The Market Brief

U.S. futures near flat on Tuesday after the S&P 500 and the Nasdaq hit record closing highs, with focus now shifting to a slate of Federal Reserve speakers for policy signals.

Macro Viewpoint

Futures on the S&P 500 edged lower after the index reached a new record on Monday, fueled by tech stocks riding the artificial intelligence spending boom.

With the government shutdown, a dearth of macro earnings, and the calendar about one week from earnings season, the “information vacuum” could see markets chop sideways.

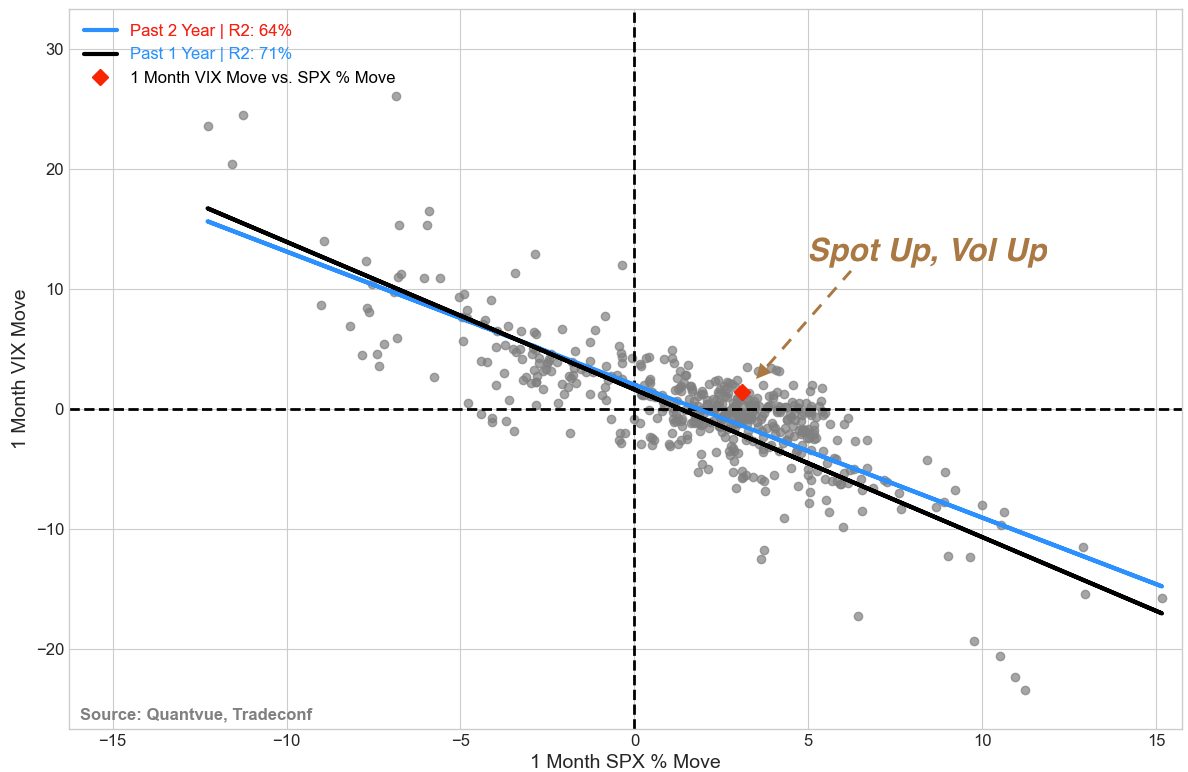

FOMO begins to creep in: spot up, vol up as right‑tail hedging lifts VIX

There are a lot of traders that look at VIX along with their NQ or ES day trading instruments as the “inverse” correlation helped them gauge sentiment.

Over the last month, the S&P 500 went up but volatility (VIX) also stayed firm or increased, which is unusual. When the market (SPX) goes up, volatility often goes down, and vice versa. The current event is likely episodic rather than a lasting regime shift.

This is likely because options market activities, especially from sellers, couldn’t fully neutralize hedging trades that protect against big moves.

The surge in demand for upside call options is so strong that it’s overriding the normal downward pressure on the VIX from downside hedging unwinds and systematic options sellers. Traders begin to be more concerned about missing the rally than they are about a market crash.

Get daily institutional-grade insights that show what really happens under the market’s surface, based on quantitative analysis & real data.