The Market Brief

Hey team. Stock futures continued the sell off early Friday after China imposed new 34% tariffs on all U.S. import in retaliation to the levies imposed by the White House earlier this week.

Let’s see what’s ahead for the markets.

Impact Snapshot

🟥 Non-Farm Payrolls - 8:30am

🟥 Unemployment Rate - 8:30am

🟥 Fed Chair Powell Speaks - 11:25am

Macro Viewpoint

US stock futures tumbled, indicating another day of big losses on Wall Street, as China kicked off the next stage of the global trade war with new tariffs on US products.

It all shows US trade partners are hitting back at President Donald Trump’s sweeping trade-tariff hikes, in what could be a severe setback for the world economy that’s already showed signs of softening.

Yesterday, all three major indexes saw their worst day since the pandemic. The S&P 500 fell 4.8%, its biggest one-day decline since June 2020.

This trade war is reflected on the market like COVID-19, which was one of the worst global crises in modern history.

Tariffs & Consequences

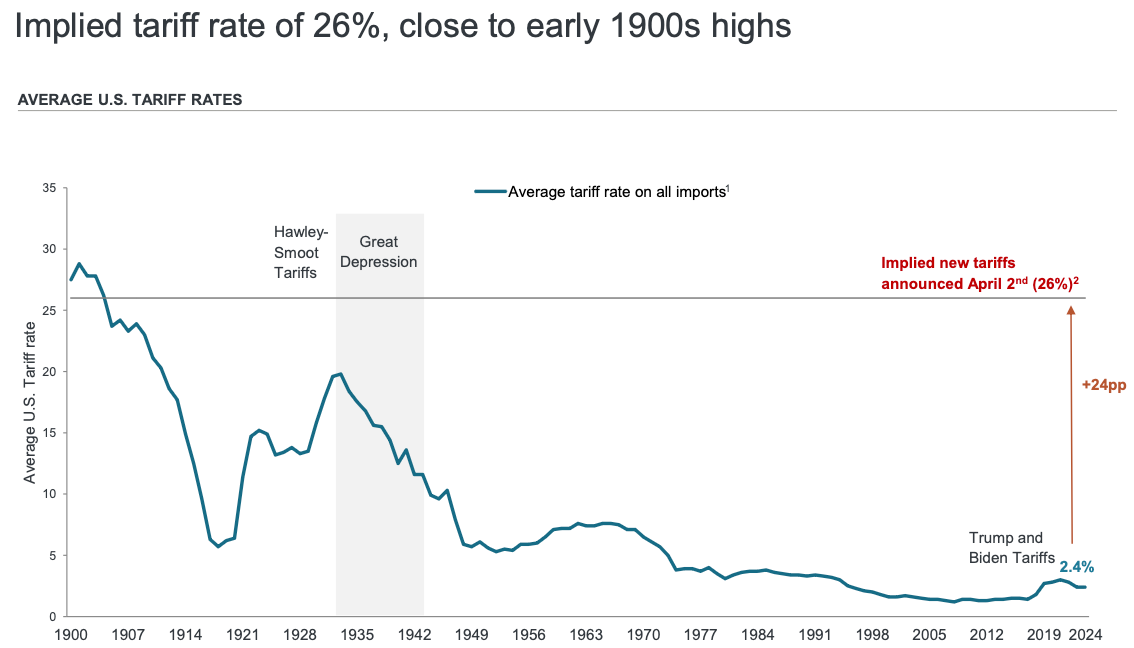

Tariffs are set to reach the highest levels in 100 years once the implementation phase is completed.

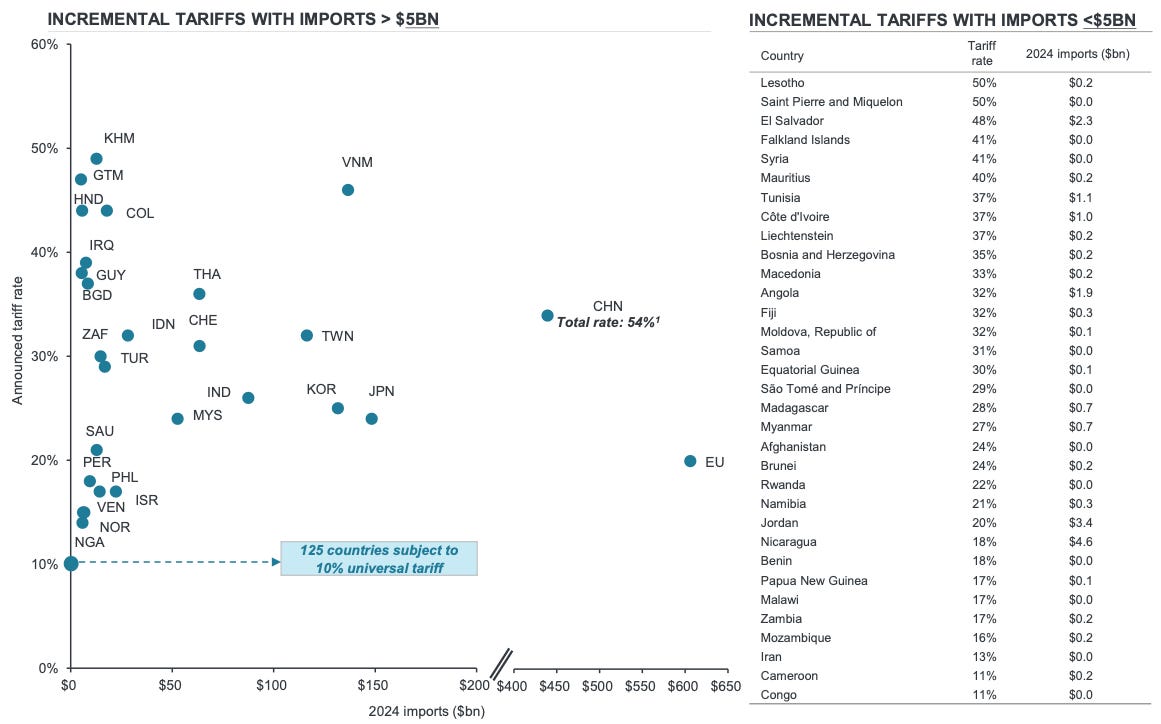

Tariff increases are likely central to the decline in business optimism and there’s a chance that tariffs will only be in place for a short time depending on the response of US trading partners. The next phase either involves:

Trading partners providing sufficient concessions to the White House so that tariffs are temporary.

An escalating tariff conflict that could cause damage to the global economy.

What to keep watching for on Tariffs

Bilateral negotiations could result in modifications of proposed tariffs

Impacted countries may announce retaliatory tariffs on U.S. (China just did)

Potential pushback by Congress or legal bodies on tariff execution

Revision of macroeconomic forecasts to reflect tariff impact

Market will reassess company-specific tariff exposure

What does this mean for me?

For ordinary Americans, this market decline is not just a business news story, it's a personal hit to their retirement funds, such as 401(k)s, that depend on the market. The massive decline in stock prices has erased trillions from the US stocks.

It also means that Businesses will pass the cost of the tariffs onto consumers, leading to price increases.

Uncertainty is going to remain sticky for the foreseeable future. GDP and S&P 500 eps growth will move lower and inflation will have an upward trajectory.