The great rotation

Hey team.

Last week we’ve projected warnings about the signs of diversification with asset managers rotating capital out of tech and into smaller caps.

Let’s look how markets reacted so far this week and see what’s next!

Impact Snapshot

Smaller firms outperforming big tech on speculation of Fed rate cuts

June retail sales stronger than expected

Market Evaluation

Stocks reached record levels as speculation that the Federal Reserve will soon lower interest rates spurred investors to move into riskier market sectors.

The Dow surged and Russell 2000 touches multi-year high, as the bull market expanded beyond technology stocks due to optimism about upcoming interest rate cuts.

Traders are now certain that the Fed will lower rates in September, according to the CME FedWatch tool.

Over the past four sessions, the Russell has beaten the Nasdaq by almost 12 percentage points something that has not been seen since 2011.

The rotation from megacap technology stocks to small-cap and cyclical stocks started a week ago, following June's consumer price index report, which indicated the lowest inflation in three years.

Retail sales data out Tuesday further validated investors belief that the Fed had achieved a so-called soft landing with the economy. June sales were unchanged, versus expectations for a decline.

The reading was seen as a sign that inflation was nearing the Federal Reserve’s 2% target, and the central bank might be able to lower interest rates.

Markets Breakdown

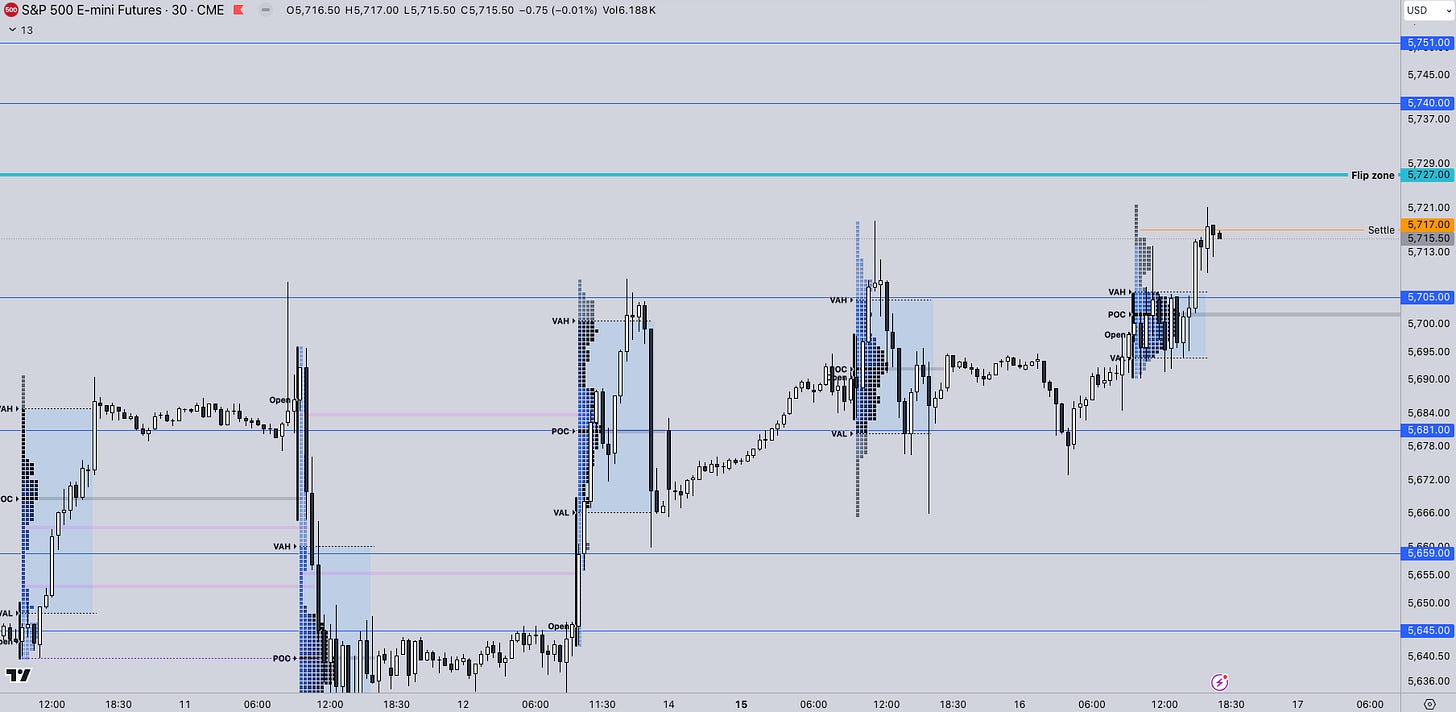

On our market report we’ve posted here this morning, our main focus point was looking at developing value for clues of continuation or the lack off.

There was an initial rejection off of our flip zone resistance at 5706 which the market has spent most of the session below until a late session breakout. As always, the more times you poke a point of reference, the weaker it becomes.

When a market goes on a “melt up” like this, it usually takes some type of catalyst to trigger a meaningful sell off.

One way of defending yourself from a bias and refrain from trying to cherry pick the all time high and stand in front of a trend is looking at developing value and not exclusively focusing on price.

If the market moves higher and higher prices bring in more buying, paired with the market spending time and building volume at these prices, then that’s a clear acceptance of these prices.

ES

Some references we’ll be looking going forward:

Upside Levels: 5727/5740/5751

Downside Levels: 5705/5681/5659

That’s all we got!

Like this post, share it with a friend.

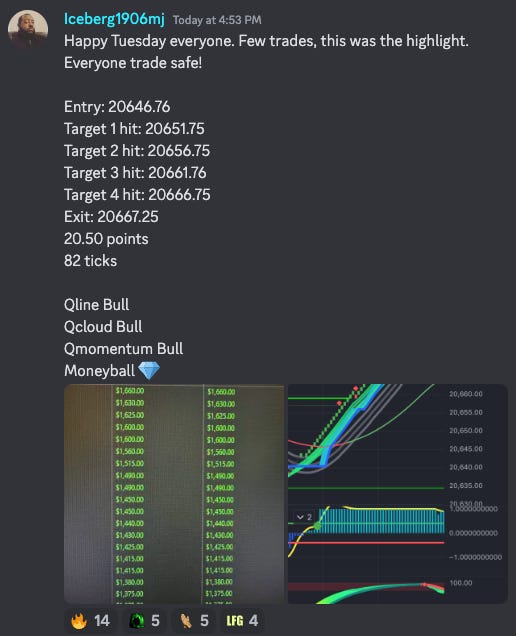

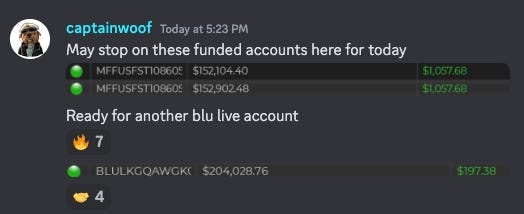

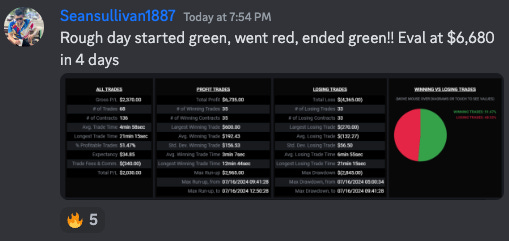

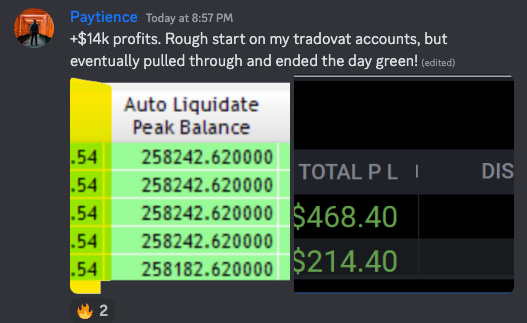

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.