The Market Brief

Hey team. Global stocks fell as a slew of corporate statements reinforced concerns about the trade war’s damaging impact on companies and the world economy.

Let’s re-cap Monday’s session and see what’s next!

Macro Viewpoint

Stocks closed lower yesterday after a choppy session that saw stocks open down nearly 1%, rally to almost unchanged, before falling into the bell.

Streaks are meant to be broken. Not shocking as we were in the midst of the longest S&P winning streak in 20+ years.

The major event yesterday was ISM-Services which point to a still resilient US economy that may be positioned to weather the impending tariff-induced slowdown.

Fed officials have recently highlighted the risks from tariffs to both sides of their mandate and said that they intend to wait for further clarity. We expect Chair Powell to repeat that message at the May FOMC meeting this week.

Prior Session Deep Dive

There are probably not many people who will understand and appreciate what putting context around price is.

Let’s review the exact comments and plan we made before the market opened yesterday, all the data points we were looking at, and how the session unfolded.

Thought process

“Extreme short and emotional ON session.” Who do you think is driving the ON activity? Weak, emotional traders. The U.S. session had 5.57 times more volume than the ON session. You can think of overnight as what we call “no adults in the room.” Think of the significant amount of risk you would expose yourself to trying to “pile up” short in this.

Risk management is what will make you profitable—or save you from destroying yourself, for that matter. Ask yourself, “How much risk am I exposing myself to trying to pile up on this?” What’s your R:R? What is your TP target—close the gap? Guess what: for 5 hours, the market couldn’t do it.

“Everyone trying to short to close the gap, market completely stalls for 5 hours not going anywhere.” You’re always better off being a bit late to a move than being too early and wrong. Everyone that was “short in the hole” became short-covering fuel.

“Short-covering fuel.” Everyone that was too short during the ON was squeezed out, with the only meaningful reference to look for profit-taking being the settle we had on the chart. Meaning, our expectation was that the market had significant room to go to the upside, which is why we didn’t place anything in between.

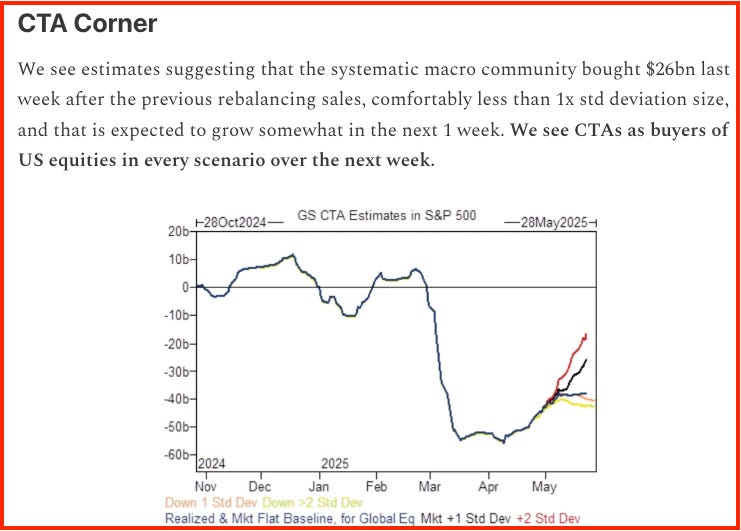

Wall St. Prime Intel

Based on key momentum signals, CTAs likely covered shorts in equities on last week’s market rally. Asset managers added to NDX longs.

The picture below shows the exact piece of context we’ve shared with our Subscribers on Apr 29, 2025 before S&P saw the longest winning streak in 20+ years.

As always, we share all data and evidence weeks and days before the fact, which come straight from Wall Street’s biggest institutional desks.👇

If you want to learn how to read and analyze markets free of cult-based retail nonsense, on a microstructure level based on academic research and a probabilistic outlook, consider becoming a paid subscriber.