The Market Brief

Global markets edged higher during early trading at the start of a busy week, with investors betting that economic data will reinforce the outlook for interest-rate cuts and lift equities higher.

Macro Viewpoint

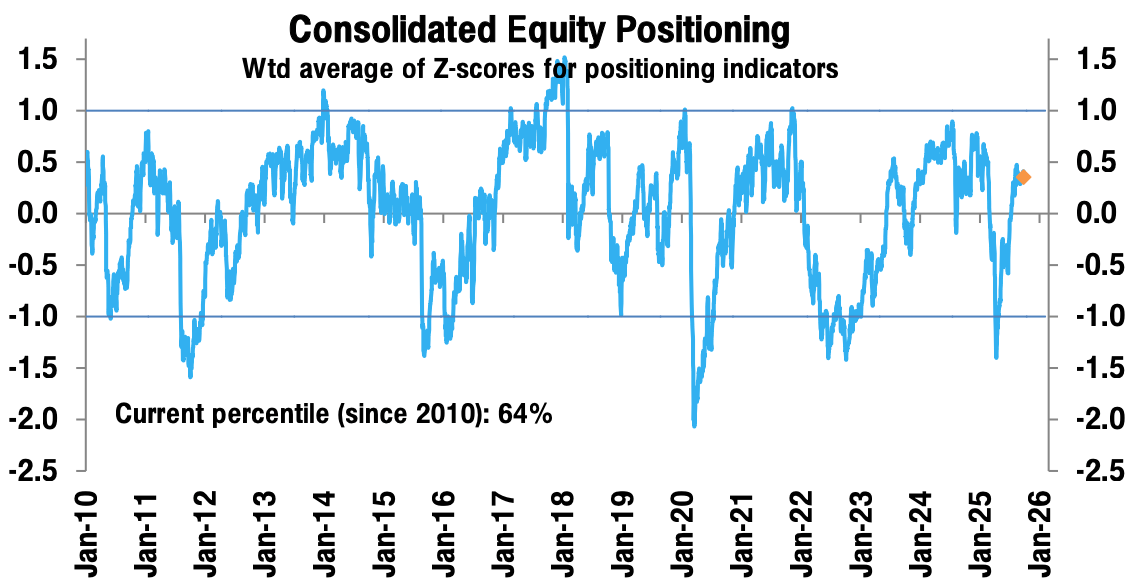

The prevailing narrative is that equity positioning has become excessively exuberant, and it is being buoyed in part by expectations of Fed rate cuts.

From the data we see, however, equity positioning is only moderately overweight, and we see growth, not rates, as the primary driver to focus on.

Data released last week pointed to significant upward revisions for the first half, as well as strong growth in Q3.

Prime Intelligence

Discretionary investors have continued to hug neutral, even as the typical drivers of their positioning, such as earnings and macro growth, suggest their exposure should be substantially higher.

With stronger data and the continued robust earnings growth we see forecasted, growth fears should abate, and we see discretionary investors raising exposure.