The Market Brief

U.S. futures edged higher during early trading after extending this year’s record-breaking rally from the previous session.

Impact Snapshot

🟥 PPI Inflation - 8:30am

🟨 10-y Bond Auction - 1:01pm

Macro Viewpoint

Stocks finished higher yesterday, thanks to an afternoon rebound driven by a few Mag 7 stocks. Market reactions were mostly muted heading into PPI/CPI.

The recent surge in stocks has been fueled by optimism that the Fed might cut rates sooner rather than later. Investors are betting that persistent pressures on wholesale and consumer prices will stay manageable, giving policymakers the flexibility to support a softening labor market.

Prime Intelligence

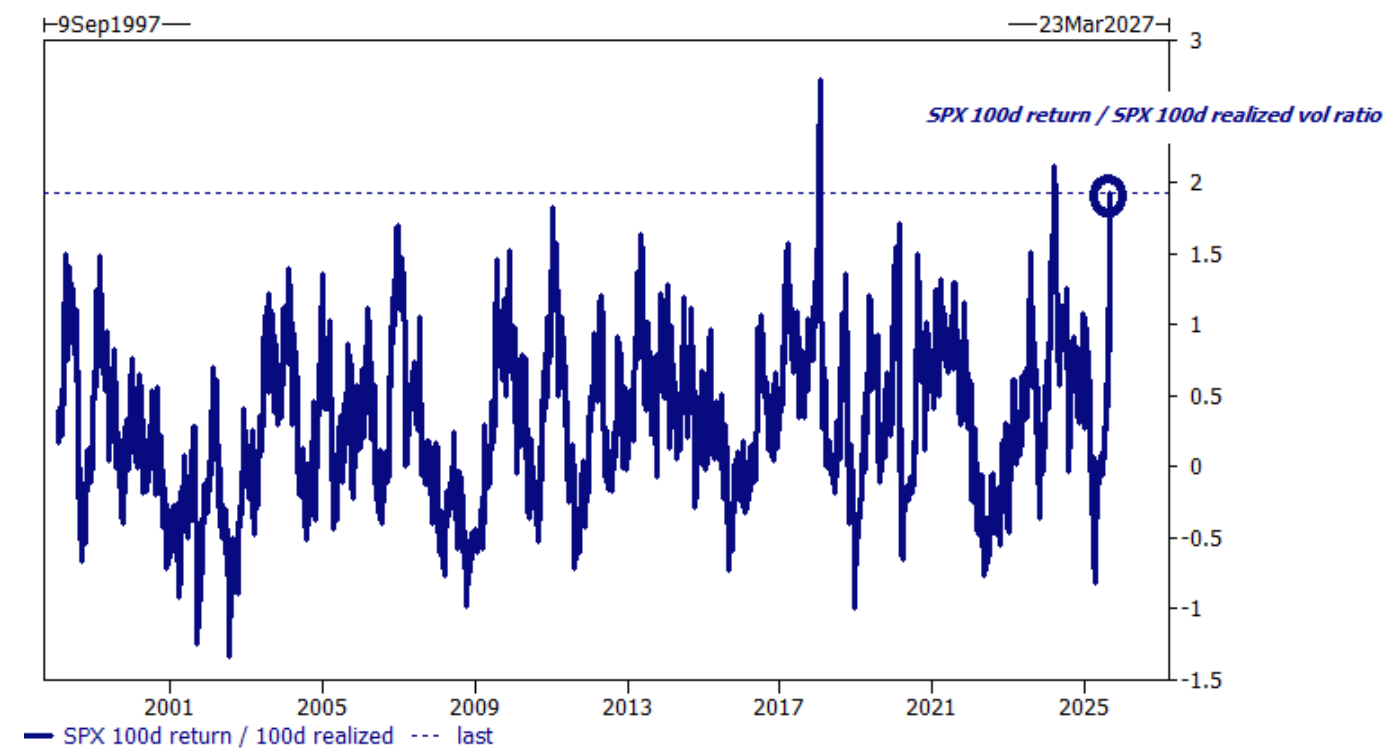

The last 100 sessions in U.S. equity markets are almost without precedent.

We reflect back on some models we’ve shared exclusively with our subscribers since April lows, forecasting a collapse of volatility that would lead to forced equity buying by both vol-control strategies and systematic funds.

A piece which we’ve shared in the FREE edition of the brief on Jul 02, 2025, reiterates the forecasting.

The ratio of price return vs. realized vol just registered one of the highest levels in 30 years, with SPX delivering one of the best risk-adjusted returns of all time (100d lookback).

Unless a bias of the market you have or a trade idea is backed by quantified and statistical data, it doesn’t exist. While others blame “luck” or “news” for any particular situation in the market, we look at statistics and quantitative modeling to justify market behaviour.

This is the exact same methodology used by hedge funds and investment banks executing trades and investment ideas for their clients, and it’s the exact same approach we take with our daily research that our subscribers get access to.

You can access it below.👇