The Market Brief

Global stocks are poised for their worst week in seven months, as concerns over lofty valuations and AI prompt investors to retreat from riskier assets.

Impact Snapshot

🟥 Manufacturing/Services PMI - 9:45am

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Fooled By Price

The S&P 500 closed negative yesterday, after gapping up more than +1.4% at the Open. This has only happened 2 other times before: April 7th 2020 (after COVID crash) April 8th 2025 (after Liberation Day crash).

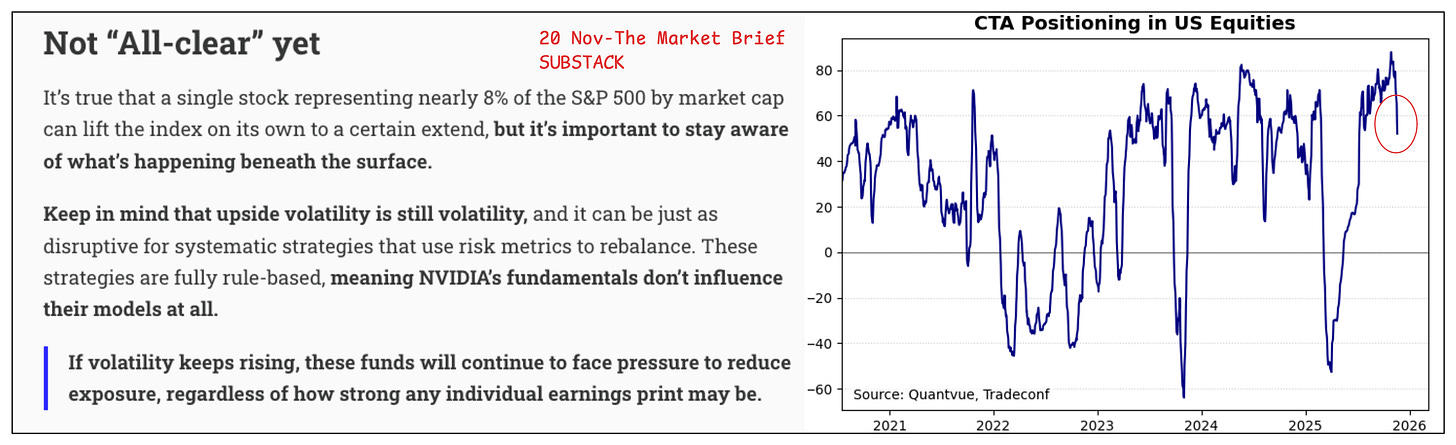

Since Sunday on our “Fragility Emerges” brief, our work has been pointing to a significant market unwind expected for this week by systematic funds, consistent with a high-volatility regime.

These rebalancing flows have NOTHING to do with fundamentals, headlines, or even price itself. As volatility rises, these systematic strategies are forced to de-risk. For CTAs alone, we estimated roughly ~$70bn of potential unwinds so far after hitting the short-term sell thresholds.

In yesterday’s overnight brief, we reiterated that the market was NOT in an “all clear” environment, despite how the overnight session appeared, which arguably “fooled” many.

We highlighted that upside volatility is still volatility, and that we expected systematic strategies to sell into it regardless of any NVDA fundamentals.

For a big number of institutional funds that apply rule-based strategies, fundamentals are simply not part of the algorithm.

🎯 On $ES, we identified 6786 as the first key resistance. That level ended up marking the absolute top before the market collapsed more than 250 points. The follow-through aligned perfectly with the scenario we laid out, essentially playing out textbook to our forecast.

All the context, pivots, and anything in-between you see above were shared with our subscribers a few hours before the U.S. open, when no news, catalysts, or the candlesticks themselves could have ever existed.

The Market Brief

📰 In today’s brief, we’re sharing a technical checklist that outlines the key data points we used to forecast the recent pressure in the broader market, along with what we’re watching next for potential reversal signals.

Our research is built for traders and investors who want to understand what’s happening beneath the surface, using actual market structure and flow data, rather than attributing every move to the latest “headline”.