The Market Brief

Hey team. Stocks moved higher following news of a ceasefire agreement between key parties in the Middle East, sparking cautious optimism around potential de-escalation and a more stable geopolitical outlook.

Let’s see what’s ahead for this market!

Impact Snapshot

🟥 Fed Chair Powell Testifies - 10:00am

🟥 Consumer Confidence - 10:00am

Macro Viewpoint

Stocks staged a risk-on rally following Iran’s retaliatory response, which avoided major oil assets with no US casualties reported. Oil quickly erased all the gains since Israel’s attack on June 12th.

Given this de-escalation in geopolitical risks, combined with dovish Fed speaks and positive macro data, stocks quickly rebounded in the afternoon session yesterday.

As the market moves past the latest geopolitical dust-up, signs point to a resilient economy with good-to-great earnings potential. A continued thawing of the trade war is the final piece to the bull case.

Wall Street Prime Intelligence

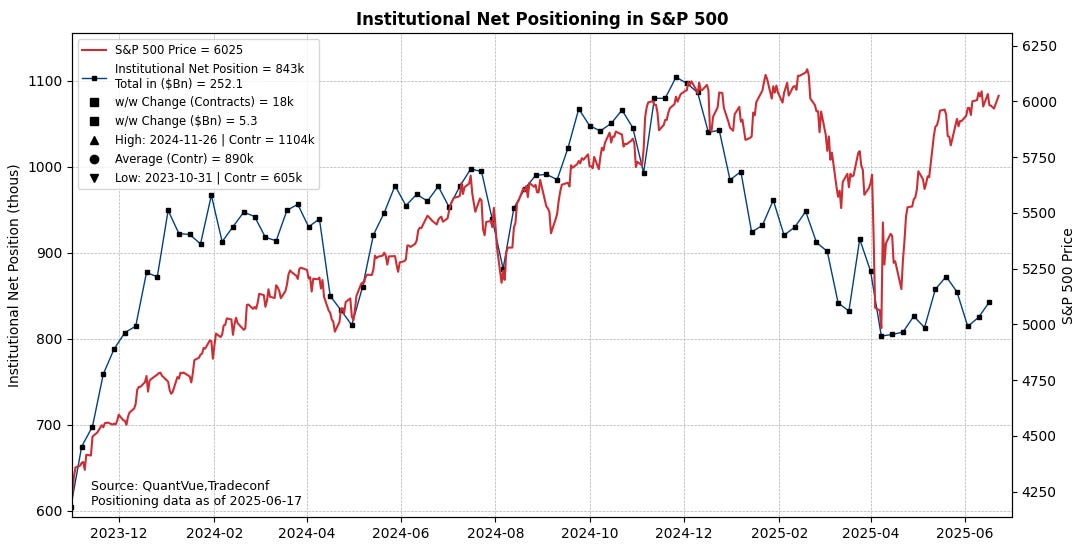

After successfully front-running the tariff sell-off back in late December while the S&P 500 was still making all-time highs, institutional positioning has remained rather depressed, with a tremendous amount of cash piled on the sidelines.

In today’s Prime Intelligence, we discuss what’s next for these investors as the market is approaching a new ATH.

Does the current state of positioning support a continuation above ATHs?

What is the exposure of leveraged funds and institutional investors in the S&P 500 and Nasdaq?

What do the vol-control funds tell us regarding the positioning?

We answer these questions and much more in today’s brief 👇

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.