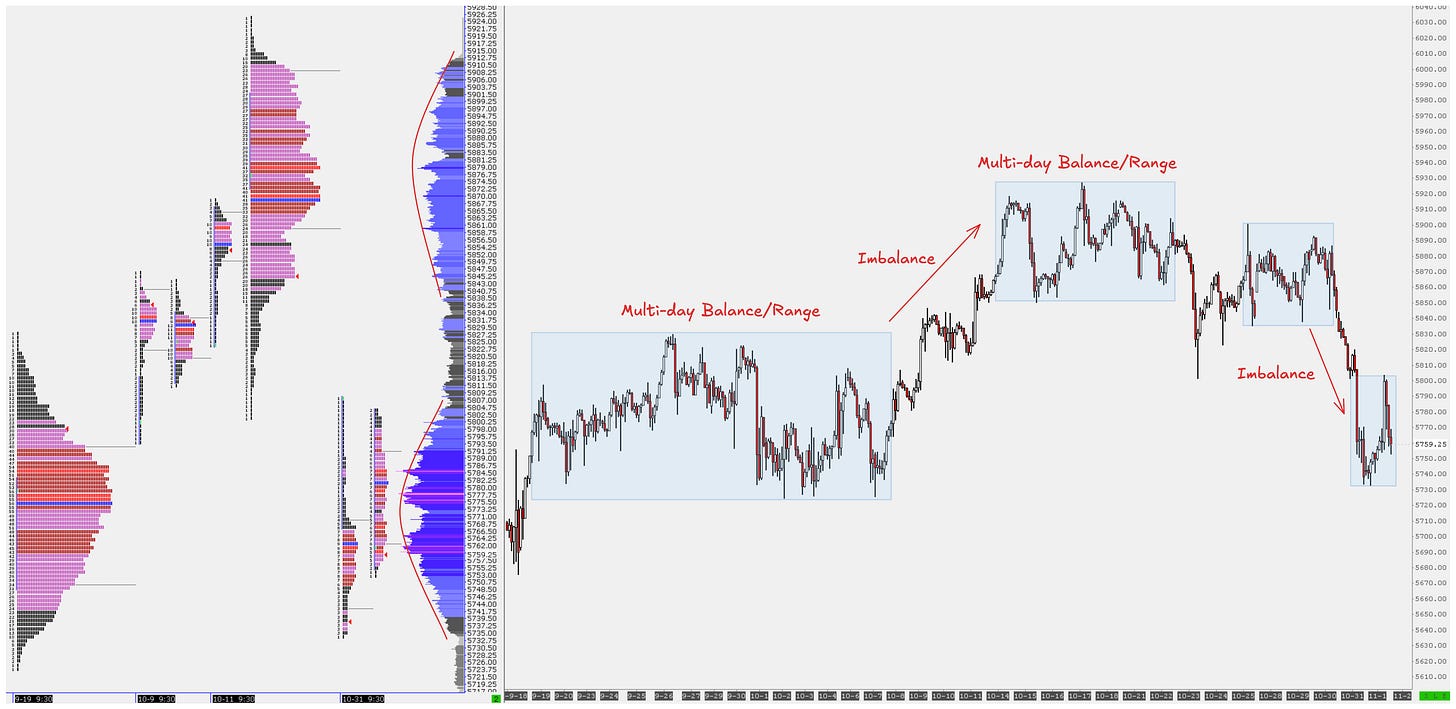

Recent price action has been reflecting these exact concepts. It usually takes some type of catalyst to change the perception of value and push the market into an imbalanced state.

Once the price breaks from a balance and then finds acceptance back within a previous balance, it tends to rotate toward the other end of that balance.