The Market Brief

Hey team. The “headlines roulette” environment is well alive, and it’s not going anywhere anytime soon—providing us with some historic days once again.

Let’s review the last session and see what’s ahead for the market!

Impact Snapshot

🟥 FOMC Meeting Minutes - 2:00pm

Macro Viewpoint

“Sometimes you will never know the value of a moment, until it becomes a memory..”

You’ll reflect back to these days as some of the most important in your career, because this is really history being made.

Yesterday was the largest EVER point reversal in the S&P 500, greater than the October 14th, 2008 Great Financial crash.

The S&P 500 erased a rally of ~4.5% in three hours.

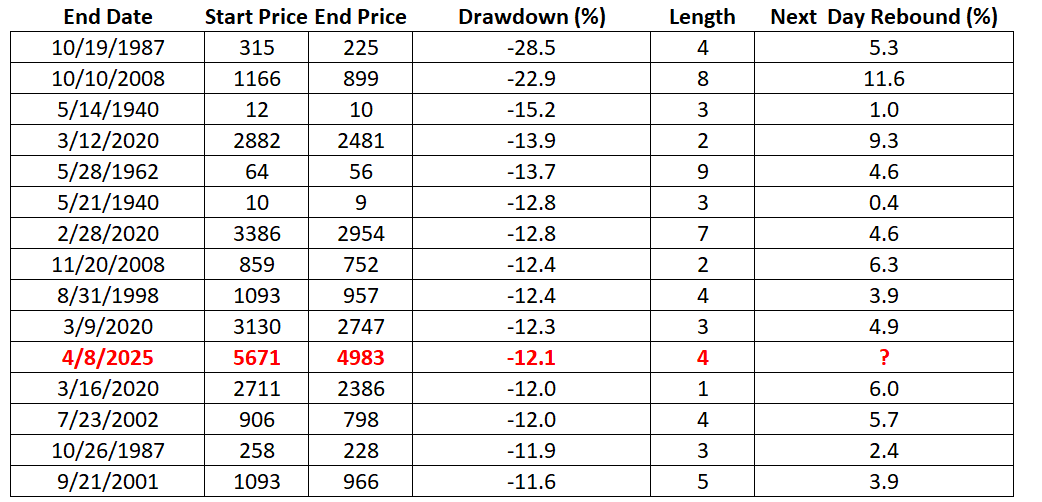

The S&P 500 is currently in its 11th-worst uninterrupted decline since 1940. Over the past 4 trading sessions, the index has dropped a massive -12.1%.

Prior Session Deep Dive

The success of this newsletter lies in the fact that we fuse key market fundamental research and technical analysis to give a holistic market perspective rather than being attached to one single data point.

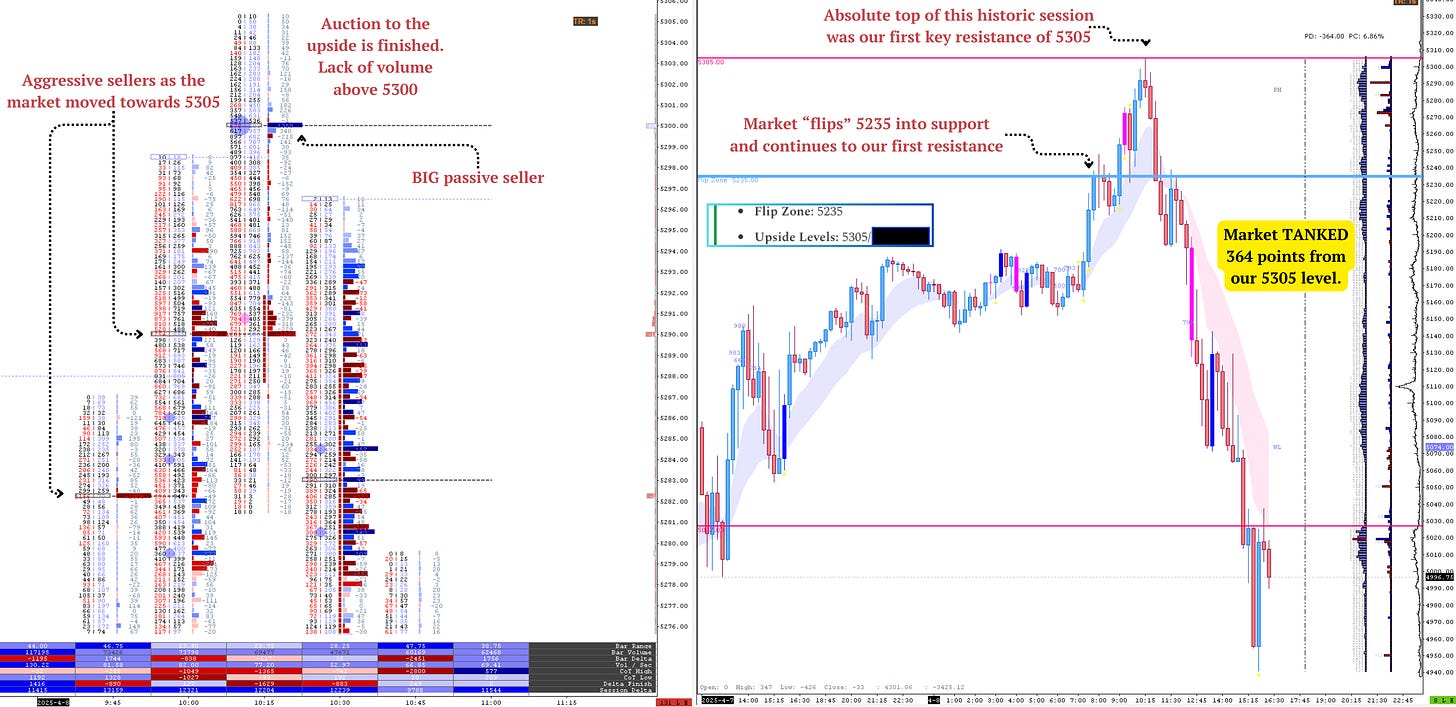

The chart above shows our market references we’ve shared during our pre-market brief yesterday. [Here].

The market squeezed higher on the open as yesterday afternoon's short covering theme continued. As the market continued to pare gains, we saw big money re-establishing shorts.

After reclaiming our flip zone, the market marched towards our first resistance, which was the absolute top of the session at 5305, and saw the session tanking 364 points right after.

Be aware of the senior

The information we’re working with is based on reviewing market structure and institutional data to write the context and plot references on our chart that we share on our Paid Substack. As you can imagine, anything can happen in the markets.

But being aware of what’s happening behind the scenes as a scenario in play gets you prepared for what’s next.

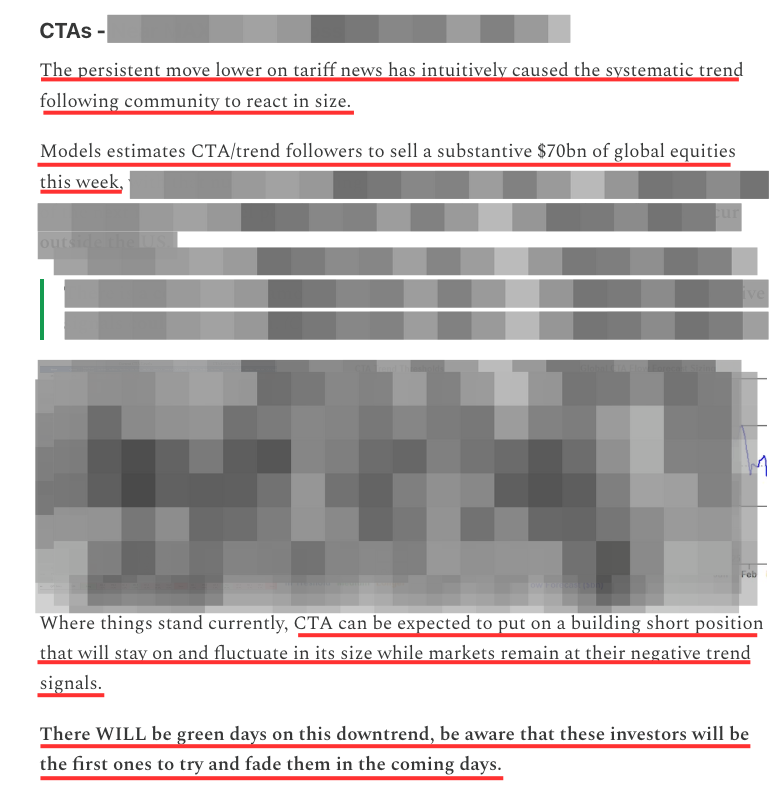

The context you see above comes from our CTA's research yesterday, highlighting the fact that we were expecting these market participants to fade a potential intraday rally.

If you want to read our full notes and how CTAs are positioned, subscribe to our paid version and get the full report. [Here]

We’re providing daily coverage of this crash from day 1. From monitoring flows of the biggest institutional investors to estimates of what is really going on behind the scenes, we help you navigate the roughest trading environment you’ll experience in a lifetime.