The Market Brief

U.S. futures near flat early Thursday, following a session where stocks logged their seventh gain in eight days as recent data has continued to strengthen expectations for a Fed rate cut.

Impact Snapshot

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

U.S. stock futures were mostly flat on Thursday, as investors paused after the growing likelihood of a Federal Reserve rate cut pushed major indexes to new highs in the prior session.

With several official reports still delayed, traders have been leaning more on private indicators, many of which suggest the job market is starting to feel the impact of corporate cost-cutting and softer consumer spending.

We’ll get fresh labor data today, including weekly jobless claims and the November layoff reports. A delayed factory orders release is also expected later in the day.

Prime Intelligence

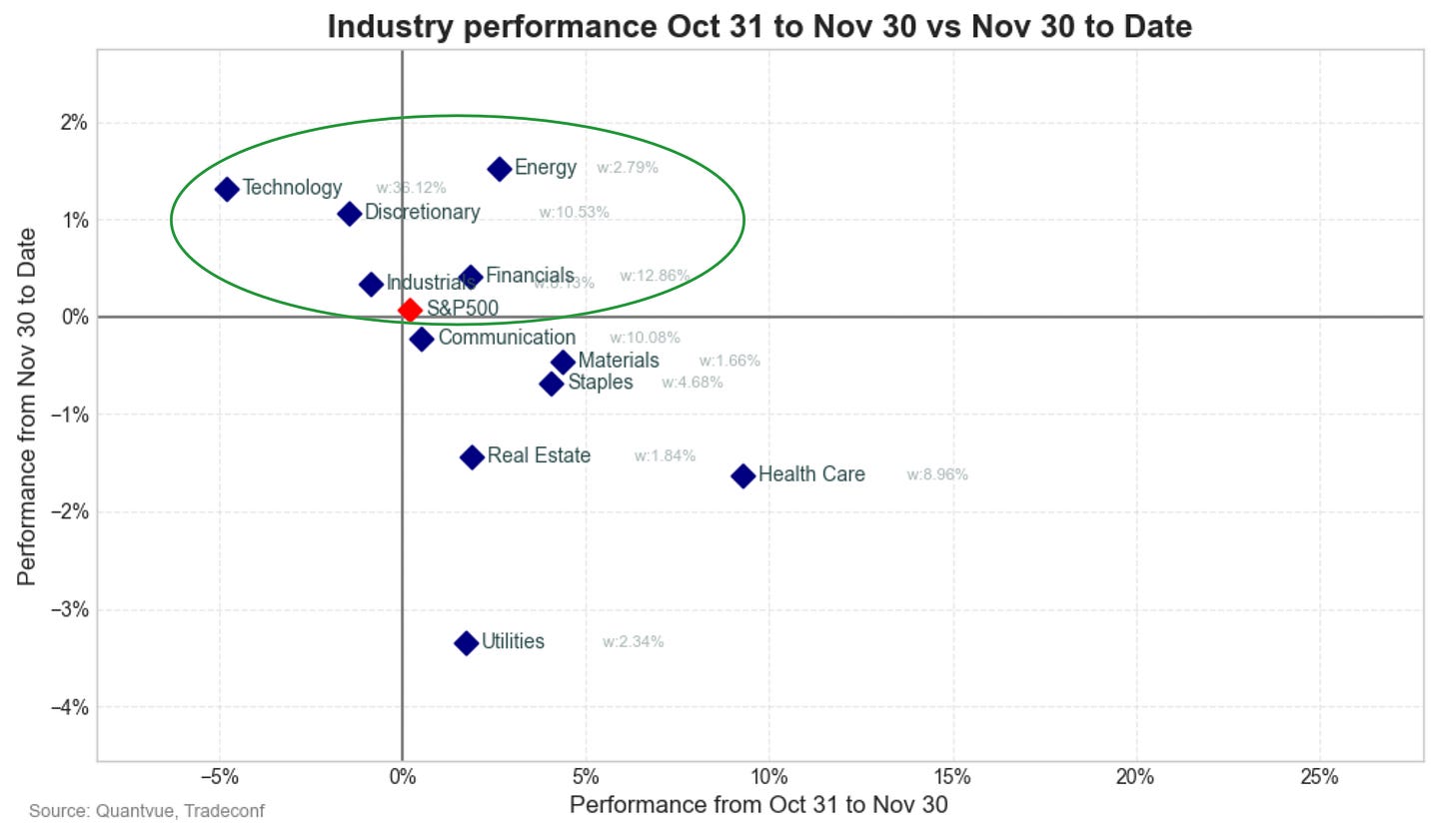

So far this month, many of November’s top performers are taking the sharper hits, while last month’s most sold-off sectors are putting up some of their best returns.

The key difference is that the sectors leading now carry much heavier index weight, so their impact on overall index performance is far more significant.

As the chart above shows, even with several sectors posting standout gains last month, the index barely managed to finish in positive territory. If the current strength holds through the month, it suggests the tech-driven risk-on trend is still alive, and that could push the index toward new all-time highs in the not-too-distant future.

Be sure to follow us on X, where we share regular intraday updates tied to these reports.

Also take a look at how we highlighted the setup for strength heading into yesterday’s session on this 👉 Video Re-cap