The Market Brief

Hey team, global stocks rebounded on Wednesday as investors awaited the Federal Reserve’s final policy decision of the year.

Let’s recap Tuesday’s session and see what’s next for the markets!

Impact Snapshot

🟥 Federal Funds Rate - 2:00pm

🟥 FOMC Press Conference - 2:30pm

Macro Viewpoint

U.S. stock index futures edged higher on Wednesday as traders awaited the Federal Reserve’s final interest rate decision of the year and guidance on whether policymakers may adopt a more cautious approach in 2025.

Wall Street’s major indexes had slipped during Tuesday’s session, with the Dow marking its ninth consecutive daily decline—the longest losing streak since February 1978.

Despite these concerns, stocks remain on track for a strong year-end finish. The S&P 500 has gained nearly 27%, the Nasdaq is up almost 34%, and the Dow has climbed over 15% so far this year.

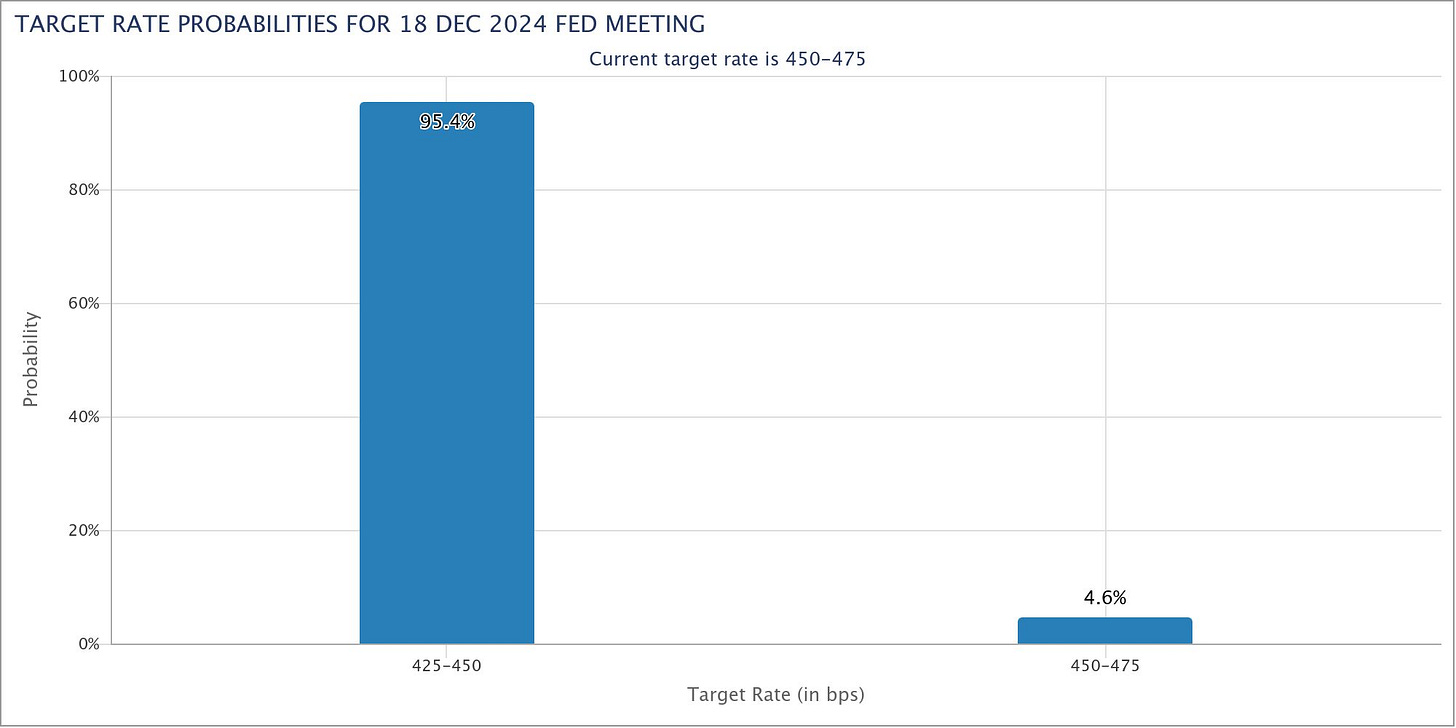

The Fed is broadly expected to lower interest rates by 25 basis points at its meeting, with the announcement scheduled for 2 p.m. ET on Wednesday.

While Wednesday’s anticipated quarter-point rate cut is largely priced in, market attention will shift to the outlook for 2025. Slower-than-expected inflation deceleration and a resilient economy are fuelling uncertainty about the pace of future easing.

In its previous projections, the Fed’s dot plot indicated a full percentage point of rate cuts for 2025, following a similar reduction this year. However, money markets now suggest Wednesday’s cut might be followed by fewer than two additional 25 basis-point reductions next year.

Prior Session Deep Dive

The challenge many traders face in these markets is attempting to be too early to a move, often without realising the amount of risk they are exposing themselves to.

Understanding the market environment you are operating in can help mitigate that risk, which is what we aim to teach through these Substacks.

As written in our market outlook on Tuesday, balance is the market’s mechanism for communicating the need for additional information in the form of catalysts before beginning the next breakout trend.

Very often, traders don’t understand the significance of this and try to enter the market to place big bets too early. The market is not going anywhere on weak-hand traders, and usually, the market before a big number is controlled by nothing other than them.

If any senior money wanted to adjust their positions, they would have done so 2-3 days before a big number. This is because markets a day before those numbers are very thin.

You don’t “know” where the market is going to go, but you can have a framework and be prepared for a potential outcome. As showcased in our bearish scenario, the market’s initial destination target to the downside after a break from the key pivot would be Friday’s value.

If the market was really that weak, do you think it would have trouble breaking down from the VAL of Friday’s session? The bounce was so mechanical and obvious that it further reinforced the narrative of the market being controlled by short-term, undercapitalised traders.

This led to a bounce right off that area, with the market rotating all the way back inside the balance. As written beforehand, opportunities would arise at these exact balance highs and lows to take the trade back inside the balance as those very traders that were counting on a breakout got trapped and forced out of their positions.

As we often say, it’s better to be a little late to a move than too early.