The Market Brief

U.S. stock index futures edged lower on Tuesday, after a modest rebound in the previous session, as concerns over a potential U.S.-China trade conflict weighed on investor sentiment.

Impact Snapshot

🟥 Fed Chair Powell Speaks - 12:20pm

Macro Viewpoint

Given the magnitude of Friday’s moves, with many sectors and sub-sectors having 2–3 standard deviation moves, the market usually rebounds the next trading session as investors assess whether that move is a dead cat bounce or a local bottom.

This was the case on Monday, as stocks clawed back most of Friday’s trade-war-induced sell-off after Trump softened his tone on China over the weekend, despite holiday-induced light volume.

Today, the market wakes up to a new reality, with China retaliating in the “trade standoff,” stirring fresh concerns over tensions between Beijing and Washington at a time when stocks look stretched after a relentless rally.

Investors attention is also turning to the start of earnings season. During this period, investors will be looking for reassurance on everything from the durability of AI spending to the fallout from tariffs.

Prime Intelligence

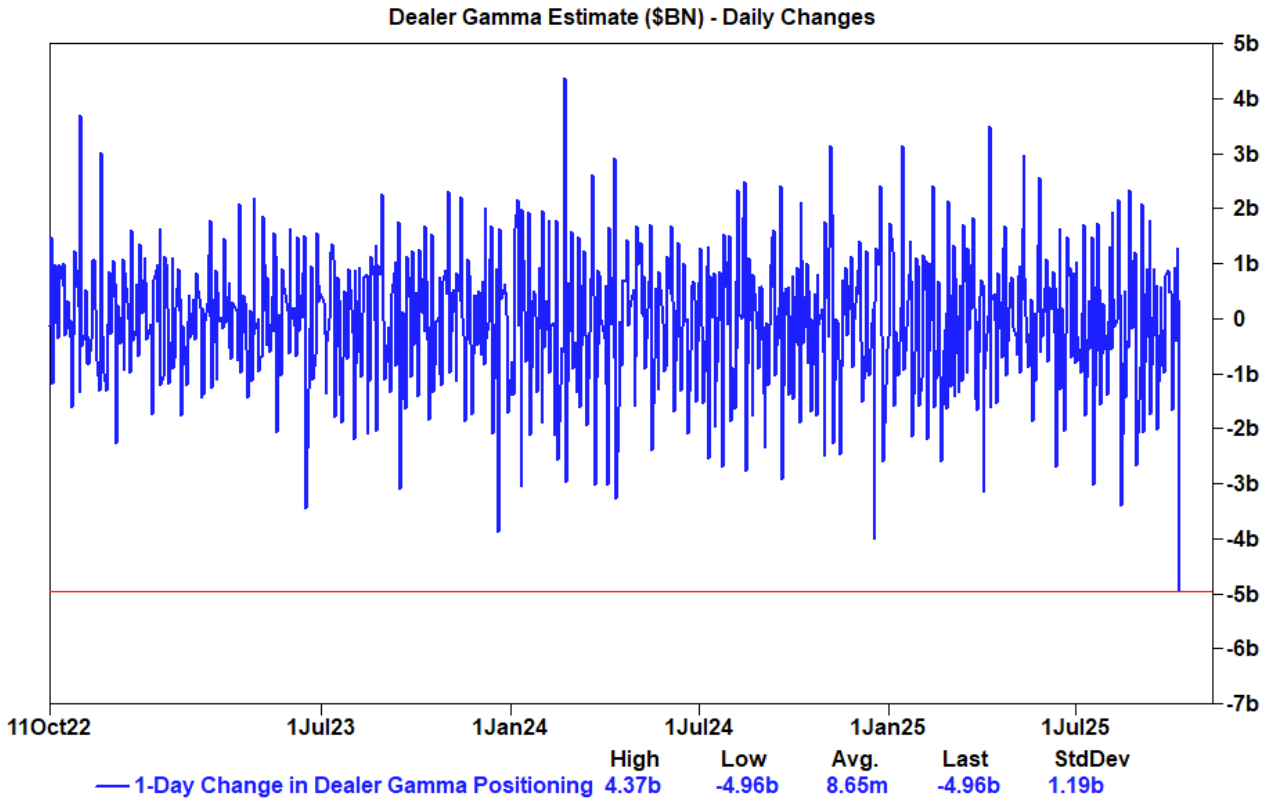

During Friday’s selloff, dealers went from being long ~$9B gamma to long ~$4B. The -$5B drop during a single trading session was the largest in over 3 years.

Why does this matter?

Dealers hedging activity will not dampen volatility as much as it has been as of late. In order to stay hedged (when dealers are long gamma), they buy underliers when prices fall and sell when prices rise, which leads to tighter trading ranges and lower realized volatility.

When dealers are short gamma (which they are not right now.. they are just less long), the opposite occurs: they sell into declines and buy into rallies, amplifying price moves.

📰 In today’s Prime Intelligence, we’re sharing the latest on the positioning of systematic funds and how they will navigate this increase in volatility.👇