The Market Brief

Global stock selloff extended to a sixth day, the longest losing streak since September 2023, as worries over Trump’s broad import tariffs fuel

Impact Snapshot

🟥 Non-Farm Payrolls - 8:30am

🟥 Unemployment Rate - 8:30am

🟥 ISM Manufacturing PMI - 10:00am

Macro Viewpoint

President Donald Trump unveiled a slew of new tariffs that boosted the average US rate on goods from across the world, forging ahead with his turbulent effort to reshape international commerce.

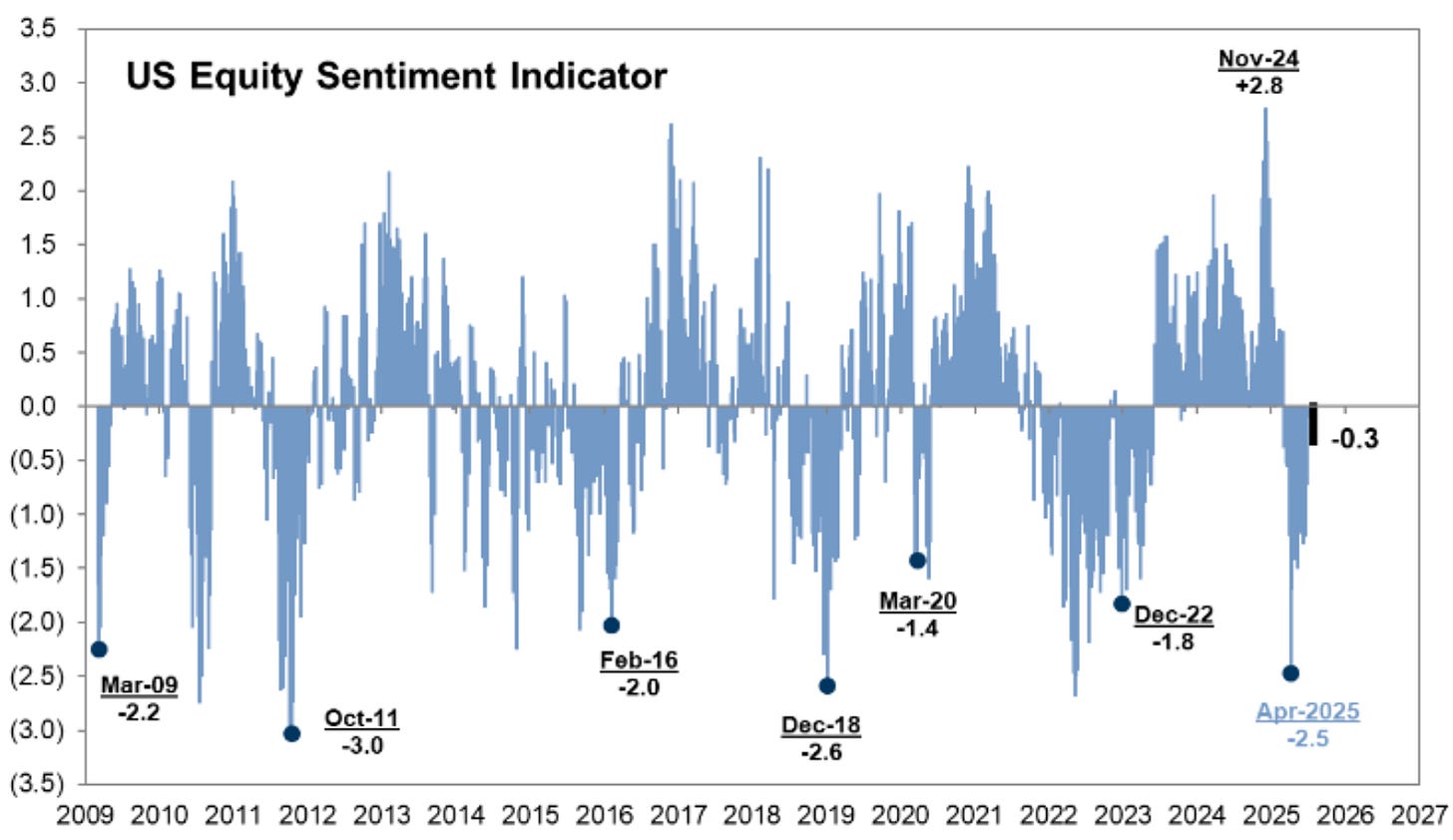

Equity investor positioning remains in neutral territory suggesting further room to add exposure to equities. However, if the jobs report is too strong, it could constrain the performance of equities as investors walk back expected Fed easing.

NFP Scenarios analysis

We think that the outcomes are skewed positively and that the market will react positively to any number above 100k.

The implied move thru today’s close is around ~0.79%.

Here is what we’re looking as potential outcomes depending the print

Above 140k. SPX gains 1% - 1.5%

Between 120k – 140k. SPX gains 50bp – 1.25%

Between 100 - 120k. SPX gains 25bp – 75bp

Between 80k – 100k. SPX loses 50bp – 1%

Below 80k. SPX loses 1.5% - 2.5%

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.