The Market Brief

Hey team. A six-day winning streak that propelled the S&P 500 to yet another great performance since last week stalled during early trading on Tuesday.

Let’s recap yesterday’s session and see what’s next!

Macro Viewpoint

The S&P 500 slipped nearly 1.1% shortly after Monday’s open, but clawed back those losses by the afternoon to briefly turn positive, before hovering around the flatline as of 2:50 p.m. in New York.

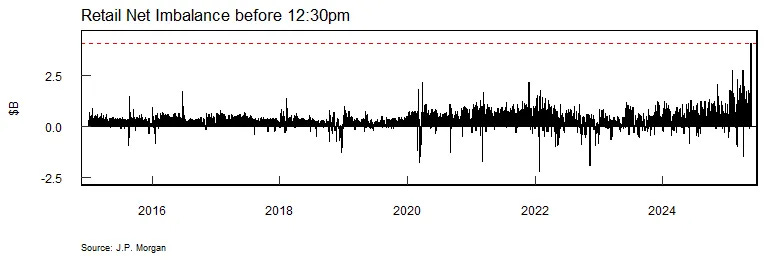

Retail investors made up 36% of the day’s trading volume, topping late April’s levels to notch a new all-time high.

Monday Session Activity

The context you read in the picture below was delivered exclusively to our subscribers during Sunday’s brief [HERE] before the electronic trading hours.

You would have a great deal of trouble trying to write something more accurate than this to describe the exact thing that happened on Monday, even two days after the fact.

It’s easy to draw 50-mile boxes on the chart after the fact, trying to tell your followers what you “think” happened in the market. Just described 90% of furus on social media.

To that we say: show us your quantified research you made before the fact to base your claims. Ours is sitting in the archives of this Substack, which you’re free to check any day of the week, delivered to our Subscribers days or even weeks before it’s reflected on the markets.

Wall St. Prime Intel

Access to Wall St. Prime Intel means access to the exact research that is delivered by the biggest investment banks across Wall Street to their institutional clients and money managers every morning, and that is what you should expect to get as well by becoming a paid subscriber.