The Market Brief

US equity futures fell as risk appetite received a further knock after Trump threatened fresh tariffs and export restrictions on advanced technology in retaliation against digital taxes abroad.

Impact Snapshot

🟥 Consumer Confidence - 10:00am

Macro Viewpoint

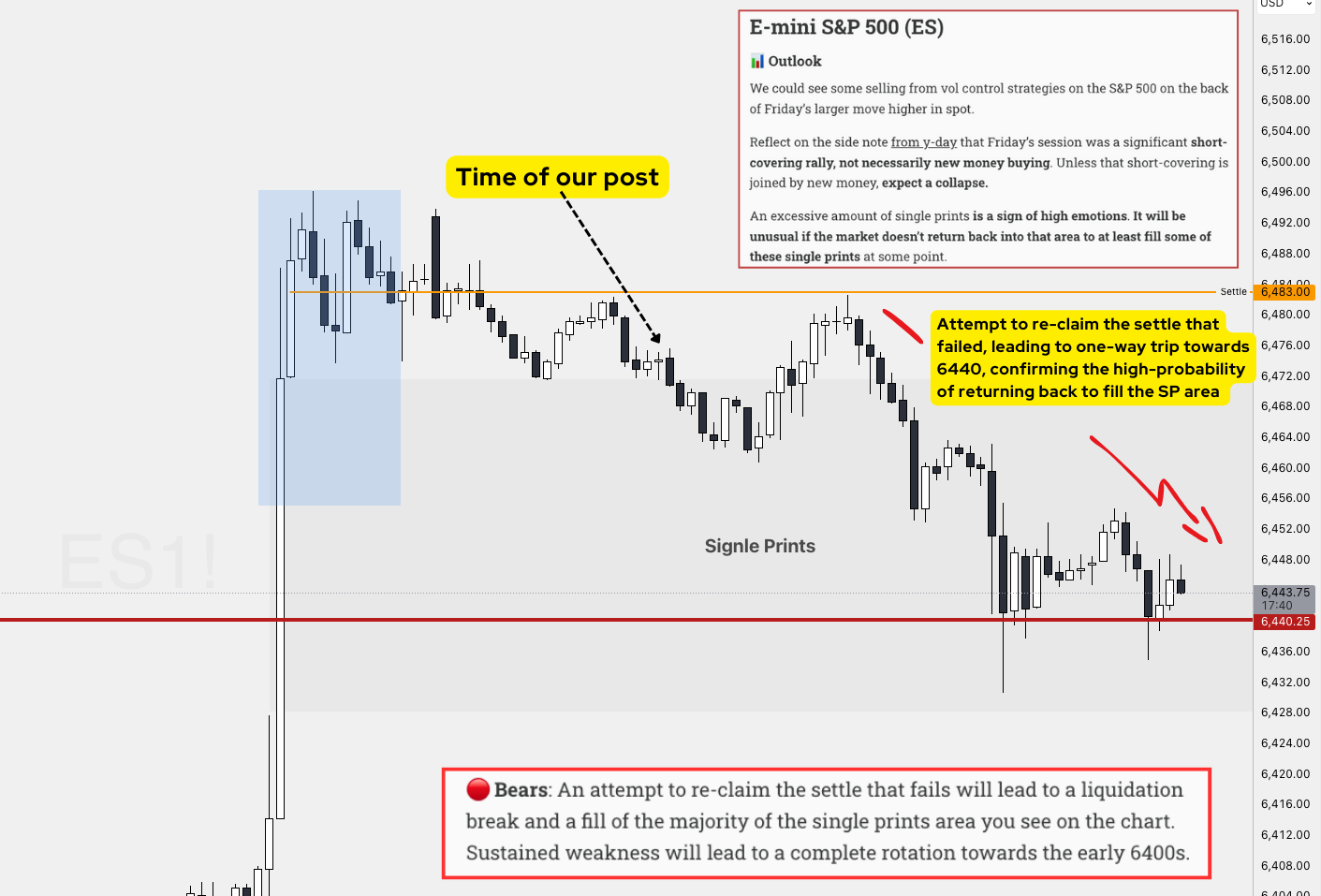

Futures were lower yesterday after the SPX’s best day since May, and the index finished the week 2 pts from an ATH. Media are pointing to a lack of Fed consensus to cut, based on comments from Fed members.

NVDA 0.00%↑ remains a key datapoint tomorrow as the AI theme has come under pressure, led by a retail investor that flipped to net short for the first time in two months.

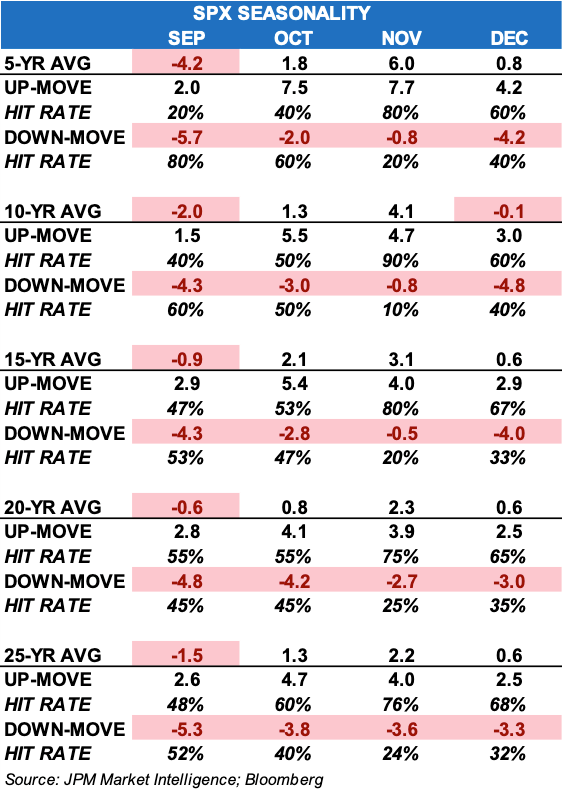

September is by far the worst seasonal month of the year (25 yr lookback), but this year might prove to be a bit trickier with Fed heading into cut(ting) regime.

While September seasonality is negative on average, it has been a 50/50 proposition whether it shows a gain or loss over the last 15–25 years.

🔄 Prior Session Re-cap

Like any worthwhile profession, nuances make the difference. If you had brain surgery, would nuances matter? You better believe they would.

Trading is no different. One of these nuances is being able to distinguish new money buying the market from forced buying due to short-covering.

Spotting the difference

The market had a lot of short interest coming into last Friday’s session. When the market is too short, that actually becomes a form of short-term support. How do you cover a short? You have to buy.

When you remove that support, it creates the potential for a weaker market. What looked like a “confident rally” trapped a lot of late buyers yesterday, as they misunderstood the session on Friday as being anything but short-covering.

We warned our subscribers on Sunday and reiterated during our 5:00 a.m. brief yesterday the potential of this exact thing taking place.

The chart above, along with the context, is the exact thing our members received. We couldn’t have written a more accurate representation of what was to come, even a day after the fact.

Most retail traders are too emotionally attached to headlines and don’t understand what’s really happening under the market’s surface.

Think about it, when you’re too emotional, you don’t quite make the best decisions, right? 👇

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack. 👇