The Market Brief

U.S. futures cautiously higher during early trading on Wednesday as rising expectations for interest-rate cuts helped carry traders newfound optimism into the Thanksgiving break.

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 Thursday 11/27 : US Markets Closed

🟥 Friday 11/28: US Equity Market Closing 1PM

Macro Viewpoint

U.S. stock index futures inched higher on Wednesday as traders continued to factor in the possibility of a Federal Reserve interest rate cut in December, while also looking ahead to upcoming economic reports for a clearer read on the strength of the world’s largest economy.

The recent rebound on Wall Street, following a tech-driven slump earlier this month, has helped pare back some of the major indexes’ monthly declines, though they still appear on track for their steepest drop since the tariff-driven volatility earlier this year.

Market sentiment remains tightly tied to shifting expectations around Fed policy. Although yesterday’s figures were backward-looking, they reinforced the case for a potential December cut, with consumer confidence, retail sales, and producer price data all lending support.

Prime Intelligence

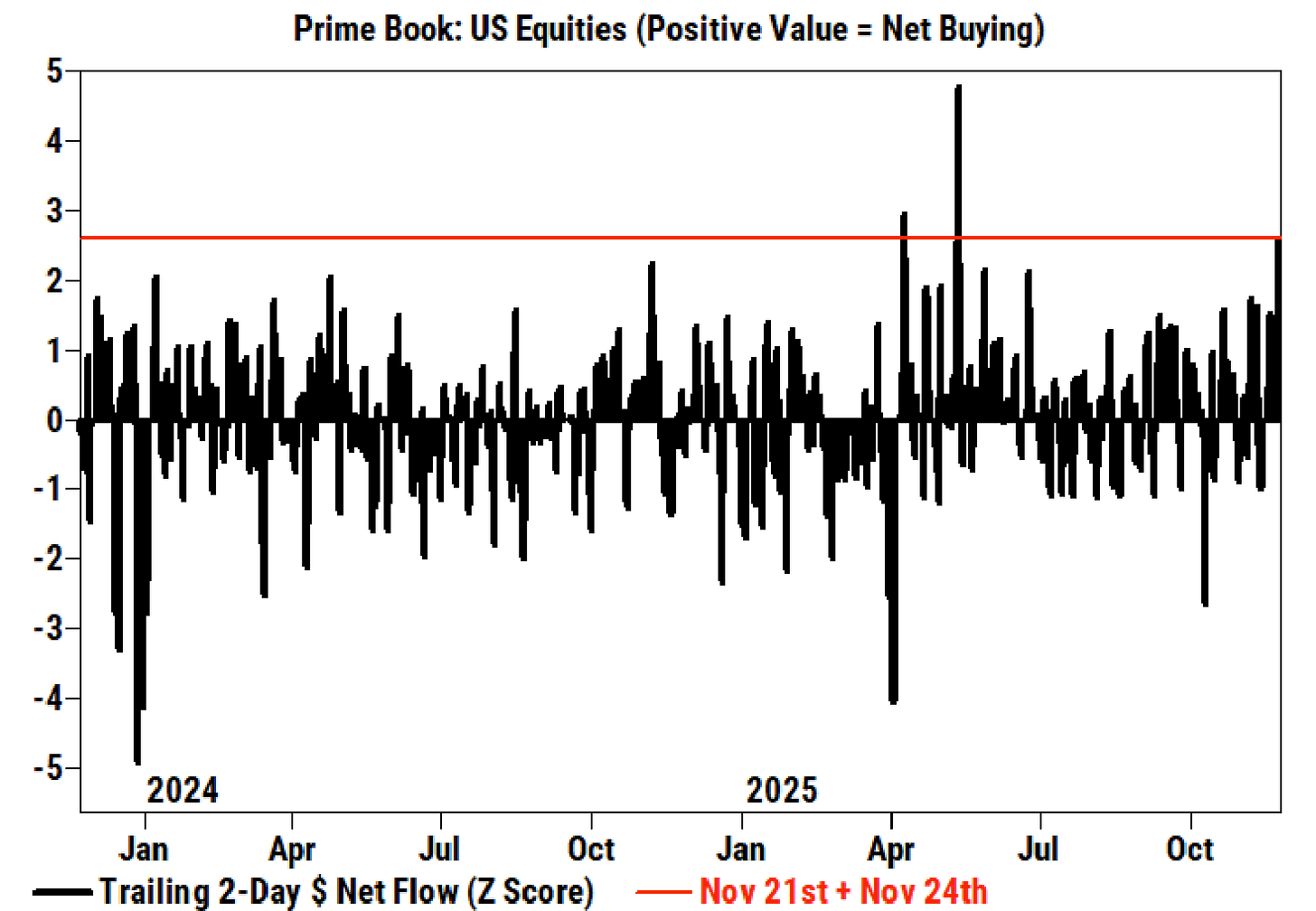

As December Fed rate cut becomes back in play, hedge funds are taking notice.

Equity markets rallied as a result, and HFs have significantly net bought US equities in each of the past trading sessions.

In cumulative $ terms, the pace of net buying on Friday and Monday combined was the largest over any two-day period in more than six months and one of the largest in the past two years.

📰 Can this buying potential support the market or is there more selling on the tape?

Let’s find out in todays market brief 👇