The Market Brief

Hey team. Futures traded mixed during the overnight session as the escalation of the trade war continued, which could disrupt global trade and trigger an economic downturn.

Let’s recap the prior session and see what’s next!

Impact Snapshot

🟥 PPI Inflation - 8:30am

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Key Earnings: JPM 0.00%↑ BLK 0.00%↑ MS 0.00%↑ WFC 0.00%↑

Too Early for “All Clear”

Wednesday’s rally, might have seemed extremely appealing to new investors that don’t understand the underlying working parts of what caused it, which was driven almost entirely by short covers.

On a long term horizon, the 90-pause on tariffs changed nothing economically. The delay does not decrease uncertainty for business owners/C-Suite, so capex will not move higher.

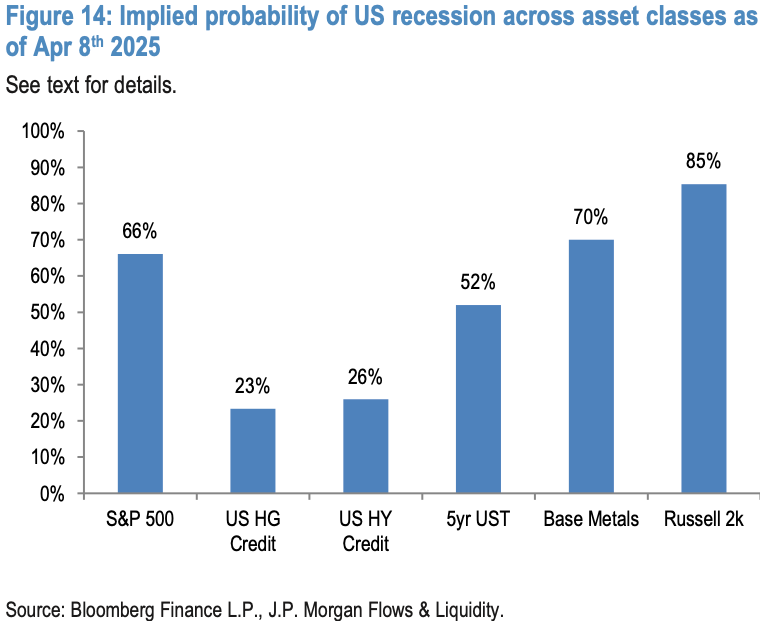

US equity markets, continue to price in significantly more elevated recession risk than credit markets.

The tariffs that remain in place are substantially higher than was anticipated prior to April 2. While some immediate tail risks have been reduced, policy uncertainty remains very high and is likely to weigh on consumer and business activity.

If this was the endgame for Trump, where are the manufacturing jobs?