The Market Brief

Hey team. U.S. stock index futures climbed on Wednesday, with S&P 500-linked futures reaching record highs, as a wave of economic reports is expected to drive increased market volatility.

Let’s re-cap Tuesday’s session and see what’s next!

Impact Snapshot

🟥 ADP Non-Farm Employment Change - 8:15am

🟥 ISM Services PMI - 10:00am

🟥 Fed Chair Powell Speaks - 1:45pm

🟥 Beige Book - 2:00pm

Macro Viewpoint

U.S. stock index futures advanced on Wednesday, with S&P 500-linked contracts reaching record highs as investors awaited key economic data and insights from central bank officials, including Federal Reserve Chair Jerome Powell.

The S&P 500 and Nasdaq edged to record closing highs on Tuesday, driven by continued gains in tech-related stocks as investors anticipated upcoming jobs data.

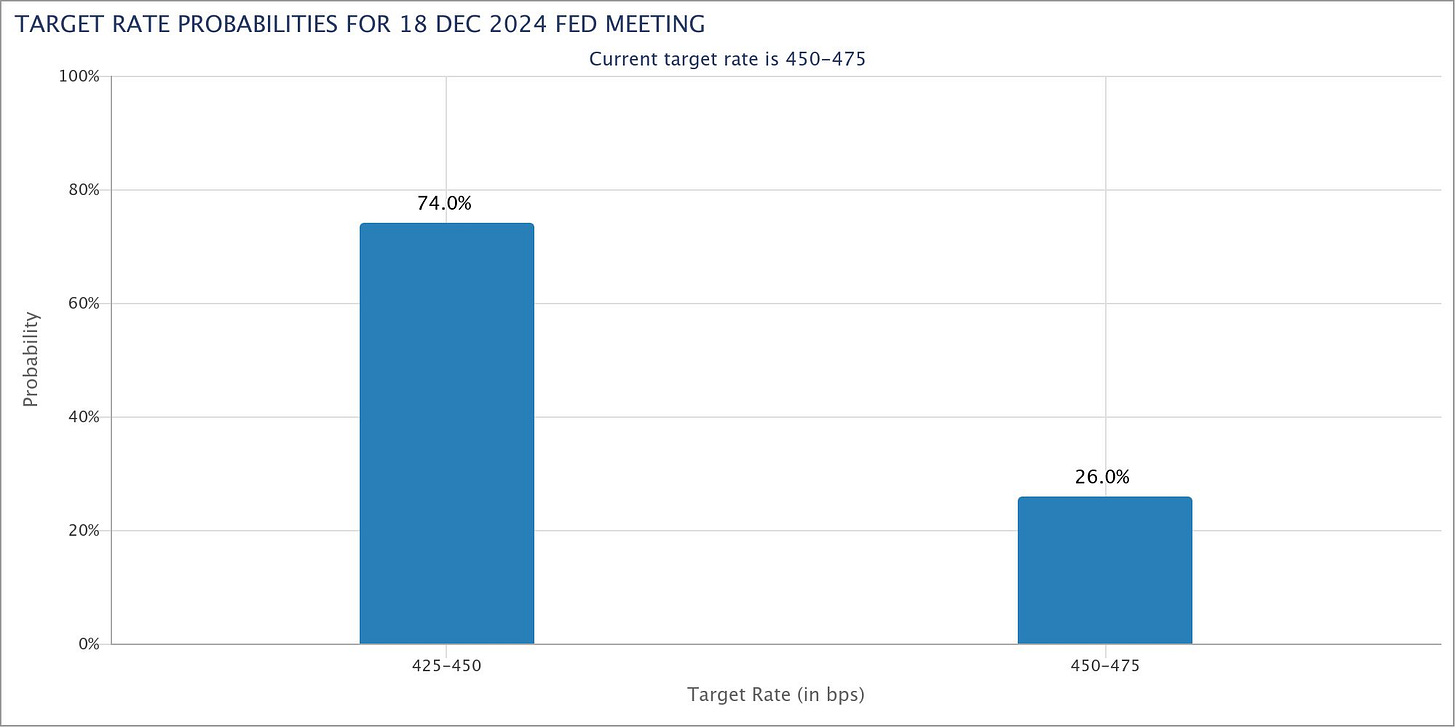

Traders are now pricing in a nearly 74% likelihood of a 25-basis-point rate cut by the Federal Reserve this month, up from just over 66% a week ago.

Key economic updates include the release of November private payroll data at 8:15 a.m. ET, followed by the closely watched monthly employment report on Friday.

Fed Chair Jerome Powell is set to deliver remarks later today, while the Federal Reserve's "Beige Book," a survey of U.S. economic conditions, is scheduled for release at 2:00 p.m. ET.