The Market Brief

Hey team. Global stocks slid as geopolitical tensions returned to focus, with overnight developments in the Middle East further weighing on risk sentiment.

Let’s see what’s ahead!

Impact Snapshot

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Macro Viewpoint

U.S. stock futures dropped sharply early Friday following a series of Israeli airstrikes on Iran, which sent energy prices surging and injected fresh uncertainty into an already tense geopolitical backdrop.

Market clearly underestimated escalation risk ahead of talks reflected in today’s sharp global equity selloff.

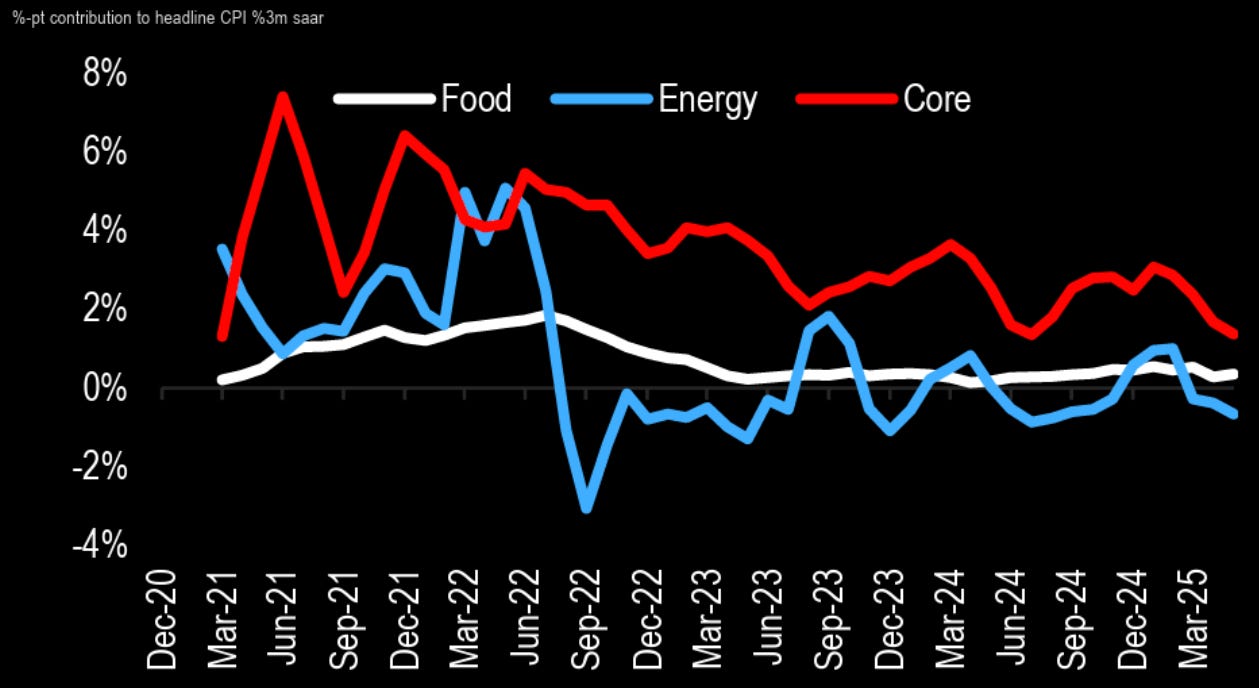

An attack on Iran, leading to a spike in oil prices to $120, could result in a 1.7% increase in the US headline CPI, assuming all other factors remain constant.

Any persistent gain in oil prices could fuel inflation, adding to the challenges confronting the Federal Reserve and other central banks as policymakers also contend with the repercussions of Trump’s trade war.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.