The Market Brief

Hey team. The primary focus continues to be on corporate earnings, with more than 100 companies set to report this week.

Let’s evaluate Monday’s session, review what we were looking at that day, and see what’s next!

Macro Viewpoint

U.S. stock index futures dropped on Tuesday, weighed down by rising Treasury yields that put pressure on rate-sensitive stocks, as investors evaluated the strength of the corporate sector from various company results.

Contracts on the S&P 500 retreated, pointing to the first back-to-back decline in about 30 sessions for the gauge.

Investors are scaling back expectations for Fed rate cuts following signals from central bank officials favouring a more gradual approach to easing, driven by recent strong economic data.

Despite the mounting risks, the current winning streak for US stocks ranks among the very best since 1928.

Prior Session Deep Dive

Most traders feel that their market preparation only requires marking down a couple of pivots and calling it a day.

However, trading references are meaningless without a solid narrative to complement these potential trade locations, which is what we aim to provide daily to help you develop a deeper market understanding.

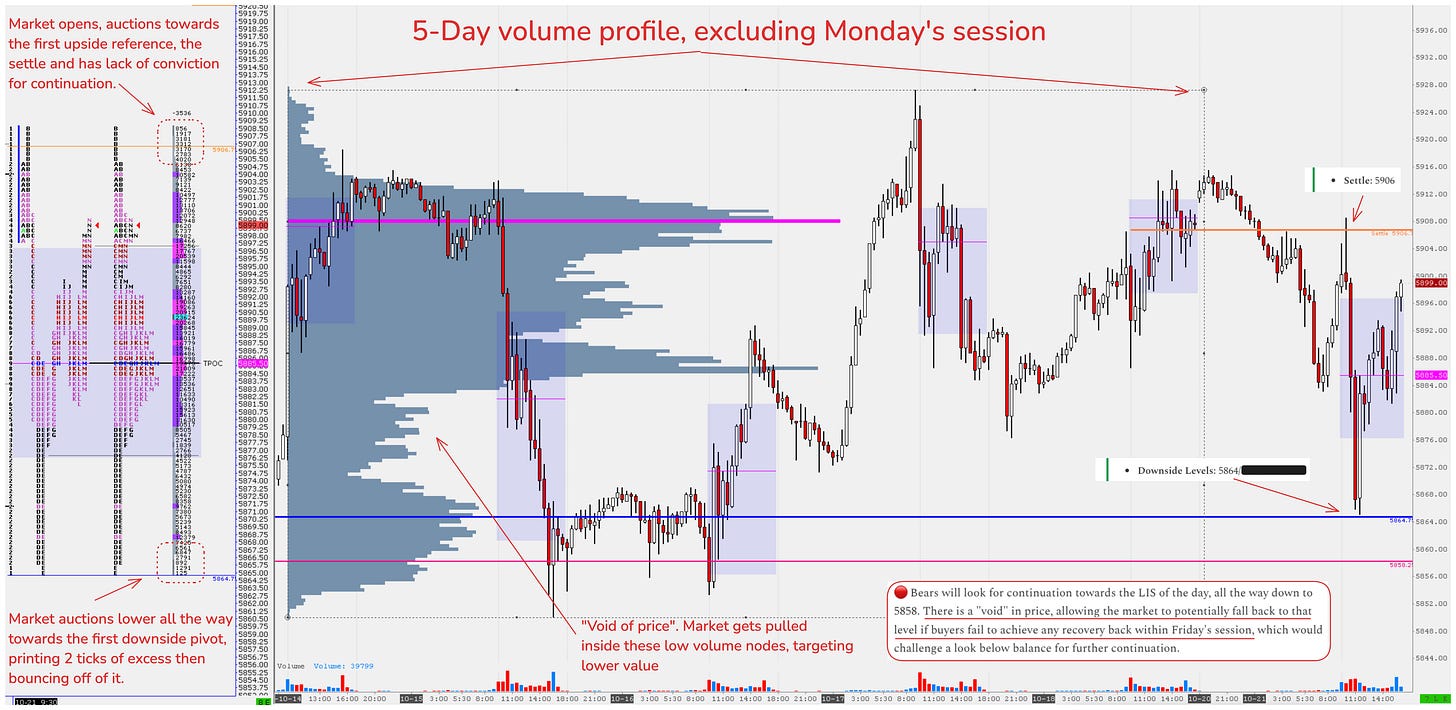

Monday’s session saw the absolute top and bottom contained within the settle and the first downside pivot. The chart in the image above includes some comments we made during the pre-market brief and outlines the scenarios we considered for the day.

The market opened and initially auctioned higher toward the settle price but lacked conviction & volume, shutting off buying activity before beginning to auction lower.

The 'void of price' comment refers to the low-volume nodes highlighted on the chart. These are areas where the market tends to avoid spending time, either bouncing right off or acting like a ‘black hole’ that pulls the market through to the next area of value.

Now, consider the risk of attempting to stand in front of this move by placing a long position inside this 'void' of price without understanding where the market is headed.

Having scenarios in mind and identifying potential areas where the market might retreat helps build a solid narrative. This approach can help you hold trades longer to reach their true profit targets, prevent overextending, and manage risk more effectively.

It’s much easier to react when you’ve thought through the possibilities in advance.