The Market Brief

U.S. futures traded near flat during the overnight session on Friday, as traders looked for fresh signs that the rally can continue after the U.S. benchmark notched its 10th record high in 19 days.

Macro Viewpoint

Investors are eager for new indicators that the market rally still has momentum, following the US benchmark’s 10th record close in just 19 days—driven by strong earnings and growing optimism over trade developments.

Meanwhile, Thursday’s data has weakened the argument for additional Federal Reserve rate cuts, as markets look ahead to next week’s central bank meeting.

The “Superbowl” of earnings is next week (July 28th) where 39% of the S&P 500 market capitalization report quarterly earnings

Wall St. Prime Intel

Having access to our prime intelligence means you get access to the same level of intel that portfolio managers and hedge funds get delivered every morning by the prime brokerage services of Wall Street’s biggest banks.

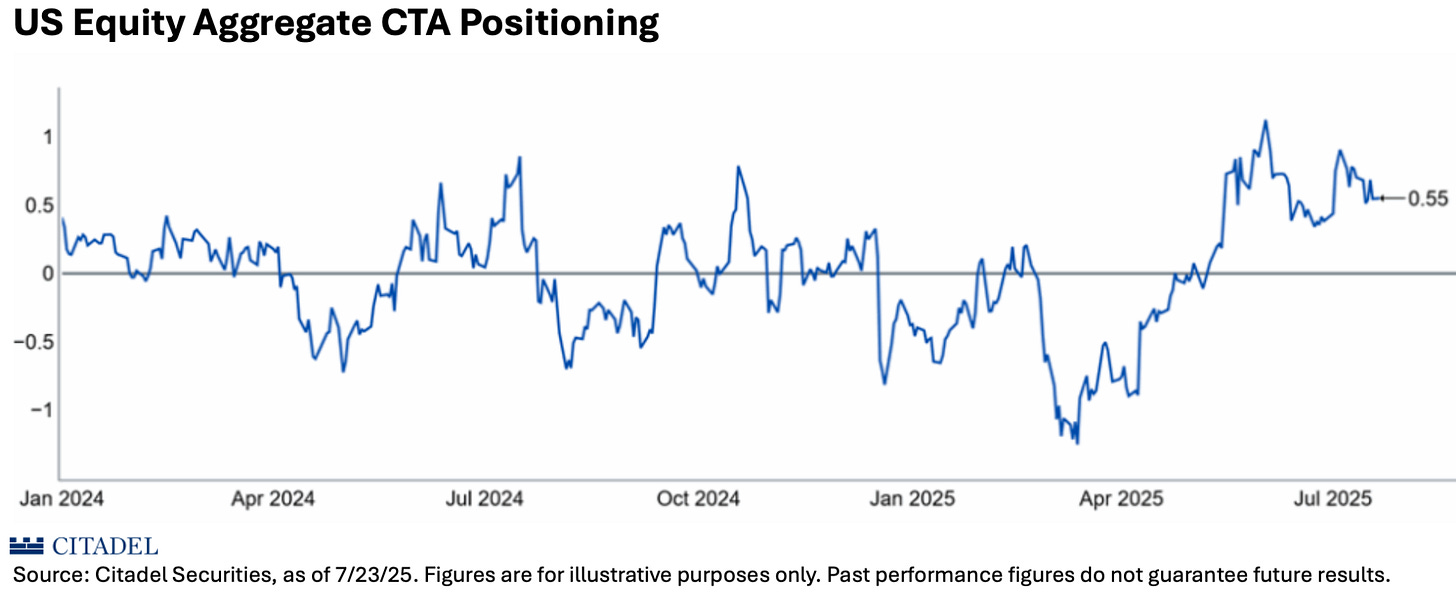

Commodity Trading Advisors (CTA) strategies, which are momentum and trend followers, have plenty of room to add equity exposure. Positioning from this cohort is not stretched and has capacity to add exposure over the next month.

Today we share research by Citadel Securities, reiterate all our observations that forecasted a massive recovery months before the fact, and discuss what’s next for this market 👇

This is a free edition of the Market Brief. To receive our additional institutional-grade research, consider becoming a paid subscriber.