The Market Brief

U.S. stock futures are holding near flat, bouncing back from earlier losses as investors exercise caution ahead of a highly anticipated jobs report that could shed light on the state of the economy.

Impact Snapshot

🟥 U.S. Jobs Report - 8:30am

🟥 U.S. Retail Sales - 8:30am

🟥 Non-Farm Payrolls - 8:30am

🟥 Manufacturing/Services PMI - 9:45am

Macro Viewpoint

The government shutdown left both investors and the Federal Reserve without key official data, forcing them to rely on secondary indicators that painted a mixed picture of the labor market.

Today’s November US jobs report is shaping up as the main market focus in the final full trading week of 2025 that will offer insight into the health of the economy and the potential path for interest rates next year.

A report showing continued economic softness could give the stock rally a boost by reinforcing expectations for further rate cuts, while a stronger-than-expected number might rattle markets.

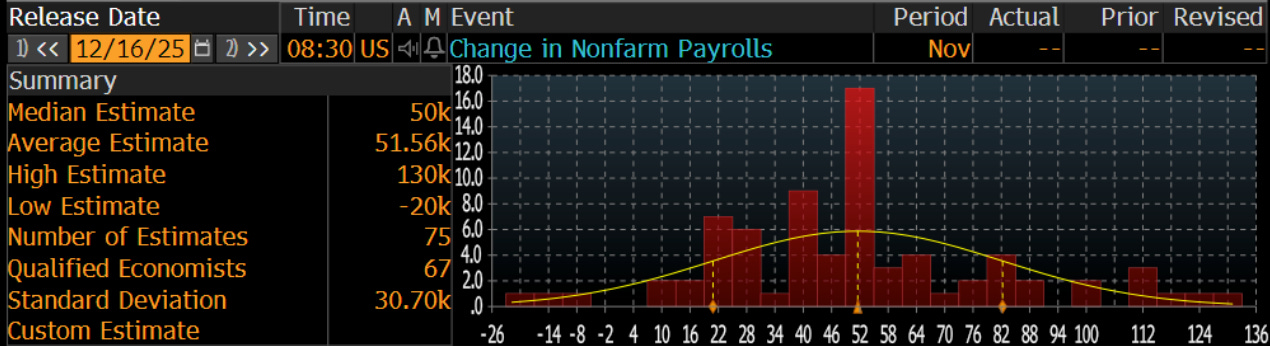

The Labor Department is set to release its report at 8:30 a.m. ET. Wall Street anticipates that job growth rebounded in November following a likely drop in October’s nonfarm payrolls, still pointing to a gradually softening labor market.

NFP Preview

This is an unusual report given that it contains two months of information and is delayed. During that time, the labor market has likely continued to cool.

Chair Powell’s comments about the labor market at last week’s FOMC press conference signaled concern about the downside risks to the labor market, and he did not lean more strongly into a January pause.

That, combined with the fact that markets are not pricing in recession worry, means that the asymmetry, especially in rates, is toward a negative surprise, which is how the market has been reacting since Monday.

Is that really the case, or is there some relief coming to risk assets? 👇

📰 In today’s brief, we’re disclosing how institutional investors are positioned for the major flow of economic reports and what Wall Street’s biggest investment banks expect for these numbers.