The Market Brief

U.S. futures edged lower during early trading on Tuesday, following the SPX’s best day in almost a month and the NDX’s best day since late May, as the government reopening sparked a risk-on tone.

Macro Viewpoint

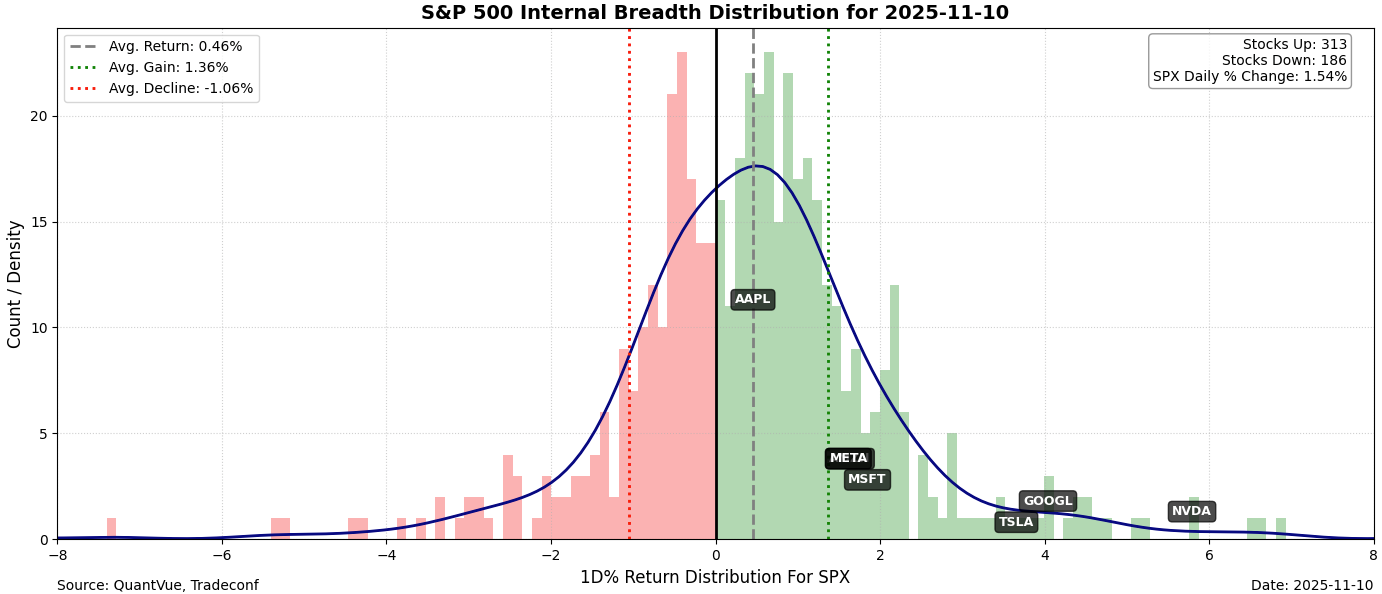

RISK-ON rally yesterday (surprise, surprise) led by Tech and the Mag 7. The rally had solid breadth, with ~62% of SPX stocks, or 8 out of 11 sectors, finishing in the green.

However, the Mag 7 still did the heavy lifting of the rally, with the group accounting for over 60% of the SPX index gains.

With the US government shutdown set to end on Wednesday, investors hope that fresh jobs and inflation reports will spur more interest-rate cuts from the Federal Reserve.

Prime Intelligence

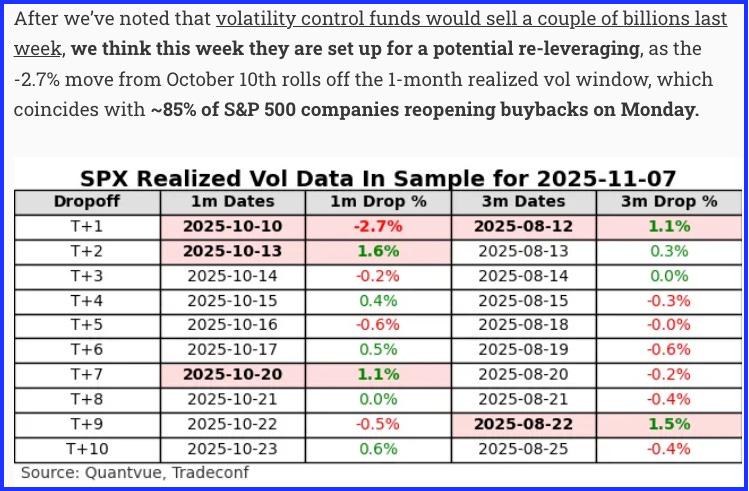

Volatility-control funds adjusts their equity exposure based on volatility scaling, typically using the higher of 1-month or 3-month realized volatility to determine position size.

Our Sunday research note to subscribers highlighted that the -2.7% drop from October 10 would roll out of the 1-month volatility sample on Monday, releasing billions in systematic exposure.

While most look to the next trending headline to explain market moves, we rely on the same institutional models used by investment banks to add real insight into the structural flows shaping the market.

We’ve compiled some of our subscriber-exclusive research from Sunday morning and Monday overnight, shared well before any “headlines” emerged and forecasted a strong rebound that was going to take place on Monday.

We’ve refreshed our research, and in today’s note, we’re highlighting the key developments and insights to keep in focus moving forward. 👇