The Market Brief

Hey team. U.S. futures rose overnight as all eyes turn to Nvidia’s highly anticipated earnings release after the market closes.

Let’s recap yesterday’s session and look ahead to what’s coming next!

Impact Snapshot

🟥 NVDA 0.00%↑ Earnings after close

Macro Viewpoint

U.S. futures climbed as traders anticipated Nvidia's earnings report later on Wednesday, seeking new momentum for the markets.

The chipmaker's quarterly results are widely viewed as critical to sustaining its unprecedented AI-driven rally.

Easing geopolitical tensions also supported stock futures, following reports that Russian President Vladimir Putin was open to discussing a Ukraine ceasefire agreement with Donald Trump.

Nvidia, which has nearly tripled in value this year, has contributed roughly 20% of the S&P 500's returns over the past year. The market's response to its earnings is expected to play a pivotal role in shaping Wall Street's direction as the year nears its close.

Prior Session Deep Dive

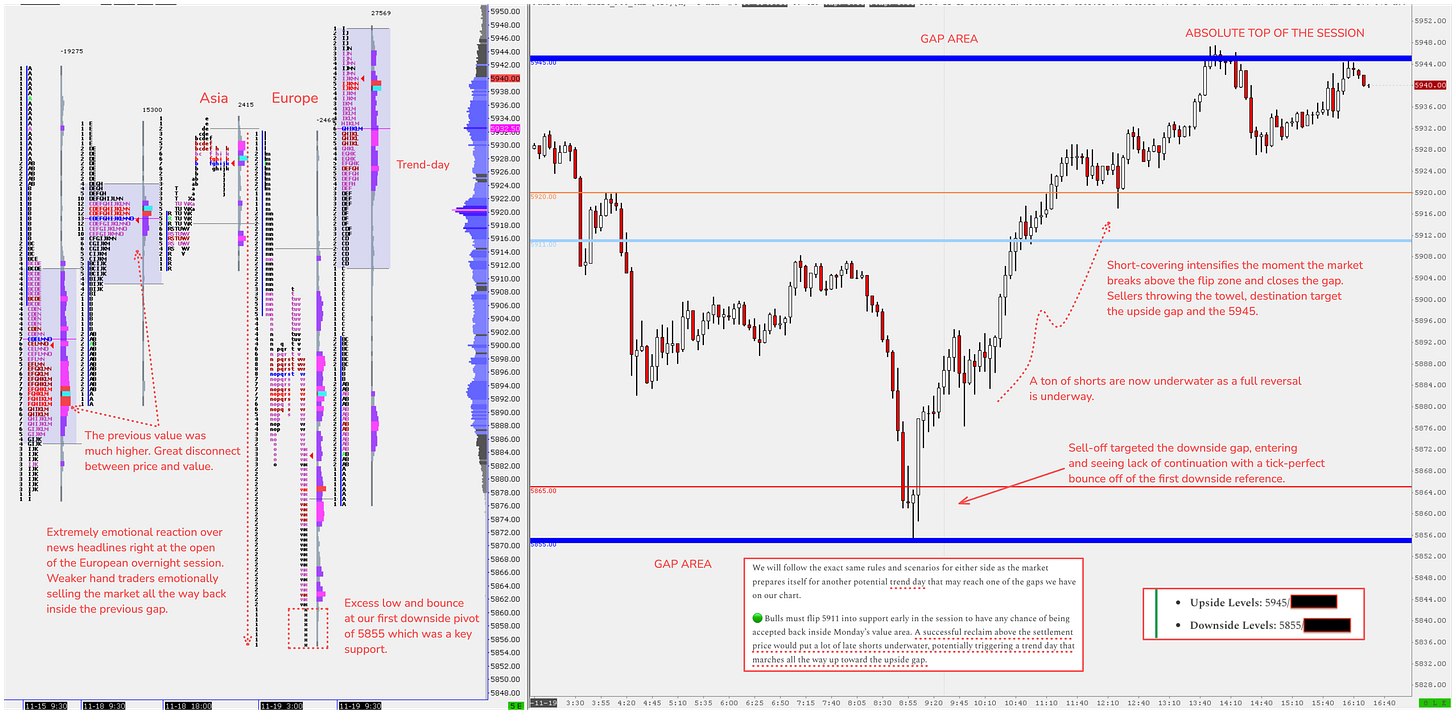

Reading a market has a lot to do with understanding who is in control of a move. Is it longer-term traders executing buying and selling orders with blocks of equities, or is it short-term, undercapitalised traders?

A very good piece of market-generated information we’ve been introducing over the last couple of days focuses on value along with price, as price by itself can often mislead you.

Think about who is in control of the overnight session. Is it strong money initiating a sell-off at 3:00 AM ET when the US stock market isn’t open, or is it short-term traders emotionally reacting to a headline they’ve read overnight, prompting them to sell their positions?

Forming a bias involves accumulating and analysing conflicting information. The same concepts we’ve been discussing for months played out once again.

The overnight session is controlled by the weakest of hands, who are easily shaken out of their positions the moment a trade goes against them. They often become the “fuel” for a short-covering trend day. How do you cover a short? You have to buy.

There was a significant disconnect between the previous value areas and where the market dropped to. Do you think strong money would have trouble breaking a support level?

Understanding your competition and identifying who initiated a move can give you a much better sense of what the market is likely to do next.

None of these candlesticks existed at the time we wrote our last market brief, but we understood the likely consequences of weak-hand sellers failing to push the market below a key level, resulting on a complete reversal with the market having a ton of room to run all the way towards our first upside resistance.