The Market Brief

U.S. stock index futures held steady on Tuesday, with investors staying cautious ahead of a pivotal inflation report that could influence expectations for the Federal Reserve’s next policy decision.

Impact Snapshot

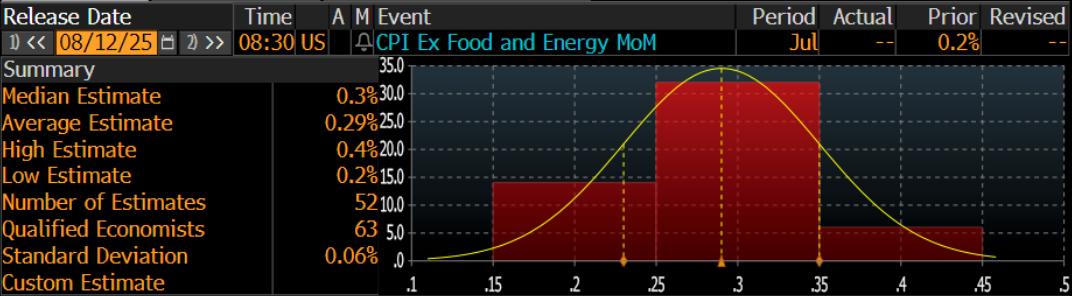

🟥 U.S. CPI Inflation - 8:30am

Macro Viewpoint

The upcoming inflation report follows a recent surge in trader expectations for Federal Reserve rate cuts this year, fueled by hopes that policymakers will step in to support a labor market showing early signs of cooling.

Money markets show traders have priced in more than two rate cuts by December, with about an 80% probability of a quarter-point reduction next month.

CPI Preview

Current expectations of Wall Street is that over the next few months, they expect tariffs to continue to boost monthly inflation and forecast monthly core CPI inflation between 0.3–0.4%.

Aside from tariff effects, we expect underlying trend inflation to fall further this year, reflecting shrinking contributions from the housing, rental, and labor markets.

Scenarios for the print to watch:

Core MoM prints above 0.40%. SPX loses 2% - 2.75%

Core MoM prints between 0.35% - 0.40%. SPX loses 75bp – SPX gains 25bp

Core MoM prints between 0.30% - 0.35%. SPX is flat to up 75bp

Core MoM prints between 0.25% - 0.30%. SPX gains 75bp – 1.2%

Core MoM prints below 0.25%. SPX gains 1.5% - 2%

This is a FREE edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.👇