The Market Brief

U.S. futures cautiously higher early Monday, kicking off a packed week that includes AI giant Nvidia's earnings and resumption of government data releases.

Macro Viewpoint

This is, by far, the most important week of the market since the tariffs-induced selloff back in April. Market participants will be seeking some clarity on US growth and the likelihood of another Fed rate cut.

Now that the longest-ever government shutdown is over, investors will finally get a look at the September employment report. While stale at this point, the report should provide some insight into labor market conditions.

A flurry of public speaking events by Fed officials will reveal whether they’re more concerned about employment or inflation.

AI will get a sentiment check on Wednesday with the world’s largest company reporting earnings ($300bn mkt cap implied move to follow).

Prime Intelligence

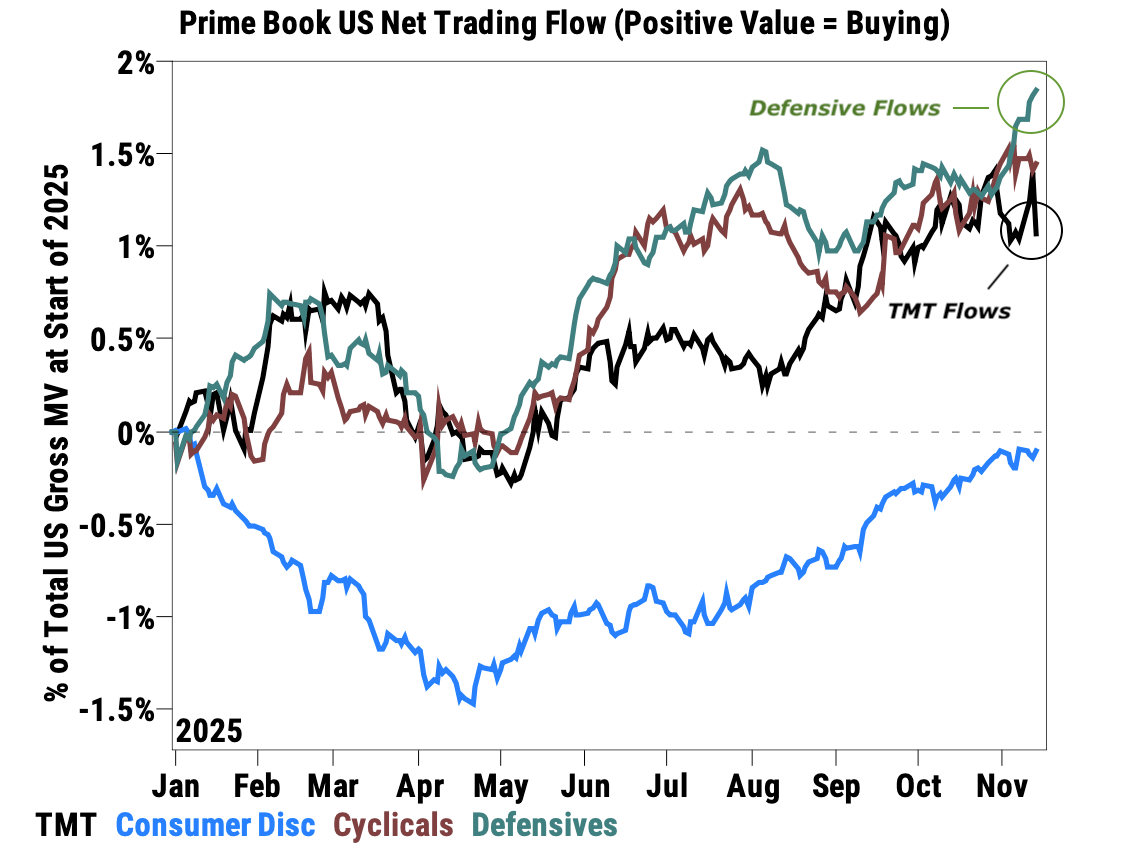

We noted two weeks ago the rotation from growth into defensive sectors had begun.

That continued last week in the face of a four-year record in gross single-stock trading activity. Short sells outpaced long buys in TMT and long buys outpaced shorts in healthcare and staples (defensive tilt continues).

One interesting note in this: we would have thought gross exposure would have decreased meaningfully with this activity, but it has not.

Does this mean there is more selling on the tape, or a reversal is inbound?