The Market Brief

U.S. futures rose after the S&P 500 pulled back from record levels, snapping a three-day winning streak amid fears over elevated market valuations and near-term inflation risks, according to Powell.

Macro Viewpoint

Doesn’t take much trigger emotions these days. Just have the person responsible for the Fed say “the stock market is fairly highly valued,” and all the weak hands immediately puke their positions as we’ve seen yesterday.

In reality, that’s how you build a stronger market. Sometimes the market has to break before it can rally back up in order to replace these weaker-hand traders with stronger money.

Seasonal Pickup in Volatility

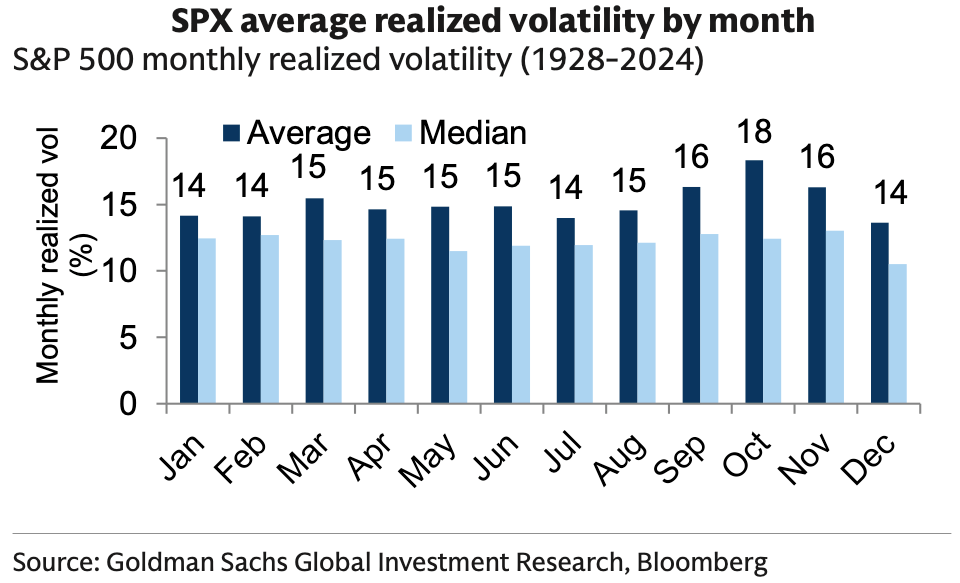

Using history as a guide, we expect global equity volatility to increase in October.

Volatility tends to be about 25% higher in October. Since 1928, October SPX realized volatility has averaged 18 vol vs. 15 vol for other months. Elevated October volatility is visible across each major index and sector over the past 30 years.

Why is October volatility so high? It is a critical period for many investors and companies that manage performance to the calendar year-end. Such pressures boost volumes and volatility as investors digest earnings reports, analyst days, and managements’ guidance for the following year.

While some consider it a coincidence that major market corrections have occurred in October, we believe performance pressures on company managements (to meet full-year expectations) and investors (final earnings catalysts for their performance year) exacerbate shifts in sentiment at this time of year.