The Market Brief

U.S. futures edged higher in early trading Friday as the possibility of interest-rate cuts, combined with confidence in the economy, boosted investors appetite for risk.

Impact Snapshot

🟥 PCE Inflation -10:00am

🟥 Consumer Sentiment - 10:00am

Macro Viewpoint

U.S. stock index futures inched higher on Friday as investors awaited a delayed inflation report, looking for clues on whether ongoing price pressures could influence the Federal Reserve’s next moves.

Markets are approaching what could be the Fed’s most contentious meeting in years, where policymakers will decide whether to cut borrowing costs. Most officials have said they need more evidence that inflation is moving closer to the central bank’s 2% target.

Recent dovish comments from several key Fed policymakers have pushed traders to price in an 87.2% chance of a 25-basis-point rate cut this month, up sharply from just 30% back in November.

Prime Intelligence

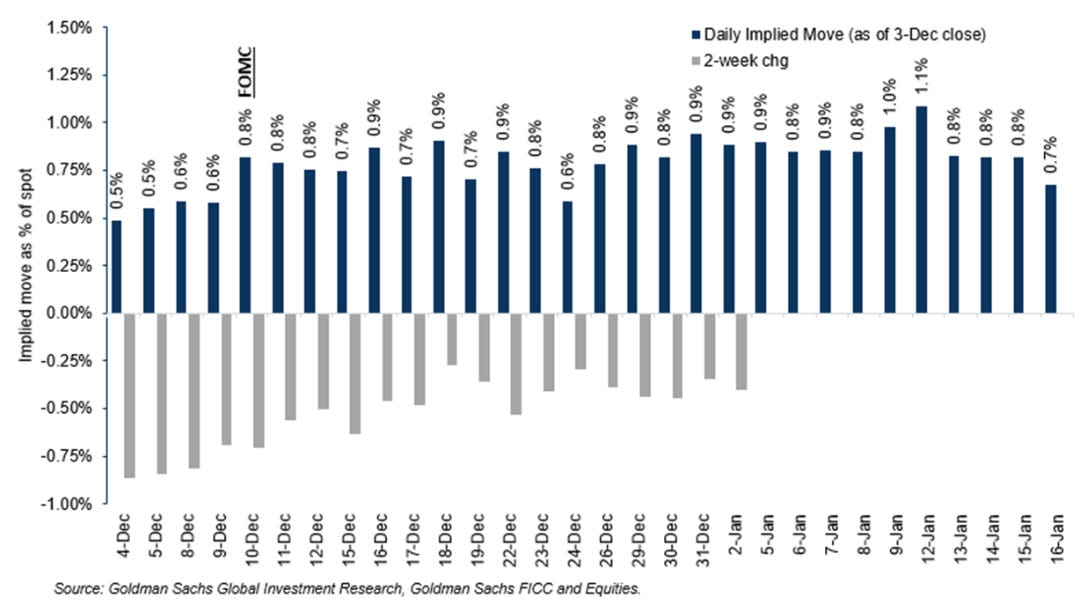

Over the past two weeks, SPX options prices have declined across the curve with professional investors lightening up on positioning.

The volatility in risk assets over the past month coincided with volatility in Fed rate cut expectations, demonstrating that Fed policy remains one of the most important variables for equity options markets.

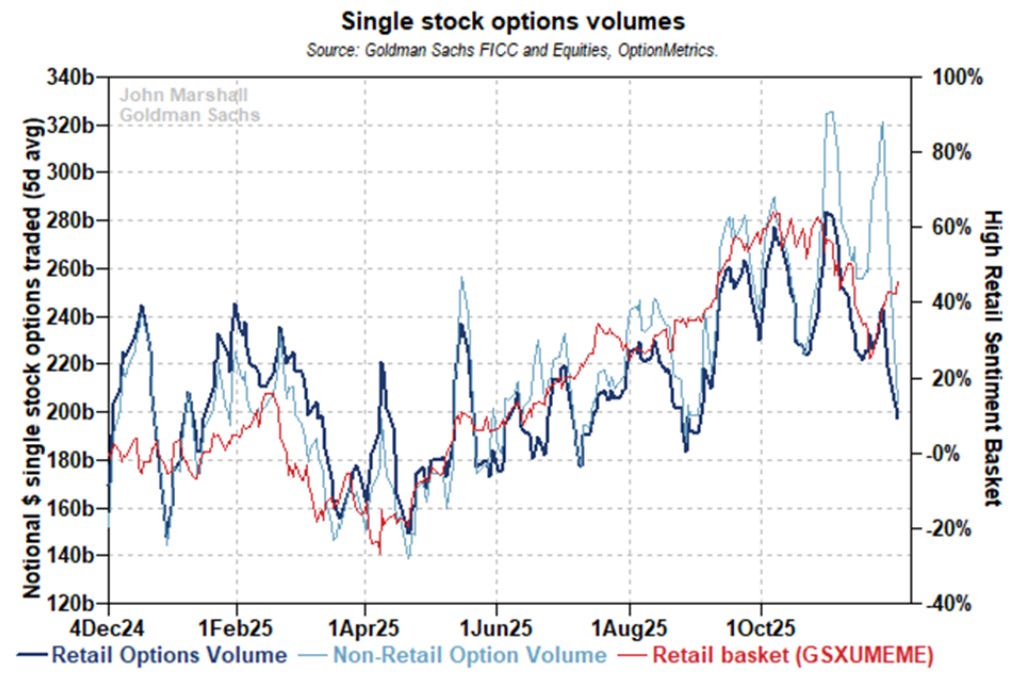

When single stock options volumes are high, hedge funds are cautious about shorting stocks because a gamma squeeze could drive asymmetric upside. Over the past few weeks, options volumes have come down reducing the impact of options positioning on stock price moves.

We believe this will embolden hedge funds to put on more shorts in stocks with weak fundamentals. We will be closely watching this trend in single stock options volumes over the coming days to see if this is more than just a quiet period.