The Market Brief

Hey team. Global stocks declined as disappointing corporate earnings reignited concerns in an already uneasy market, which continues to struggle with the potential fallout of a US trade war.

Let’s re-cap the previous session and see what’s next!

Macro Viewpoint

U.S. stock index futures saw a slight decline on Friday as traders weighed the impact of tariffs on the market.

Concerns over a prolonged global trade war and its potential effects on economic growth and corporate earnings have kept investors wary of riskier assets.

Markets are now looking ahead to President Donald Trump’s anticipated plans to introduce new reciprocal and sectoral tariffs, expected in early April.

Some reassurance came from the Federal Reserve’s recent stance, which indicated that two 25 basis point rate cuts could still be on the table by year-end, following its decision on Wednesday to keep borrowing costs unchanged.

Wall St. Prime Intel

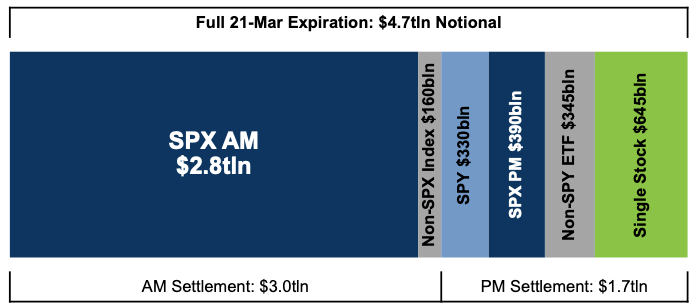

⚠️ Over $4.7 trillion of notional options exposure will expire today, including $2.8 trillion of SPX options and $645 billion notional of single stock options.

Are you using options as a hedge or interested in learning more about the Monthly Expiration (March 2025) and what it means for the market?

We’ve put together a Highlights post in today’s Wall St. Prime Intel 👇