The Market Brief

Hey team. US stock futures staged a small rebound after Monday’s tech-fueled selloff with market participants still evaluating the recent AI developments.

Let’s re-cap Monday’s session and see what’s next!

Impact Snapshot

🟥 Consumer Confidence - 10:00am

Key Earnings: BA 0.00%↑ GM 0.00%↑ SBUX 0.00%↑ LMT 0.00%↑

Macro Viewpoint

Futures linked to the S&P 500 and Nasdaq climbed on Tuesday, recovering from sharp declines in the prior session.

The earlier selloff was triggered by concerns over a low-cost artificial intelligence model developed in China, which unsettled shares of U.S. companies heavily invested in AI technology.

In premarket trading, AI chip giant Nvidia saw its shares rise by 4.8%, rebounding after a staggering $593 billion loss in market value during the previous session—the largest single-day drop for any company on record.

Meanwhile, investors are anticipating the Federal Reserve’s first interest-rate decision of the year on Wednesday, with expectations firmly set for the central bank to maintain its current rates steady.

Prior Session Deep Dive

“Larger moves in the market happen because the stage is already set for them behind the scenes.”

Everyone likes to talk about why something happened after the fact. Typically, they’ll say things like, 'It was caused by this headline,' or, 'This indicator showed a signal, so we headed lower.'

The power of what we do—and what we aim to communicate through these newsletters—lies in building market context, understanding structure and framework, and developing that field of vision to anticipate moves and expected outcomes, just as we do, hours or even days before the fact.

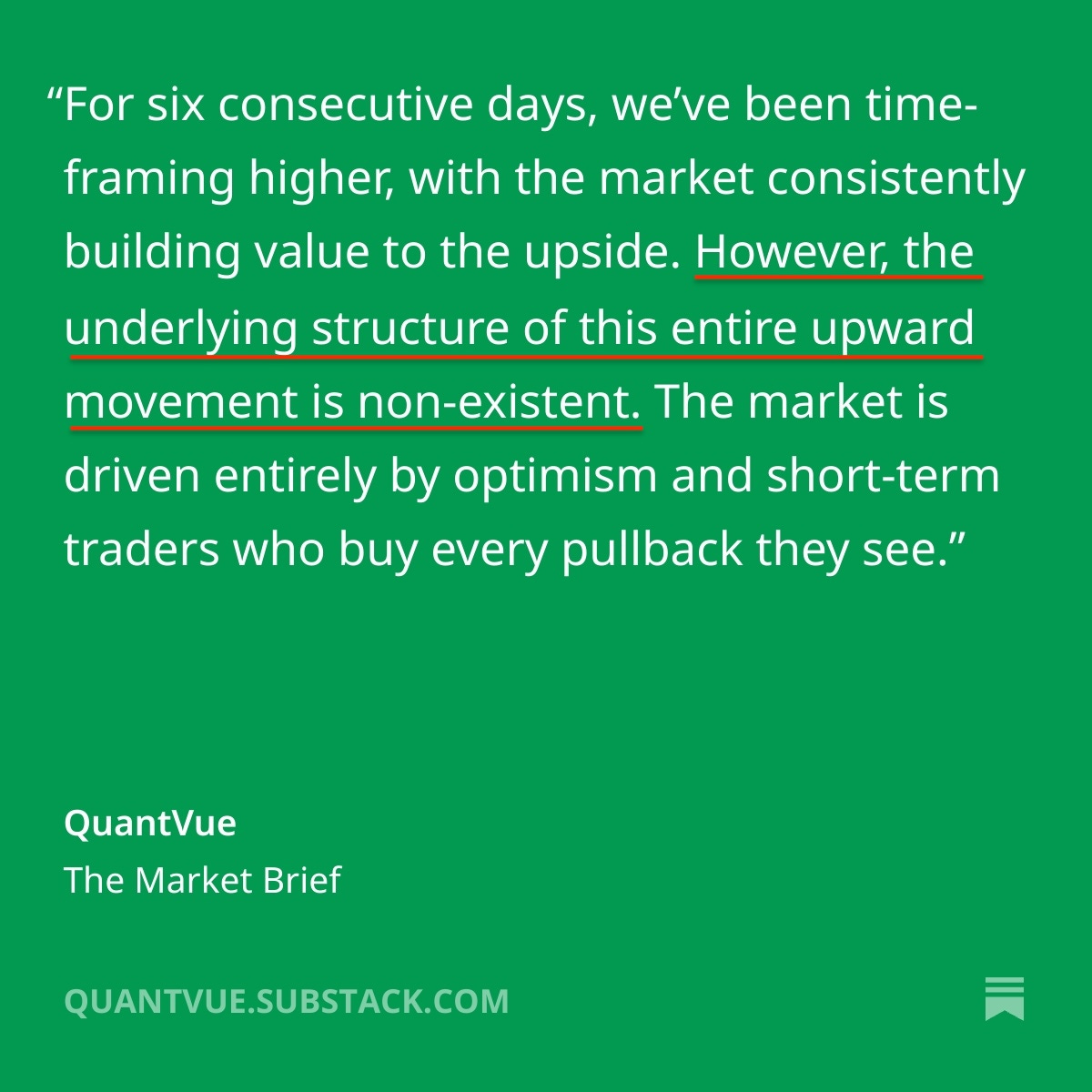

The context in the image above highlighted what we believed was unfolding in the market at that time, one week ago ( Jan 22 in this post - paid version outlook).

What is “Weak hand traders”

The image above (though mostly a meme) represents what we define as short-term, undercapitalised, emotional market participants.

Ask yourself: What would happen if those weak-handed, emotional traders—who drove the entire rally since last week—were suddenly hit with a negative headline or catalyst?

Scary, right?

Sunday’s X post showed a close outside that channel, with the market finding acceptance below it for the first time (spending time beneath it). Gaps highlight weak market structure and a lack of support.

When you understand what is likely taking place during a move, you can better evaluate the odds of it continuing or being on the brink of a major collapse.

Is it weak-hand traders that they will get shaken out the moment the trade goes against them?

Is strong money stepping in to buy the market, initiating upside momentum and looking to absorb selling pressure while defending their positions?

Very often, the market must break in order to shake out weak-handed traders and replace them with stronger buyers before it can rally back up.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.