The Market Brief

Global stocks extended their rally, with bullish sentiment getting a boost from growing expectations that the US could secure additional trade agreements following its recent deal with Japan.

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 Manufacturing/Services PMI - 9:45am

Key Earnings (After close): INTC 0.00%↑

Macro Viewpoint

Major indices climbed as optimism around trade talks lifted sentiment, following reports that the US and EU are nearing a deal that would include 15% tariffs on European imports.

The easing of global trade tensions has helped calm investor nerves, reducing concerns over a drawn-out trade war and supporting a broad market rally.

Many traders appear confident that Washington will take a measured stance, aiming to avoid significant damage to corporate earnings before any tariffs take full effect.

Wall St. Prime Intelligence

Vol moved lower y-day and skew flattened out on the rally. As we break through the highs, the VIX roll down is one of the steepest roll downs we've seen in the last 3-4 yrs.

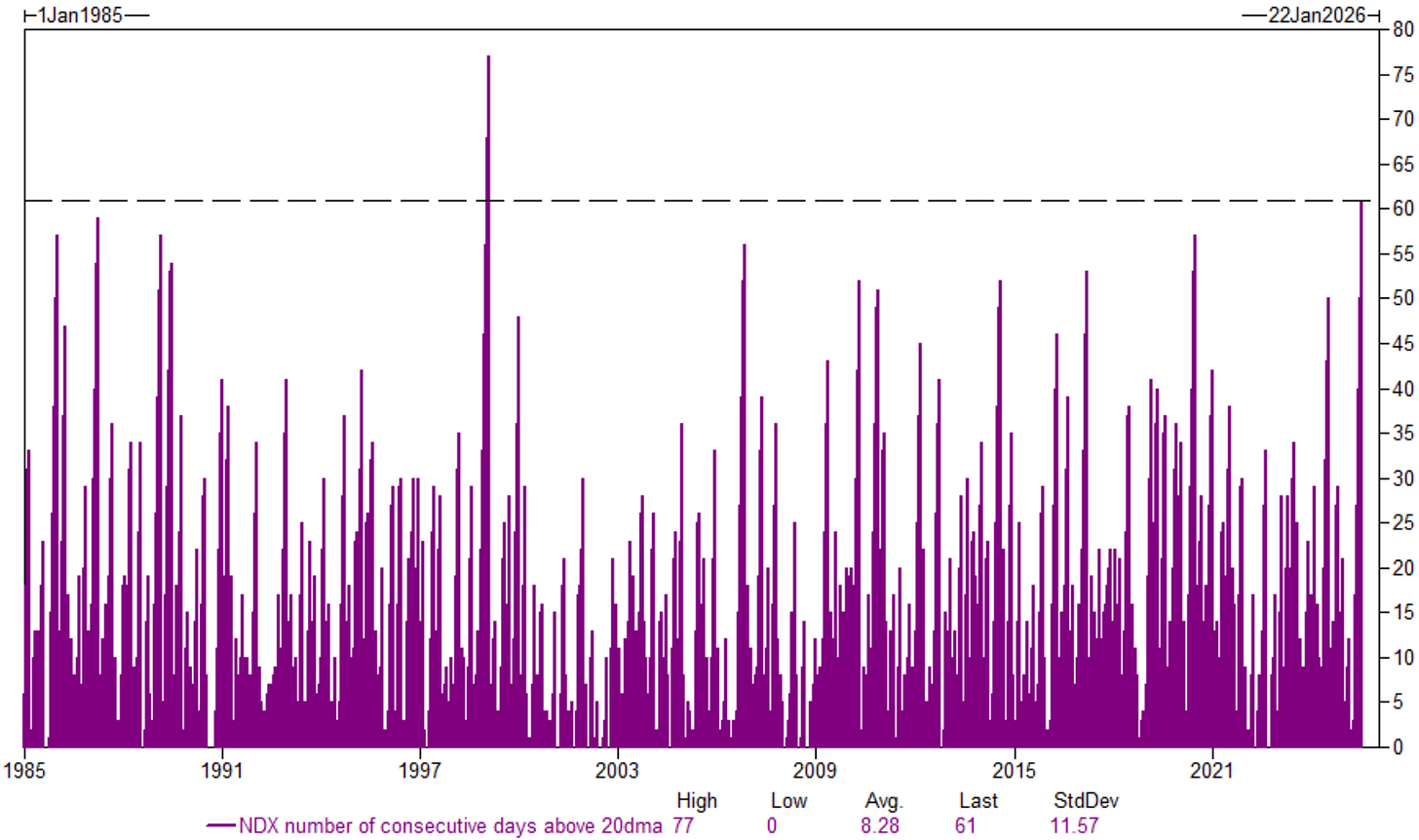

NDX notched its 62 consecutive day above the 20-dma. The last time this happened was January 1999 (1-year later, the index was up 77%).

📰 In today’s Prime Intelligence, we reiterate the latest around institutional U.S. equity derivative strategies, their positioning, and what’s our expectations ahead.

You’ll get an update on:

Volatility targeting funds

Systematic CTAs positioning

Options implied moves

Dealer’s gamma positioning

This is a free edition of the Market Brief. To receive our additional institutional-grade research, consider becoming a paid subscriber.👇