The Market Brief

U.S. futures near flat following a pause in the recent record-breaking rally overnight, as investors digested a wave of corporate earnings and awaited updates from major U.S. tech companies.

Macro Viewpoint

Buckle up this week, as things start to get really interesting tomorrow (10/29) with BA and CAT earnings pre-open, the FOMC decision at 2 PM, GOOGL, META, and MSFT post-close, followed by the BOJ decision in the evening.

In terms of flows, US-listed ETF shorts saw net covering of -5.9%, the largest decrease in five months. About 80% of the total net buying we’ve monitored in macro products was almost entirely driven by short covers.

However, there are still a significant number of shorts at the index level, which presents a dangerous cocktail for squeeze risk.

Also noteworthy: the relentless retail bid, corporates exiting their buyback blackout window, and the heaviest mutual fund tax-loss selling ends this week.

Prime Intelligence

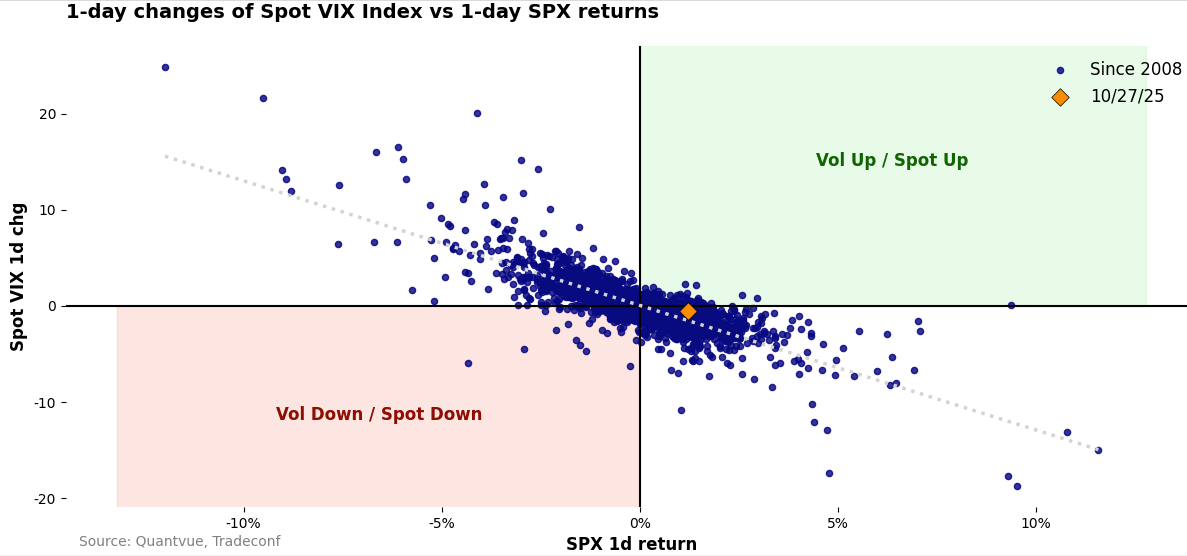

The current market environment is characterized by a transition toward the “spot-up, vol-up” regime last seen few weeks ago.

This pattern typically emerges when realized volatility underperforms the expectations priced into straddle options, often signaling the onset of momentum-driven buying behavior. These are sings of FOMO among market participants.

This evolution suggests that systemic positioning may be under stress, as market makers who are structurally short volatility may find themselves exposed during sustained equity rallies.

We think the bulk of the street’s gamma positioning is now to the downside, which makes sharp moves lower more difficult.

This is a FREE edition of the Market Brief. Upgrade to access our full research, data-driven insights, and quantitative models that help us build out a holistic picture and raise conviction. 👇