The Market Brief

US futures extended their losses as doubts over the health of U.S. regional banks drove traders to cut down on risk, capping a volatile week that exposed the vulnerability of markets near record highs

Macro Viewpoint

With the government still on shutdown, which keeps investors in a vacuum regarding economic releases, the market is desperate for any new catalyst that will weigh in on sentiment.

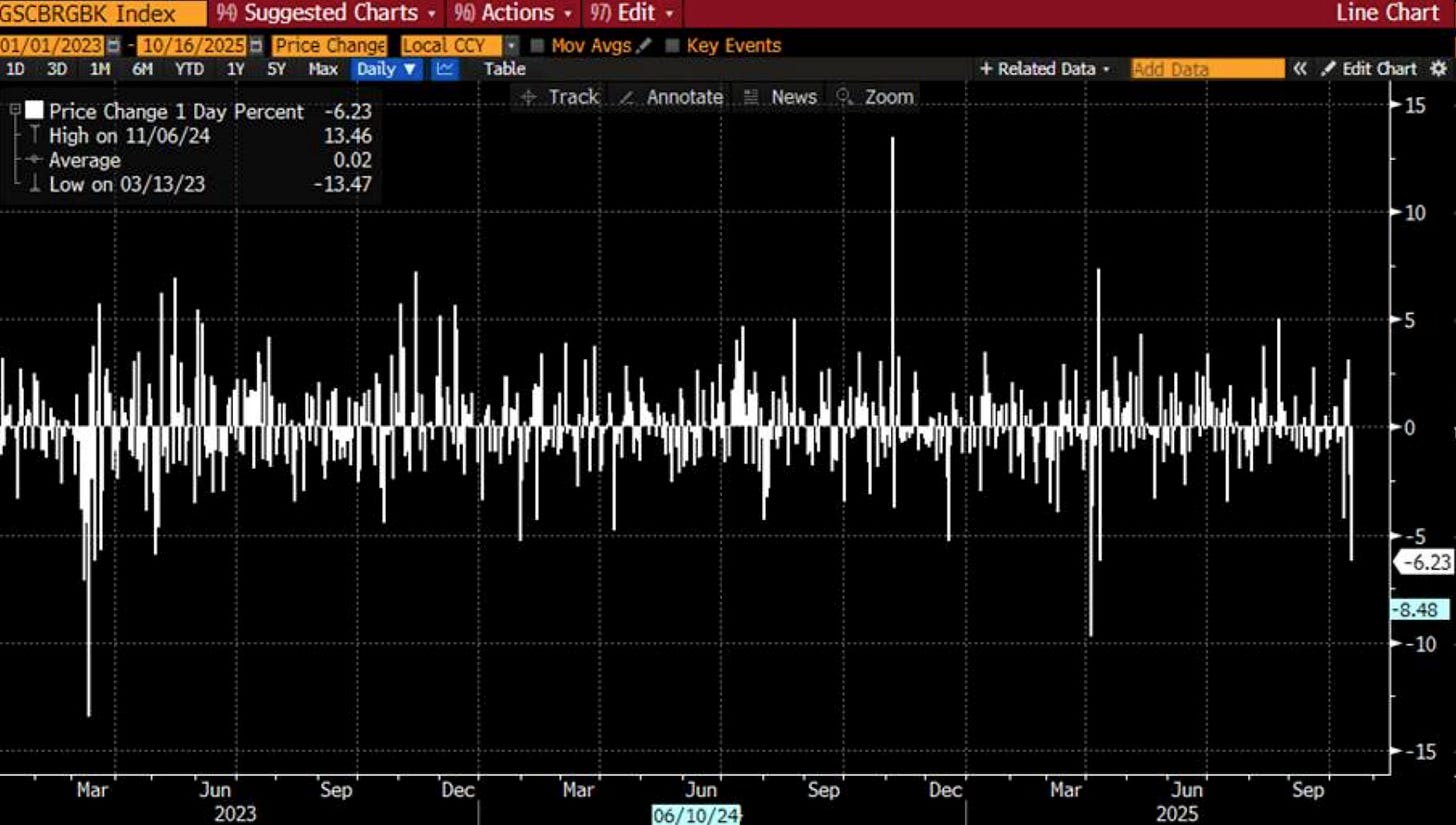

This was the case with yesterday’s sell-off, as regional banks took center stage amid pressure on credit provision weakness, which saw the second worst day for the group since the collapse of SIVB in March 2023.

With dealer gamma dropping by $5B last Friday, the largest single day drop in over three years, they now provide much less of a “shock absorber” than the market had grown accustomed to over the last few months.

As we forecasted in our brief on September 24, 2025, this was expected to be a volatile month, and the outcome hasn’t disappointed.

Prime Intelligence

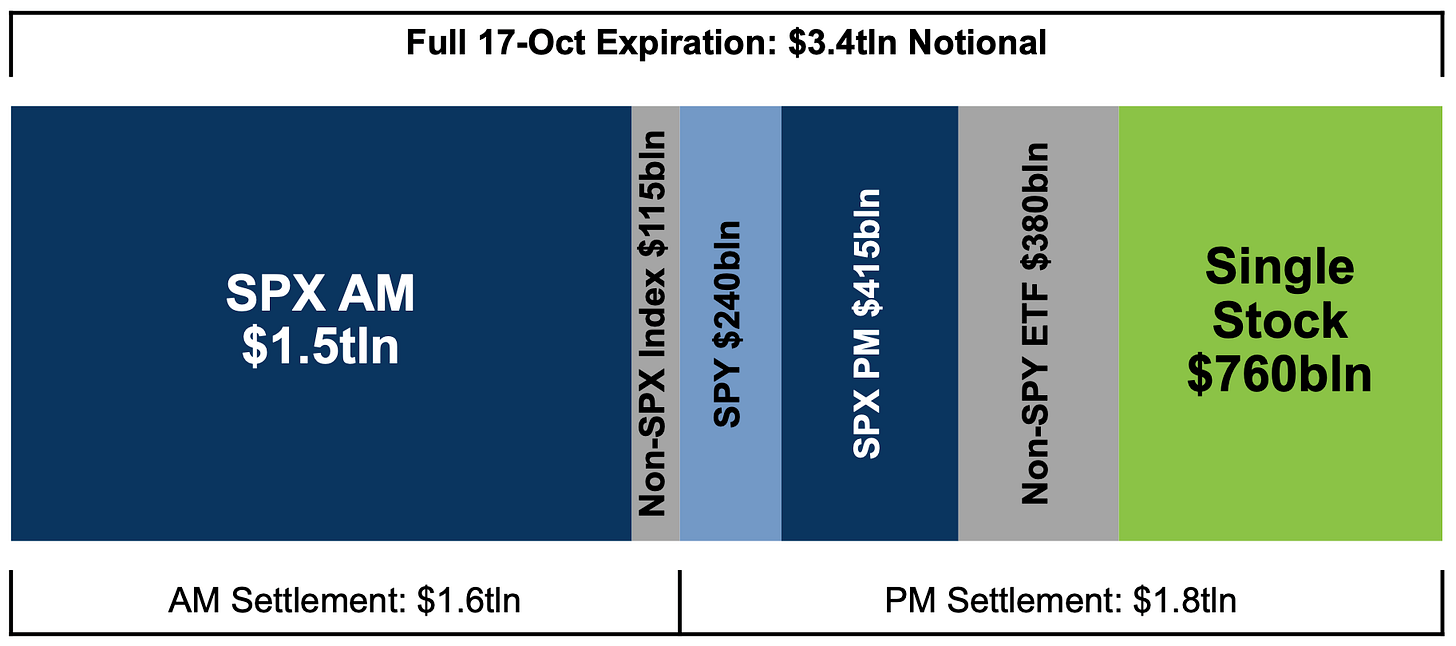

Over $3.4 trillion of notional options exposure will expire today, including $1.9 trillion of SPX options and $760 billion notional of single stock options. The notional open interest for this expiration is the largest recorded for any October.

Open interest in ATM options expiring on Friday may impact stock trading as concentrated expirations can trigger large hedging flows.

At major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes, delta-hedging activity can impact the underlying stock’s trading that day.

If you want to understand how institutional money managers and market makers operate during OPEX, we’ve authored an article in today’s brief. 👇