The Market Brief

US equity futures struggled for direction ahead of Friday’s inflation report and next week’s key monthly jobs numbers, after US GDP data Thursday complicated the outlook for further interest-rate cuts

Impact Snapshot

🟥 PCE Inflation - 8:30am

🟧 Consumer Sentiment - 10:00am

Macro Viewpoint

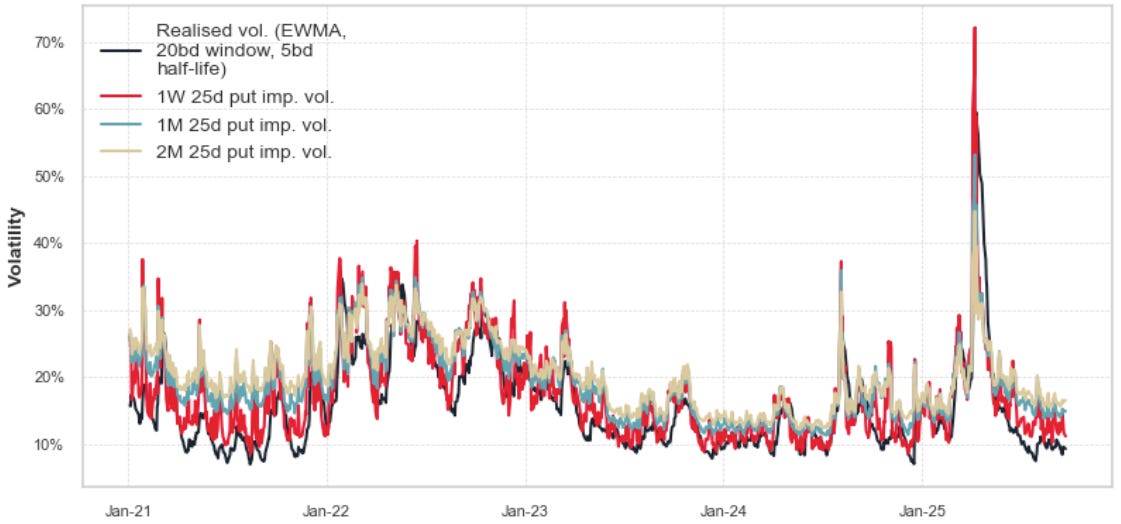

The S&P 500 has gained over 30% since its early April low point. The rally has been accompanied by declining realised volatility, a key component that we forecasted to follow and has played a significant role to support the market.

Implied volatilities have expectedly also declined along and a clear upward sloping term structure has emerged. Short-dated (one-week) volatility is lower than that for one month, which in turn is lower than that for two months.

Market players appear to be comfortable taking risk at the very short end in option markets, while possibly using longer tenors to hedge.

This means that the steep term structure tells us that investors are bullish on equities in the near term but lack conviction further out.

Prime Intelligence

On Sunday, we warned of mounting risks in the market as the S&P 500 was entering overbought territory and facing tougher technicals on the underlying. Since Monday, we’re now down ~2%.

In today’s Prime Intelligence, we’ve indexed all the signs and underlying divergences that pointed to the pullback that our subscribers were getting exclusive access to since the start of the week to help them better prepare.

Instead of blaming headlines for any given market move, we look at institutional data to form a statistically better bias to support our decision-making process.

You can read today’s article and our before-the-fact briefs below. 👇