The Market Brief

Hey team. Futures edged lower in early trading as investors shift their focus to Wednesday afternoon’s interest rate announcement and the press conference.

Let’s recap the last session and see what’s ahead for the market!

Macro Viewpoint

Stock futures dipped early Tuesday after two straight winning sessions, offering a brief break from the recent market sell-off.

Investor sentiment remained cautious due to weak economic data and President Donald Trump’s unpredictable tariff policies, raising concerns about the U.S. economy.

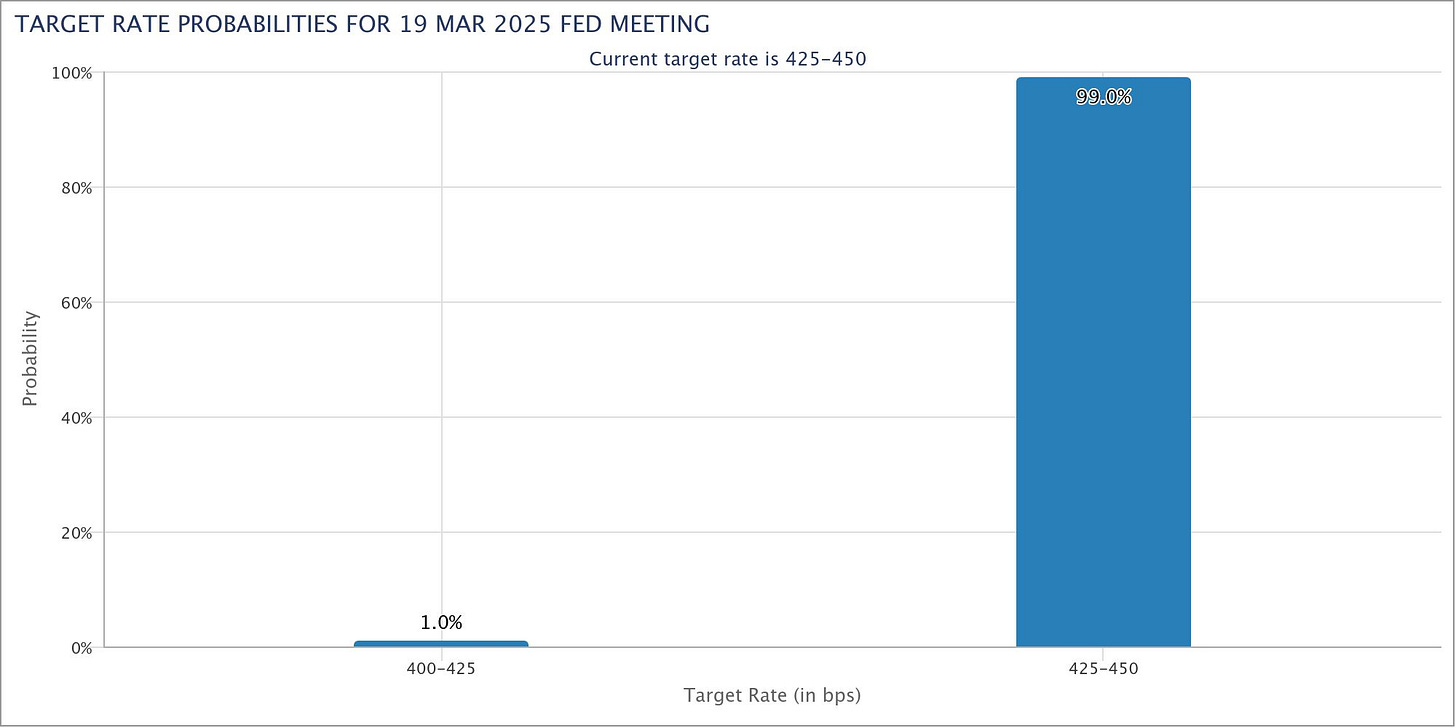

Attention now turns to the Federal Reserve’s two-day policy meeting, which begins Tuesday. Fed funds futures indicate a 99% chance that interest rates will remain unchanged.

Traders will be watching closely for Wednesday afternoon’s rate announcement and the follow-up press conference with Fed Chair Jerome Powell.

Wall St. Prime Intel

Asset managers significantly reduced U.S. equity longs, while leveraged funds were large buyers last week. Dealers’ net shorts increased, suggesting that demand for equity financing remains high.

Today’s brief includes notes straight from Wall Street’s biggest trading desks regarding the latest flow and positioning of the biggest market participants.👇