The Market Brief

U.S. futures are trading near flat as earnings reports show a mixed picture of corporate profitability amid concerns over trade, the U.S. government shutdown, and geopolitical risks.

Impact Snapshot

Key Earnings (After close): TSLA 0.00%↑ IBM 0.00%↑

Macro Viewpoint

Even with recent de-risking tied to trade and credit worries, global macro hedge funds and long-only strategies are maintaining stock exposure at levels not seen in over a year.

Any drawdowns have been brief, with investors viewing them as chances to add risk back into their portfolios.

Earnings are likely to be the main factor in determining whether the rally can continue, as the looming government shutdown keeps economic reports, key catalysts for market direction, on hold.

Prime Intelligence

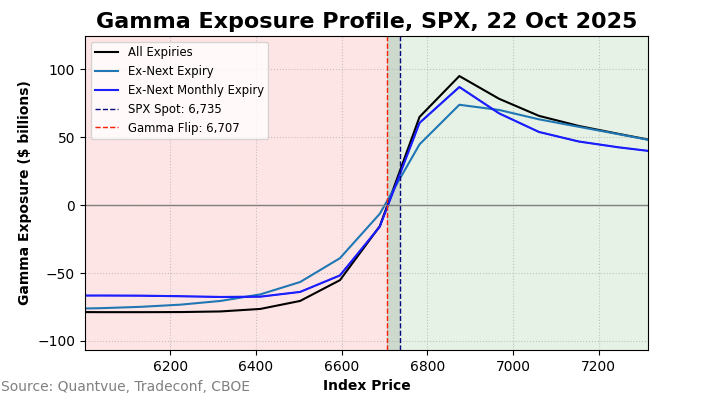

This week’s moves pushed SPX back into positive gamma territory, creating one of the conditions for lower volatility, something the market desperately needed.

In this environment, options market makers are forced to hedge their delta exposure by buying or selling SPX futures in a way that offsets the underlying trend. As we noted yesterday, expect a lot of chop in the second half of October.

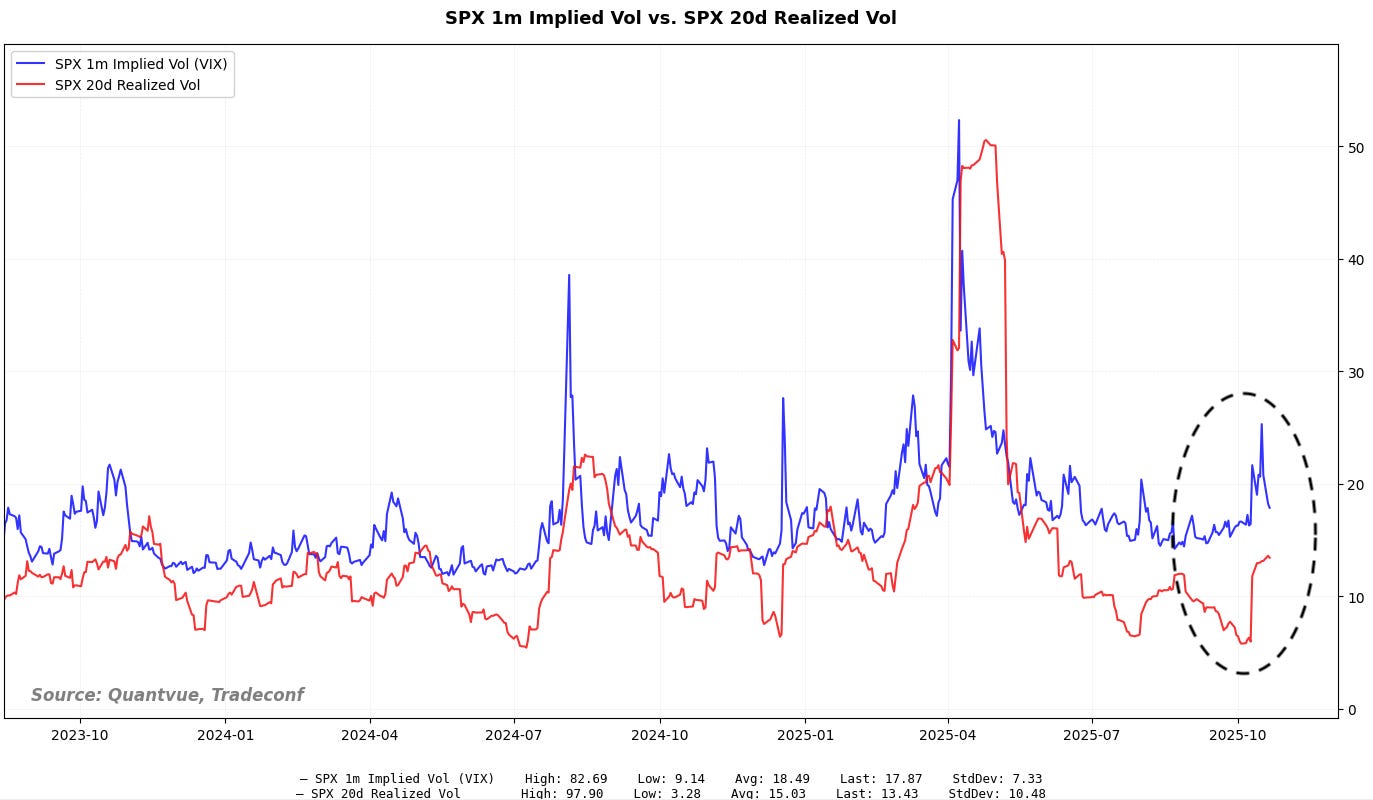

Back on October 5, 2025, we highlighted the continued divergence between equity implied volatility and realized volatility, which ended up showing their “explosive nature” five days later. The gap between implied and realized volatility has narrowed substantially since then.

However, for a significant amount of the systematic flows we’re tracking, it’s the realized volatility that counts, as it drives the bulk of rebalancing activity.

While prices have mostly rebounded from the October 10 drop, the elevated volatility regime has persisted. The recent move back into positive gamma represents a key sign of stabilization, since lower volatility generally reduces the need for mechanical de-risking by systematic funds.

Volatility supply matters because it stuffs dealers and market makers with gamma, creating a countercyclical buffer that allows markets to better absorb deleveraging flows.

In practice, this manifests as selling into strength and buying into weakness, providing a structural volatility buffer around the SPX.